Skechers (SKX) Gears Up for Q4 Earnings: What Lies Ahead?

Skechers U.S.A., Inc. SKX is likely to register top-line growth when it reports fourth-quarter 2023 earnings on Feb 2, after market close. The Zacks Consensus Estimate for quarterly revenues is pegged at $2,013 million, indicating a rise of 7.2% from the prior-year quarter’s reported figure.

The consensus estimate for fourth-quarter earnings per share is pegged at 52 cents, suggesting an increase of 8.3% from the year-ago period’s actual. This estimate has been increased by a couple of cents over the past 30 days, underscoring the market's confidence in Skechers' fourth-quarter performance.

This designer, developer, marketer and distributor of lifestyle and performance footwear stunned analysts with an earnings surprise of 19.2% in the last reported quarter. SKX has a trailing four-quarter earnings surprise of 50.3%, on average.

On its last reported quarter’s earnings call, management guided sales between $1.91 billion and $2.01 billion, and earnings of 40-50 cents a share for the fourth quarter.

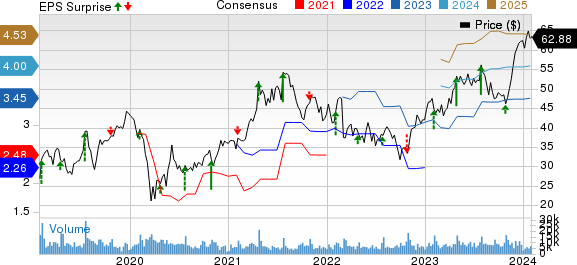

Skechers U.S.A., Inc. Price, Consensus and EPS Surprise

Skechers U.S.A., Inc. price-consensus-eps-surprise-chart | Skechers U.S.A., Inc. Quote

Key Factors to Note

Skechers' focus on growing its direct-to-consumer segment, and providing innovative, superior-quality products has been a key factor in driving its revenues. The brand's commitment to expanding its retail footprint, enhancing its omnichannel capabilities, and reinforcing its distribution strengths has been playing a crucial role in solidifying its market stance and securing continuous growth.

We anticipate direct-to-consumer revenues to increase 12.1% in the fourth quarter. This growth is fueled by expected improvements of 11.9% and 12.2% in the domestic and international direct-to-consumer businesses year over year, respectively.

SKX's international business has been a major contributor to its sales, with notable successes across various regions, including the Asia-Pacific, and Europe, the Middle East and Africa. This achievement has largely been fueled by the company's dedicated approach to offering innovative, high-quality products customized to meet the specific tastes and preferences of each region. We expect the international wholesale business to increase 4.4% in the fourth quarter. This is in sharp contrast with the domestic wholesale business, which is expected to decline 4.7% year over year.

In addition to the aforementioned factors, Skechers' meticulous management of operating costs is expected to have driven the company's profitability. Although there was an increase in general and administrative expenses in the third quarter, the expenditure has facilitated the company's growth, driven by higher sales volumes, particularly in the direct-to-consumer segment and international markets. We foresee an operating margin expansion of 80 basis points for the fourth quarter.

What the Zacks Model Unveils

Our proven model conclusively predicts an earnings beat for Skechers this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is the case here.

Skechers currently has a Zacks Rank #2 and an Earnings ESP of +15.70%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With the Favorable Combination

Here are three other companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season:

lululemon athletica LULU currently has an Earnings ESP of +0.40% and a Zacks Rank #2. The Zacks Consensus Estimate for fourth-quarter fiscal 2023 earnings per share is pegged at $4.99, suggesting a rise of 13.4% from the year-ago reported number.

You can see the complete list of today’s Zacks #1 Rank stocks here.

lululemon athletica’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $3.19 billion, which indicates an increase of 14.9% from the figure reported in the prior-year quarter. LULU has a trailing four-quarter earnings surprise of 9.2%, on average.

Deckers Outdoor DECK presently has an Earnings ESP of +1.39% and a Zacks Rank #2. The company is expected to register a bottom-line rise when it reports third-quarter fiscal 2024 results. The Zacks Consensus Estimate for quarterly earnings per share of $11.36 suggests an increase of 8.4% from the year-ago quarter’s reported number.

Deckers Outdoor’s top line is anticipated to increase year over year. The consensus mark for revenues is pegged at $1.43 billion, indicating a rise of 6.6% from the figure reported in the year-ago quarter. DECK has a trailing four-quarter earnings surprise of 26.3%, on average.

Ulta Beauty ULTA currently has an Earnings ESP of +0.97% and a Zacks Rank of 3. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $7.48 suggests a rise of 12% from the year-ago reported number.

Ulta Beauty’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $3.51 billion, which suggests an increase of 8.9% from the prior-year quarter’s reported figure. ULTA has a trailing four-quarter earnings surprise of 5.8%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report