Six Flags Entertainment Corp (SIX) Reports Mixed Results Amid Strategic Shifts

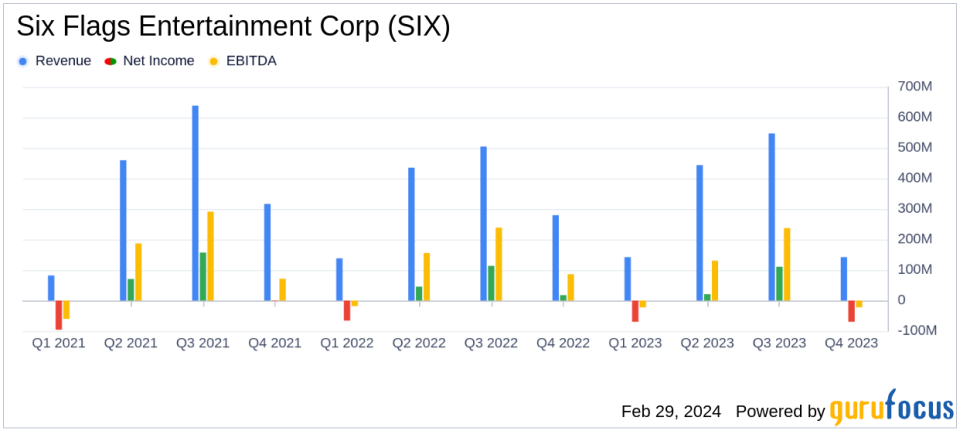

Revenue: Fourth quarter revenue increased by 5% to $293 million, and full year revenue rose by 5% to $1,426 million.

Net Loss/Income: Fourth quarter reported a net loss of $22 million, while full year net income was $39 million, a 61% decrease from the previous year.

Adjusted EBITDA: Fourth quarter Adjusted EBITDA remained flat at $98 million, with full year Adjusted EBITDA slightly up to $462 million.

Attendance: A 6% increase in fourth quarter attendance and a 9% increase for the full year.

Spending Per Capita: Decrease in total guest spending per capita by 1% in the fourth quarter and by 5% over the full year.

Debt and Cash Position: Total reported debt of $2,365 million and cash and cash equivalents of $78 million as of December 31, 2023.

Capital Investments: $171 million invested in new capital, marking a $59 million increase over the previous year.

On February 29, 2024, Six Flags Entertainment Corp (NYSE:SIX) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, known for operating 27 theme parks and waterparks across North America, including the United States, Mexico, and Canada, has faced a year of strategic shifts aimed at long-term profitable growth.

Fiscal Performance and Strategic Initiatives

Despite a challenging economic environment, Six Flags reported a 5% increase in fourth quarter revenue, reaching $293 million, and a full year revenue increase of 5% to $1,426 million. This growth was primarily driven by a 6% increase in attendance during the fourth quarter and a 9% increase for the full year. However, the company reported a net loss of $22 million in the fourth quarter, a stark contrast to the net income of $10 million in the same period last year. Full year net income also saw a significant drop, falling 61% to $39 million.

President and CEO Selim Bassoul highlighted the company's "premiumization strategy," which has led to a 17% growth in guest spending per capita since 2021. Despite the positive strides in revenue and attendance, spending per capita saw a decrease, with total guest spending per capita down by 1% in the fourth quarter and 5% over the full year.

Looking ahead to 2024, we have seen early success in sales of our 2024 passes, which are ahead of last year, and should provide a solid foundation as we head into the core operating season," said Bassoul.

Financial Achievements and Challenges

The company's financial achievements in 2023 include a stable Adjusted EBITDA of $98 million for the fourth quarter and a slight increase to $462 million for the full year. These figures are crucial for the travel and leisure industry, as they reflect the company's ability to maintain profitability in the face of inflationary pressures and strategic investments.

However, challenges remain, including a net loss in the fourth quarter due to merger-related transaction costs and higher cash operating costs. The company also faced a decrease in deferred revenue and increased capital expenditures, which rose to $171 million for the year.

Balance Sheet and Cash Flow

As of December 31, 2023, Six Flags reported a total debt of $2,365 million and cash and cash equivalents of $78 million. The decrease in deferred revenue and the increase in capital investments reflect the company's commitment to enhancing guest experiences and operational efficiency.

The company's cash flow from operating activities remained strong, providing $257 million for the year, although this was a slight decrease from the previous year's $269 million.

Outlook and Analysis

Looking forward, Six Flags is poised for the 2024 season with new rides and technological innovations expected to drive guest spending and improve operational efficiency. The company's focus on premium experiences and strategic partnerships, along with early pass sales for 2024, suggests a solid foundation for the upcoming year.

However, the company must navigate the challenges of lower spending per capita and the impact of inflation on operating expenses. The pending merger with Cedar Fair is also a significant development that could reshape the company's financial landscape.

Value investors and potential GuruFocus.com members may find Six Flags' commitment to strategic growth and cost management, coupled with its solid revenue growth and attendance figures, an interesting case for investment consideration.

For a more detailed analysis and to stay updated on Six Flags Entertainment Corp's financial journey, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Six Flags Entertainment Corp for further details.

This article first appeared on GuruFocus.