SJW Group (SJW) Surpasses Earnings Expectations and Sets New Targets for 2024

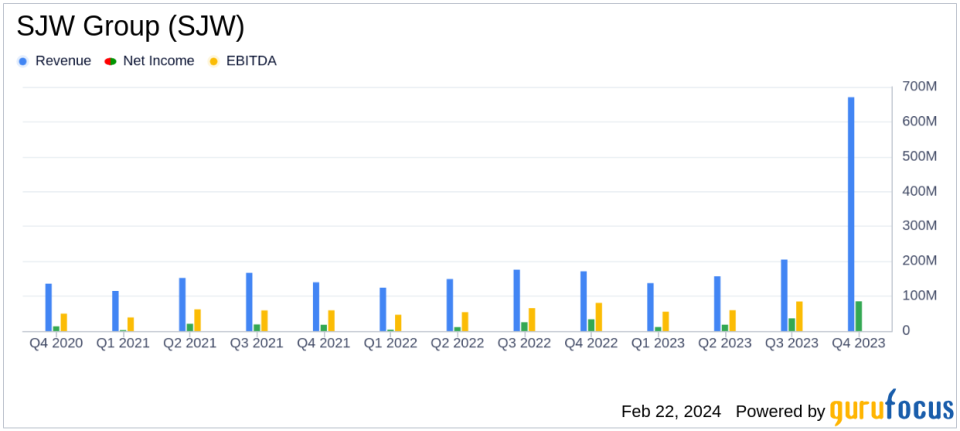

Net Income: $85.0 million in 2023, a 15% increase from $73.8 million in 2022.

Diluted Earnings Per Share (EPS): $2.68 in 2023, surpassing the initial guidance of $2.40 to $2.50.

Operating Revenue: Increased by 8% to $670.4 million in 2023 from $620.7 million in 2022.

Capital Expenditures: $272 million invested in infrastructure, exceeding the 2023 guidance.

2024 Guidance: Net income per diluted share projected to be between $2.68 and $2.78.

On February 21, 2024, SJW Group (NYSE:SJW) released its 8-K filing, announcing financial results that not only exceeded the initial earnings per share guidance but also aligned with the updated projections. The company, a leading U.S. water utility services holding company, has reported a significant increase in net income and earnings per share for the fiscal year 2023, indicating a strong financial performance and strategic capital investments that have positioned it for continued growth.

Company Overview

SJW Group is a prominent water utility services holding company that operates primarily in California and has expanded its reach to other states. The company's operations are divided into Water Utility Services and Real Estate Services, with the majority of its revenue stemming from water utility services. SJW Group's commitment to providing, storing, purifying, and distributing water has been a cornerstone of its business model, catering to the needs of various municipalities and communities.

Financial Performance and Achievements

The company's financial achievements in 2023 are noteworthy within the Utilities - Regulated industry. SJW Group's net income reached $85.0 million, or $2.68 per diluted share, representing a 15% increase from the previous year's $73.8 million, or $2.43 per diluted share. This performance is particularly significant as it surpassed the initial guidance range and met the updated forecast. Such an increase is indicative of the company's ability to navigate regulatory environments effectively and capitalize on rate filings and operational efficiencies.

Operating revenue saw an 8% rise to $670.4 million in 2023, driven by rate filings and customer growth. This growth underscores the company's ability to expand its customer base and adapt to changing market conditions. Operating expenses also increased by 6% to $520.9 million, reflecting higher water production costs and increased interest expenses, among other factors.

"With a strong fourth quarter, our 2023 financial results and operating performance exceeded expectations and the initial earnings per share guidance we set for SJW Group at this time last year," stated SJW Group Chair, CEO, and President, Eric W. Thornburg. "The results we announce today are a testament to our talented teams across the country delivering on our companys mission to be a force for good every day for our customers, communities and shareholders."

Strategic Investments and Regulatory Updates

SJW Group's capital expenditures in 2023 amounted to $272 million, surpassing the guidance and demonstrating the company's commitment to improving and maintaining its water supply and infrastructure. The company has also planned a substantial investment of over $1.6 billion over the next five years, which includes approximately $230 million for the treatment of per- and polyfluoroalkyl substances (PFAS), subject to regulatory approvals.

Regulatory updates have been favorable for SJW Group, with the California Public Utilities Commission (CPUC) approving a new Group Insurance Balancing Account and establishing a Water Cost of Capital Mechanism (WCCM)-adjusted return on equity of 10.01% in California. Additionally, rate activity in Connecticut, Maine, and Texas has been constructive, contributing to the company's revenue growth and operational expansion.

Looking Ahead: 2024 Guidance and Growth Strategy

For 2024, SJW Group has issued guidance projecting net income per diluted share to be between $2.68 and $2.78, with regulated infrastructure investments anticipated to be approximately $332 million. The company's long-term growth strategy, aiming for a non-linear diluted EPS growth of 5% to 7% anchored off 2022's diluted EPS, reflects confidence in its operational capabilities and strategic direction.

As SJW Group continues to build on its strong foundation, the company remains committed to investing in its operations, engaging with local communities, and delivering sustainable value to its shareholders. With a clear vision and strategic investments, SJW Group is well-positioned for continued success in the water utility industry.

For more detailed information on SJW Group's financial results and future outlook, interested parties are encouraged to access the live webcast presentation scheduled for February 22, 2024, or visit the company's website at www.sjwgroup.com.

Explore the complete 8-K earnings release (here) from SJW Group for further details.

This article first appeared on GuruFocus.