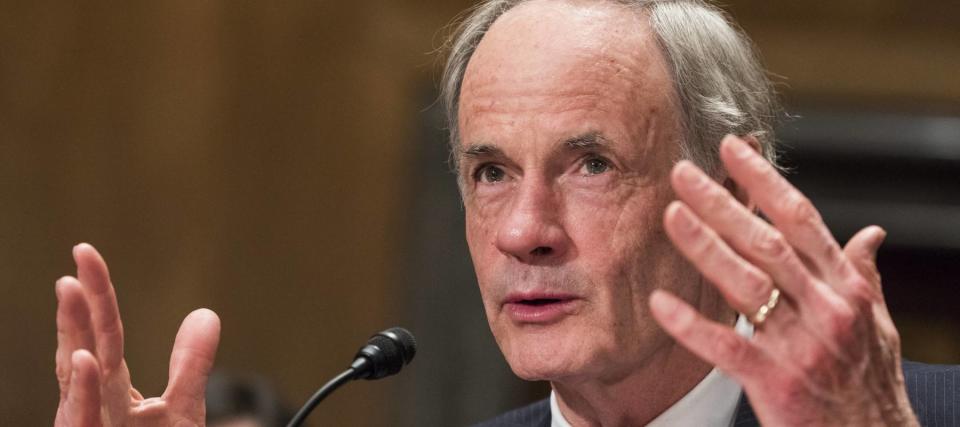

This sitting member of the Senate Finance Committee just made a bet against the US stock market by buying an inverse Nasdaq ETF — here's why a government watchdog is calling him out for it

A senior member of the Senate Finance Committee bet against the U.S. stock market with a bearish ETF purchase last month.

Senator Thomas Carper (D-DE) bought two stakes of $1,000 to $15,000 in the ProShares Short QQQ ETF (NYSE:PSQ) on July 13, according to a new filing disclosure shared by CongressTrading on X.com (formerly Twitter).

Don't miss

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Blackrock’s CEO says art is a ‘serious asset class’ — here’s how you can own a piece of a Pablo Picasso

PSQ is an ETF that offers inverse exposure to the Nasdaq 100 Index — an index made up of the 100 largest non-financial companies listed on the tech-heavy Nasdaq.

It is an attractive option for investors looking to hedge against or profit from a decline in the index.

But here’s why it’s a different story when an elected official decides to make the same play.

Potential conflict of interest

The lawmaker’s suspected bet against the U.S. economy comes at a time when the Nasdaq 100 Index is up 42% year-to-date — thanks largely to strong performances by technology stocks, particularly those with an interest in artificial intelligence.

Carper’s position on the inverse ETF has been called out by CongressTrading on X.com (formerly known as Twitter) as a potential conflict of interest.

The watchdog group posted: “Senator Carper reports shorting (betting against) the American economy in his stock portfolio. So now is he incentivized to pass laws to ruin the economy so he makes money?”

Attempts to ban congressional stock trading

Public scrutiny of congressional stock trading has intensified in recent years, with politicians being accused of using their connections and insider information to score winning deals.

A new bipartisan law was proposed in late July, which would ban members of Congress and the federal executive branch — including the president — from owning or trading stocks, even in blind trusts.

What to read next

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

The US dollar has lost 98% of its purchasing power since 1971 — invest in this stable asset before you lose your retirement fund

36% of millionaires say it’ll ‘take a miracle’ to retire amid rising costs and a shaky market — here are the best shock-proof assets to grow your nest egg

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.