SiTime Corp (SITM) Reports Q4 and Fiscal Year 2023 Financial Results

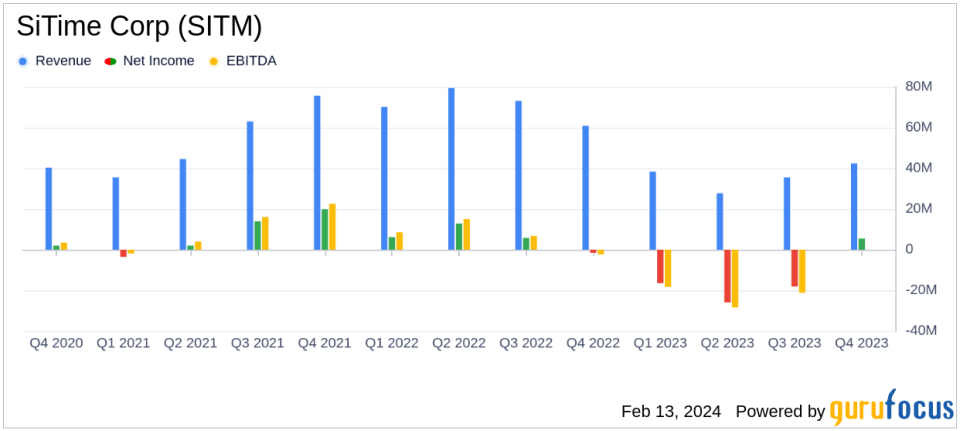

Quarterly Revenue: Increased to $42.4 million, up 19% from the previous quarter.

Annual Revenue: Declined to $144.0 million in 2023 from $283.6 million in 2022.

GAAP Net Loss: Reported at $20.0 million for Q4 and $80.5 million for the fiscal year.

Non-GAAP Net Income: Achieved $5.5 million in Q4 and $4.2 million for the fiscal year.

Liquidity Position: Total cash, cash equivalents, and short-term investments stood at $528.2 million.

Acquisition: Completed the acquisition of assets and an exclusive license from Aura Semiconductor Pvt. Ltd.

On February 13, 2024, SiTime Corp (NASDAQ:SITM), a leading provider of silicon timing systems solutions, announced its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company reported a 19% increase in quarterly revenue, reaching $42.4 million, compared to $35.5 million in the previous quarter. However, annual revenue saw a significant drop from $283.6 million in the previous fiscal year to $144.0 million in 2023. SiTime Corp (NASDAQ:SITM) released its 8-K filing detailing these figures and more.

Despite the challenges faced over the fiscal year, SiTime Corp (NASDAQ:SITM) managed to achieve a non-GAAP net income of $5.5 million, or $0.24 per diluted share, in the fourth quarter, and $4.2 million, or $0.18 per diluted share, for the full year. This performance highlights the company's ability to maintain profitability on a non-GAAP basis amidst a tough economic environment.

Financial Performance and Strategic Developments

GAAP results for the fourth quarter showed a gross profit of $23.7 million, or 55.9% of revenue. However, the company reported a GAAP net loss of $20.0 million, or $0.89 per basic share, for the same period. The full-year figures were also in the red, with a GAAP net loss of $80.5 million, or $3.63 per basic share. These losses reflect the broader challenges in the semiconductor industry, including supply chain disruptions and fluctuating demand.

SiTime's balance sheet remains robust, with $528.2 million in cash, cash equivalents, and short-term investments. This strong liquidity position provides the company with the flexibility to navigate market uncertainties and invest in strategic growth initiatives, such as the recent acquisition of assets from Aura Semiconductor Pvt. Ltd., which could enhance SiTime's product offerings and market reach.

Operational Highlights and Future Outlook

SiTime's operational expenses for the fourth quarter were $51.2 million, with research and development and selling, general and administrative expenses constituting the bulk of the costs. The company also incurred acquisition-related costs of $7.7 million during the quarter, reflecting its investment in future growth.

Looking ahead, SiTime's management remains focused on leveraging its technological leadership and strong balance sheet to drive long-term growth. The company's recent inducement plan grants, which include 61,464 restricted stock units for newly hired non-executive individuals, demonstrate its commitment to attracting and retaining top talent, which is crucial for sustaining innovation and competitive advantage.

Value investors may find SiTime's current financial position and strategic initiatives of interest, especially considering the company's potential for growth in the evolving semiconductor industry. The full financial statements and non-GAAP reconciliations are available in the company's 8-K filing.

For more in-depth analysis and up-to-date information on SiTime Corp (NASDAQ:SITM) and other valuable investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from SiTime Corp for further details.

This article first appeared on GuruFocus.