Skechers (SKX) Thrives on Innovation and Market Adaptability

Skechers U.S.A., Inc.’s SKX expansion into new sports categories and strategic collaborations showcase its commitment to innovation and market adaptability. This move represents a proactive approach to tapping new market segments and catering to evolving consumer preferences.

The company's strategic foresight is evident in its ability to capitalize on the burgeoning demand for comfort technology products, solidifying its position as a go-to choice for consumers seeking style and functionality. SKX 's investment in digital capabilities has not only bolstered its e-commerce presence but has also elevated customer interaction.

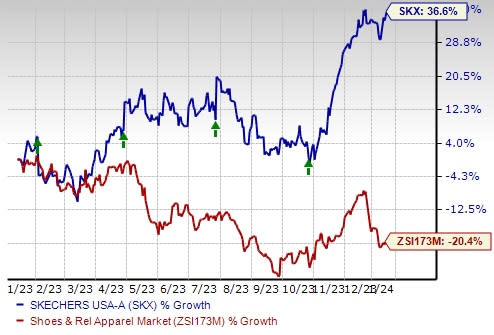

Image Source: Zacks Investment Research

Broadening Product Range Bodes Well

Skechers continues to offer a wide range of products, including fashion, athletic, non-athletic and work footwear, all at competitive prices. Recently, the company has focused on comfort-oriented footwear and apparel, catering to the rising trend of consumers preferring a more relaxed lifestyle in work and leisure environments.

Skechers has launched three collections in collaboration with Snoop Dogg, boosting its market presence in North America, Europe and other key regions. This collaboration, along with partnerships with Martha Stewart and the Rolling Stones, has increased the brand's visibility.

The company's commitment to innovation is evident in its diverse product lines like the Hands-Free Slip-ins and Arch Fit. SKX’s marketing efforts, featuring global influencers, highlight its focus on combining comfort with contemporary style.

DTC Business - A Key Catalyst

The DTC business has been a meaningful contributor to Skechers' overall business. DTC sales experienced a notable year-over-year increase of 23.8% in the third quarter of 2023. Skechers achieved $850.4 million in DTC sales, constituting 42% of the total sales.

The company attained a 14.1% increase in domestic DTC sales and a substantial 33.3% rise in international DTC sales. Additionally, the DTC unit volume exhibited an 18.8% increase, accompanied by a 4.3% rise in the average selling price. The strong performance of retail stores globally and significant outperformance on the international e-commerce platforms were the key factors driving growth.

Financial Targets

Skechers is optimistic about reaching its target of $10 billion in annual sales by 2026. Markedly, management is actively investing in various avenues, including the opening of stores, enhancing omnichannel capabilities, and expanding distribution capacity in key markets such as India, China and Chile.

For 2023, the management aims to achieve sales of $7.95-$8.05 billion, whereas it reported $7.44 billion in 2022. Additionally, the company anticipates earnings per share of $3.33-$3.43 compared with the earlier mentioned $3.25-$3.40, whereas it posted $2.38 in 2022.

Wrapping Up

This Zacks Rank #2 (Buy) stock has outpaced the Zacks Shoes and Retail Apparel industry over the past year. In the said period, shares of the company have gained 36.6% against the industry’s decline of 20.4%.

Skechers has demonstrated remarkable growth and adaptability through its expansion into new sports categories and strategic collaborations. With a notable increase in DTC sales and a diverse product range focused on comfort, Skechers is well-positioned for continued success, outpacing its industry and moving confidently toward its ambitious sales targets.

3 Other Red-Hot Stocks to Consider

A few other top-ranked stocks are The Gap, Inc. GPS, Abercrombie & Fitch Co. ANF and Deckers Outdoor Corporation DECK.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Gap’s current fiscal-year sales indicates growth of 387.5% from fiscal 2022’s reported figures. GPS has a trailing four-quarter average earnings surprise of 138%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. The company flaunts a Zacks Rank #1 at present. ANF delivered a 60.5% earnings surprise in the last reported quarter.

The Zacks Consensus Estimate for Abercrombie’s current fiscal-year sales implies growth of 15.1% from fiscal 2022’s reported number. ANF has a trailing four-quarter average earnings surprise of 713%.

Deckers is a leading designer, producer and brand manager of innovative, niche footwear and accessories. It currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Deckers’ current fiscal-year earnings and sales indicates growth of 21.9% and 11.7%, respectively, from fiscal 2023’s reported figures. DECK has a trailing four-quarter average earnings surprise of 26.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report