Sitio Royalties Corp.'s (NYSE:STR) Earnings Haven't Escaped The Attention Of Investors

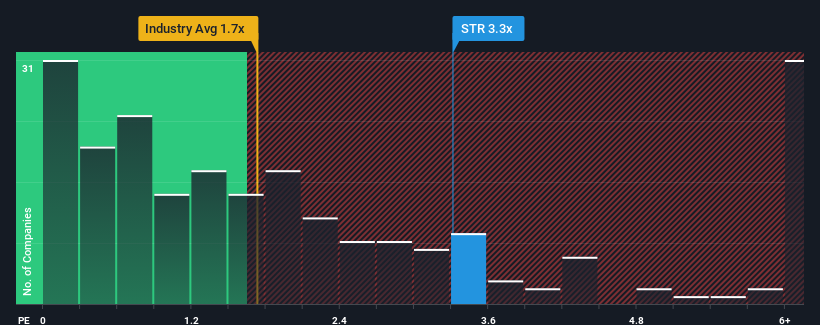

When close to half the companies in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") below 1.7x, you may consider Sitio Royalties Corp. (NYSE:STR) as a stock to potentially avoid with its 3.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Sitio Royalties

What Does Sitio Royalties' Recent Performance Look Like?

Recent times have been pleasing for Sitio Royalties as its revenue has risen in spite of the industry's average revenue going into reverse. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Sitio Royalties will help you uncover what's on the horizon.

Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Sitio Royalties would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 70% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 22% over the next year. That's shaping up to be materially higher than the 4.5% growth forecast for the broader industry.

In light of this, it's understandable that Sitio Royalties' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Sitio Royalties maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Oil and Gas industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Sitio Royalties is showing 3 warning signs in our investment analysis, and 2 of those make us uncomfortable.

If you're unsure about the strength of Sitio Royalties' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.