SiTime (SITM) Unveils MEMS-OCXO-Based Endura Epoch Platform

SiTime SITM recently unveiled the Endura Epoch Platform based on its ruggedized Microelectromechanical system (“MEMS”) Oven-controlled oscillators (“OCXO”)-technology. The new devices, which include SiT7111, SiT7112, SiT7101 and SiT7102, are claimed to significantly improve the accuracy of clock signals over quartz OCXOs.

The launch of these Endura devices is part of SiTime’s portfolio, which also includes the Endura ultra-stable Super-TCXO and the Endura low-jitter differential oscillator launched for its Aerospace and Defense clients in January 2023.

The Endura Epoch Platform MEMS OCXO offers a range of features that redefine precision and reliability in its class. With programmable frequencies spanning an impressive range from 10 to 220 MHz, it provides flexibility for various applications. The OCXOs can endure a g-force of up to 70 times better g-sensitivity, surviving shocks rated at 20,000 g.

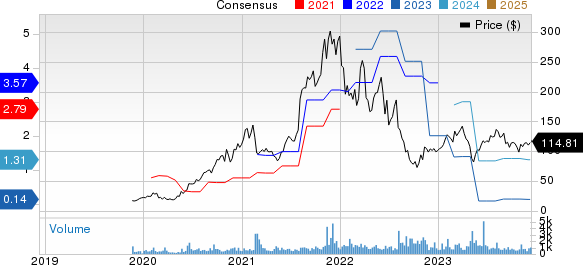

SiTime Corporation Price and Consensus

SiTime Corporation price-consensus-chart | SiTime Corporation Quote

Its stability is unmatched, showcasing up to 20 times better frequency stability over temperature and up to three times better Allan deviation, reflecting exceptional short-term frequency stability. The platform is designed to be compact and surface-mountable, with dimensions of 9.0 mm x 7.0 mm x 3.6 mm, a low weight of just 0.35 g (up to 300 times lower) and a remarkably efficient steady-state power consumption of 420 mW (up to 2 times lower).

Endura OCXOs withstand heat-related disturbances, irregular airflow, physical shock and vibration, ensuring the delivery of an ultra-stable local clock signal. Integrated into Positioning, Navigation and Timing (“PNT”) systems, this platform provides uninterrupted information for determining the position, orientation and precise timing crucial for military operations across space, air, maritime, ground and cyber domains.

In the event of signal manipulation, jamming, physical barriers and weather interference causing the PNT system to lose GPS signal due to internal equipment failure, the Endura OCXO serves as a backup, ensuring continued PNT operations.

Beyond its Endura platform, the company features a range of devices, such as the Cascade MEMS-based Clock-System-on-a-Chip, Emerald OCXO, the newly introduced Epoch Platform in September 2023 and the automotive-grade SiT1623/25 Oscillator in its portfolio. It caters to automated driving, 5G, data centers and artificial intelligence verticals with these offerings, all of which contribute to the company’s promising long-term prospects.

The company is also expanding its portfolio through acquisitions, such as its recent acquisition of clock products from Aura Semiconductor. This move will aid in licensing Aura’s clock IP and contribute to the company's vision of becoming the sole provider of comprehensive and innovative precision timing products. Alongside its innovative products, SiTime is benefiting from strength in its single-source business and increased design wins.

Zacks Rank & Stocks to Consider

SiTime carries a Zacks Rank #3 (Hold). Shares of SITM have gained 13% year to date.

Some better-ranked stocks from the broader technology sector are CrowdStrike CRWD, GoDaddy GDDY and Logitech International LOGI, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for CrowdStrike's fourth-quarter 2024 earnings has been revised northward by 5 cents per share in the past 30 days. For fiscal 2024, earnings estimates have been revised 10 cents upward to $2.92 per share in the past 30 days.

CRWD’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 16.56%. Shares of CRWD have climbed 130.4% year to date.

The Zacks Consensus Estimate for GoDaddy's fourth-quarter 2023 earnings has been revised 3 cents upward to $1.05 per share in the past 30 days. For fiscal 2023, earnings estimates have increased 6 cents to $2.72 per share in the past 30 days.

GDDY's earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missed the same on one occasion and matched in the remaining one, the average surprise being negative 0.6%. Shares of GDDY have gained 39.4% year to date.

The Zacks Consensus Estimate for Logitech’s third-quarter fiscal 2024 earnings has been revised 2 cents northward to $1.12 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by a penny to $3.43 in the past 30 days.

LOGI's earnings beat the Zacks Consensus Estimate in three of the trailing four quarters while missing the same on one occasion, the average surprise being 30.41%. Shares of LOGI have gained 43.1% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Logitech International S.A. (LOGI) : Free Stock Analysis Report

GoDaddy Inc. (GDDY) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

SiTime Corporation (SITM) : Free Stock Analysis Report