Six Flags (SIX) Launches a Digital Alliance With Six Companies

Six Flags Entertainment Corporation SIX has entered into partnerships with Google Cloud, Dell Technologies, Snowflake, HCL Tech, Fueled and Pure Imagination Studios, thus announcing it as the largest digital alliance in the theme park industry.

This first-of-its-kind digital alliance intends to offer pioneering technologies from the aforementioned top-tier companies, aimed to enhance guest experiences across multiple touchpoints in the park as well as benefit team members. The company aims to leverage data-driven personalization to deliver tailored experiences to its guests and set a new benchmark for customer engagement.

Benefits From the Digital Alliance

Each member of this top-tier digital alliance will contribute to advancing innovation in the industry by leveraging their distinctive capabilities and technologies.

Google Cloud will act as the primary cloud provider and AI innovation partner; HCL Tech will ensure the acceleration of digital transformation initiatives of Six Flags for personalizing and enhancing its guest experiences; and Dell will help in advancing the generative AI and the hardware that powers the company’s capabilities for revolutionizing the customer experience.

Furthermore, Snowflake’s Snowflake Data Cloud will help this new digital alliance harness the power of data and improve the guest experiences; Fueled will offer services in designing and developing the mobile application; and finally, Pure Imagination Studios will offer an enhanced level of innovation in AR, VR and animation that will bring Six Flags into the metaverse and the future of experiential entertainment.

Focus on Enhancing Guest Experience Bodes Well

Six Flags has been intently focusing on improving its guests’ experiences through several strategic initiatives comprising digital enhancements, expansion and acceleration of its events calendar, along with diversifying its product offerings. These initiatives come under light through collaborations, acquisitions and other organic investments.

During the conference call on its equal merger with Cedar Fair, Six Flags stated that during the third quarter of fiscal 2023, it made great strides in improving its guest experiences through digital transformations. It made intentional decisions on laying down new developmental opportunities, including introducing new shows for a multi-generational audience, enhancing fireworks display shows, testing and promoting speedy gates, along with automated toll plazas.

Furthermore, the company launched its very first waterpark festival as well as introduced a water float parade in its Texas theme parks. Six Flags also cultivated its sponsorship relationships, resulting in additional revenues and cross-branding initiatives. Thanks to these tailwinds, the company could grow its guest attendance and increase revenues while simultaneously investing in its park enhancements and paying down debts.

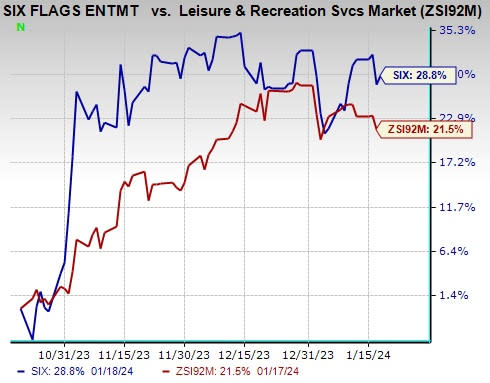

Image Source: Zacks Investment Research

Shares of this regional theme park company gained 28.8% in the past three months, outperforming the Zacks Leisure and Recreation Services industry’s 21.5% growth.

Zacks Rank & Key Picks

Six Flags currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Zacks Consumer Discretionary sector.

H World Group Limited HTHT currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

It has a trailing four-quarter earnings surprise of 94.5%, on average. The stock has declined 35.2% in the past year. The Zacks Consensus Estimate for HTHT’s 2024 sales and earnings per share (EPS) indicates an improvement of 7.9% and 9.8%, respectively, from the year-ago levels.

American Public Education, Inc. APEI currently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 23.2%, on average. The stock has declined 10% in the past year.

The Zacks Consensus Estimate for APEI’s 2024 sales and EPS suggests growth of 2.5% and 115.8%, respectively, from the year-ago levels.

Sphere Entertainment Co. SPHR sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of a whopping 728%, on average. The stock has declined 36.5% in the past year.

The Zacks Consensus Estimate for SPHR’s fiscal 2024 sales and EPS suggests a decline of 34.7% and 116%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

H World Group Limited Sponsored ADR (HTHT) : Free Stock Analysis Report

Six Flags Entertainment Corporation New (SIX) : Free Stock Analysis Report

Sphere Entertainment Co. (SPHR) : Free Stock Analysis Report