Skechers (SKX) Thrives on DTC Growth & Product Innovation

Skechers U.S.A., Inc.’s SKX investment strategy aligns with key priorities such as increasing brand presence globally, expanding the direct-to-consumer (DTC) business and bolstering omnichannel capabilities.

Widening Product Offerings

Skechers remains committed to providing a diverse offering, encompassing fashion, athletic, non-athletic, and work footwear, all at attractive price points. Notably, the company recently emphasized comfort-centric footwear and apparel to align with the growing trend of consumers adopting a more relaxed lifestyle in both work and casual settings.

Skechers unveiled three capsules from the Snoop Dogg collaboration, expanding its presence in North America, Europe and key markets. The partnership, alongside collaborations with Martha Stewart and the Rolling Stones, enhanced brand visibility. Its commitment to innovation, demonstrated through diverse collections like Hands-Free Slip-ins and Arch Fit, coupled with targeted marketing campaigns featuring global influencers, underscores the brand's dedication to comfort and style.

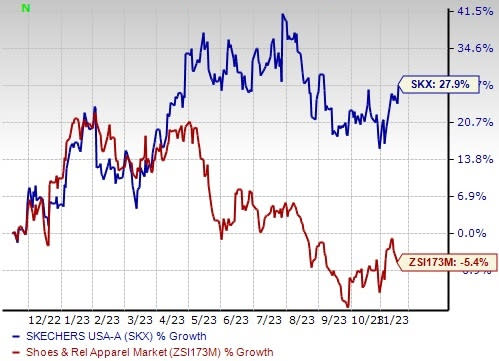

Image Source: Zacks Investment Research

Growing DTC Business

Skechers’ DTC business has been a significant revenue driver. DTC sales experienced a notable year-over-year increase of 23.8% in the third quarter of 2023. Skechers achieved $850.4 million in DTC sales, constituting 42% of the total sales.

The growth in DTC sales was further delineated by a 14.1% increase in domestic DTC sales and a substantial 33.3% rise in international DTC sales. Additionally, DTC unit volume exhibited an 18.8% increase, accompanied by a 4.3% rise in average selling price.

Expanding Reach

In terms of store expansion, Skechers opened 72 company-owned stores in the third quarter, with a significant presence in China and other international markets. Additionally, the company opened 324 third-party stores, bringing the total worldwide store count to 4,992.

Internationally, Skechers' business remains a major contributor to sales growth. International sales accounted for 61% of overall sales in the third quarter, showcasing growth of 2.3% and 14.4% year over year in the EMEA and APAC regions, respectively.

Digital initiatives play a crucial role in Skechers' growth strategy, with ongoing enhancements to its online presence, mobile applications, and loyalty programs. The company has also implemented omnichannel features like "Buy Online, Pick-Up in Store" and "Buy Online, Pickup at Curbside" to improve customer engagement.

The acquisition of its long-term Scandinavia distributor has strengthened Skechers' brand in the Nordic region, contributing to the company's online and offline presence.

Promising Outlook

Skechers is optimistic about reaching its target of $10 billion in annual sales by 2026. Markedly, management is actively investing in various avenues, including the opening of new stores, enhancing omnichannel capabilities and expanding distribution capacity in key markets such as India, China and Chile.

In 2023, the management aims to achieve sales in the range of $7.95-$8.05 billion, compared with $7.44 billion reported last year. Additionally, the company anticipates earnings per share to be between $3.33 and $3.43, surpassing the earlier expectation of $3.25-$3.40 and $2.38 reported last year.

Wrapping Up

Skechers’ commitment to diverse footwear offerings, including an emphasis on comfort-centric products, aligns with evolving consumer preferences. Its global expansion through the opening of company-owned and third-party stores, coupled with digital initiatives, positions the company for continued success.

This Zacks Rank #2 (Buy) stock has outpaced the Zacks Shoes and Retail Apparel industry in the past year. In the said period, shares of the company have gained 27.9% against the industry’s decline of 5.4%.

3 Other Red-Hot Stocks to Consider

A few other top-ranked stocks in the same space are American Eagle Outfitters Inc. AEO, Abercrombie & Fitch Co. ANF and Deckers Outdoor Corporation DECK.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year earnings and sales indicates growth of 36.1% and 2.4%, respectively, from the previous year’s reported figures. AEO has a trailing four-quarter average earnings surprise of 43.2%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently carries a Zacks Rank #2. ANF delivered a significant earnings surprise in the last reported quarter.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales implies growth of 10.3% from the previous year’s reported number. ANF has a trailing four-quarter average earnings surprise of 724.8%.

Deckers Outdoor is a leading designer, producer and brand manager of innovative, niche footwear and accessories. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Deckers’ current fiscal-year earnings and sales indicates growth of 20.2% and 11.1%, respectively, from the previous year’s reported figures. DECK has a trailing four-quarter average earnings surprise of 26.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report