Six Flags (NYSE:SIX) Misses Q4 Revenue Estimates

Amusement park operator Six Flags (NYSE:SIX) fell short of analysts' expectations in Q4 FY2023, with revenue up 4.5% year on year to $292.6 million. It made a GAAP loss of $0.27 per share, down from its profit of $0.16 per share in the same quarter last year.

Is now the time to buy Six Flags? Find out by accessing our full research report, it's free.

Six Flags (SIX) Q4 FY2023 Highlights:

Revenue: $292.6 million vs analyst estimates of $297.5 million (1.7% miss)

EPS: -$0.27 vs analyst estimates of $0.27 (-$0.54 miss)

Free Cash Flow was -$51.23 million, down from $120.4 million in the previous quarter

Gross Margin (GAAP): 46.4%, down from 48.7% in the same quarter last year

Visitors: 4.3 million

Market Capitalization: $2.06 billion

"As we close out our second year pursuing our premiumization strategy, we are encouraged by the progress we have made to date. Since 2021, we have grown guest spending per capita by 17%, lowered cash expense in the face of historical levels of inflation, leveraged key partnerships to expand sponsorship revenue, and paid down debt," said Selim Bassoul, President and CEO.

Sporting the fastest rollercoaster in the United States, Six Flags (NYSE:SIX) is a regional theme park operator offering thrilling rides, entertainment, and family-friendly attractions.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Sales Growth

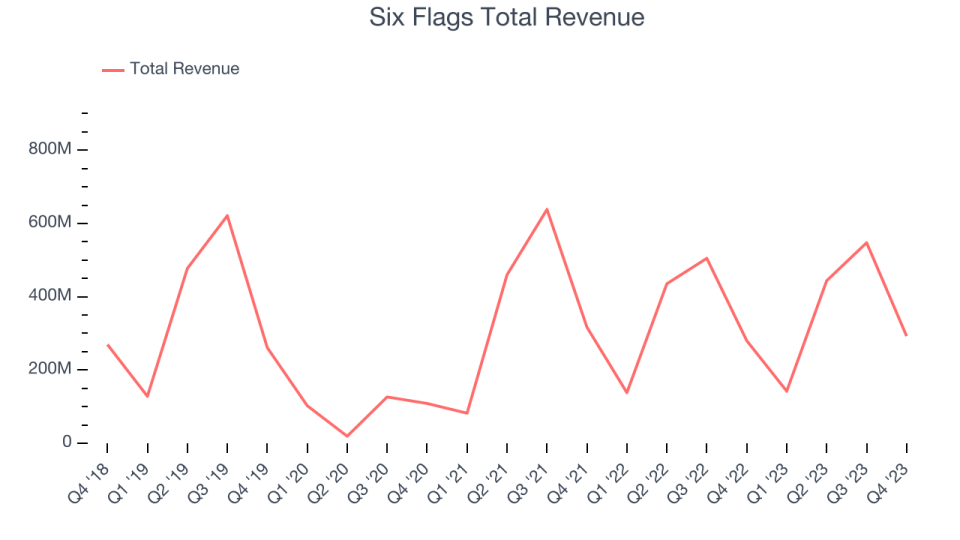

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Six Flags's revenue was flat over the last five years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Six Flags's recent history shows a reversal from its five-year trend as its revenue has shown annualized declines of 2.4% over the last two years.

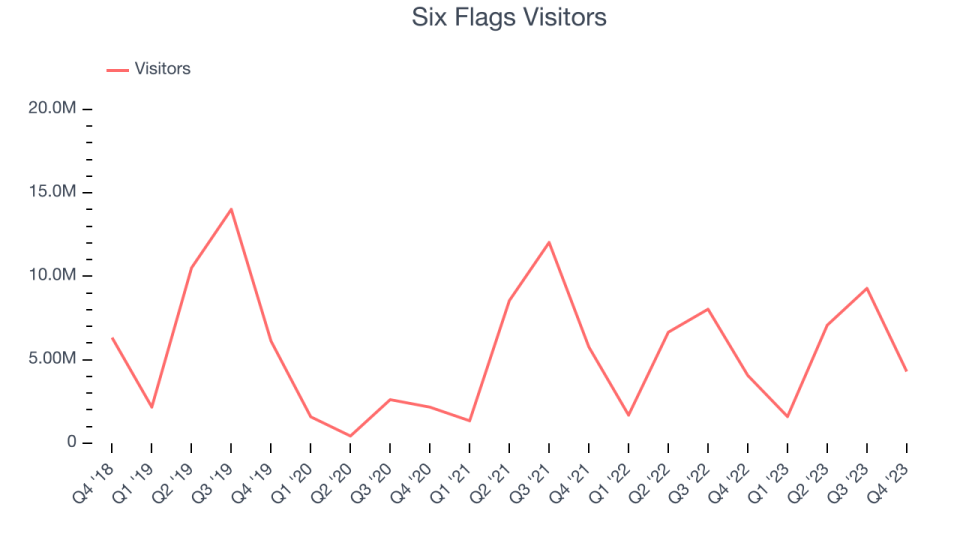

We can dig even further into the company's revenue dynamics by analyzing its number of visitors, which reached 4.3 million in the latest quarter. Over the last two years, Six Flags's visitors averaged 4.7% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company's monetization has risen.

This quarter, Six Flags's revenue grew 4.5% year on year to $292.6 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 6.1% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

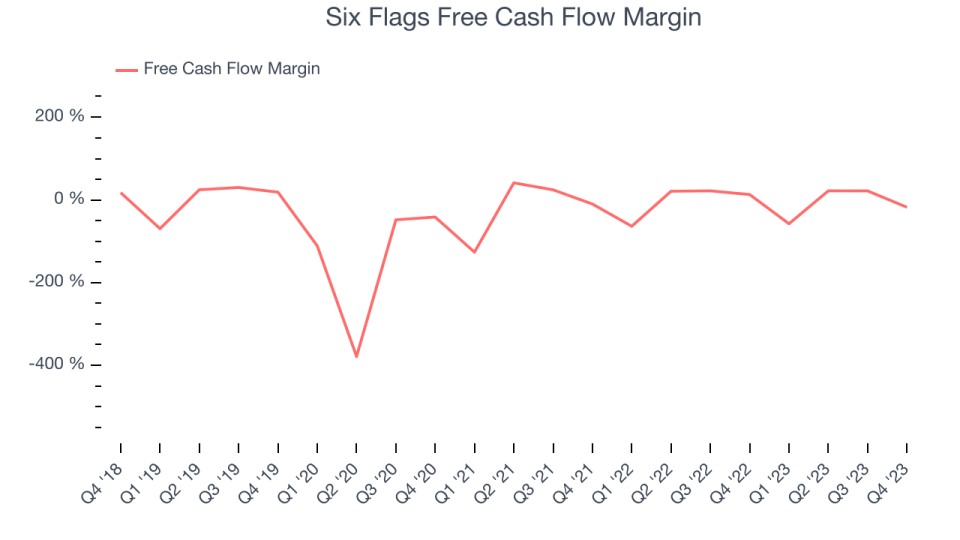

Over the last two years, Six Flags has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.6%, subpar for a consumer discretionary business.

Six Flags burned through $51.23 million of cash in Q4, equivalent to a negative 17.5% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter. Over the next year, analysts predict Six Flags's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 6% will increase to 11.6%.

Key Takeaways from Six Flags's Q4 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS fell short of Wall Street's estimates as it brought in fewer visitors into its parks than expected.

On a side note, Six Flags merged with Cedar Fair (NYSE:FUN), another large regional theme park operator, on November 6th. This is quite exciting as there are only a few public theme park companies, so this is a blockbuster deal in the space.

Despite the flair around the merger, this quarter's results could have been better. The stock is up 1.1% after reporting and currently trades at $24.84 per share.

So should you invest in Six Flags right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.