Skyline Champion Corp (SKY) Faces Headwinds as Q3 Fiscal 2024 Earnings Dip

Net Sales: Decreased by 3.9% to $559.5 million.

Net Income: Decreased by 43.3% to $47.0 million.

Earnings Per Share (EPS): Decreased by 43.8% to $0.81.

Adjusted EBITDA: Decreased by 39.2% to $66.3 million.

Gross Profit Margin: Contracted by 460 basis points to 25.3%.

Operating Cash Flow: Increased by 4.7% to $89.5 million.

Backlog: Increased 12.6% to $290.4 million compared to the previous quarter.

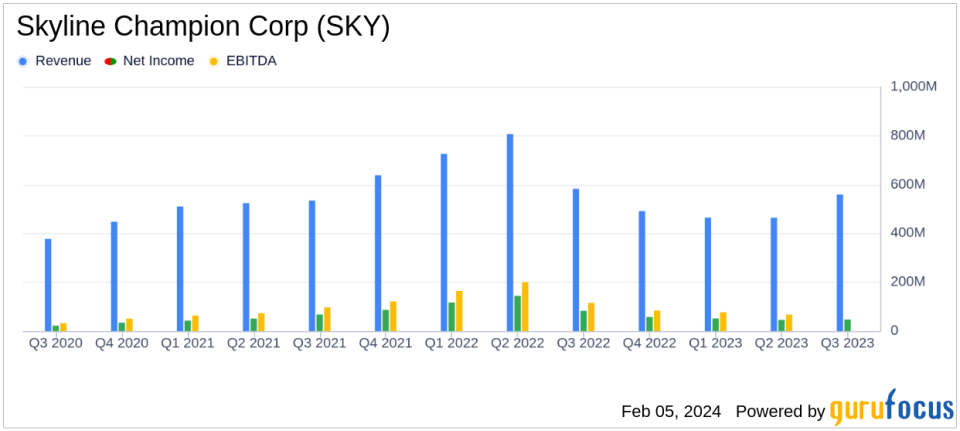

On February 5, 2024, Skyline Champion Corp (NYSE:SKY) released its 8-K filing, announcing the financial results for its third quarter ended December 30, 2023. The company, a prominent player in North America's factory-built housing industry, reported a decrease in net sales and net income, reflecting a challenging economic environment characterized by lower average selling prices and a contraction in gross profit margins.

Financial Performance Overview

Skyline Champion Corp's net sales saw a decline of 3.9% to $559.5 million, with U.S. homes sold decreasing by 1.8% to 5,643 units. The average selling price per U.S. home also fell by 2.0% to $92,300. Despite these challenges, the company's total backlog increased by 12.6% to $290.4 million compared to the second quarter, indicating potential for future revenue.

The gross profit margin experienced a significant contraction, dropping by 460 basis points to 25.3%. This decrease was attributed to lower selling prices, a shift in product mix, the impact of the Regional Homes operations, and the ramping up of previously idled facilities. Net income suffered a substantial decline of 43.3% to $47.0 million, and earnings per share followed suit, decreasing by 43.8% to $0.81.

Adjusted EBITDA, a key metric for evaluating a company's operating performance, decreased by 39.2% to $66.3 million, with the adjusted EBITDA margin contracting by 690 basis points to 11.8%. However, the company did generate more cash from operations, with a 4.7% increase to $89.5 million.

Strategic Moves and Operational Highlights

During the quarter, Skyline Champion closed the acquisition of Regional Homes and launched Champion Financing, a captive joint venture. Additionally, the company expanded its Southeast capacity by opening a new facility in Bartow, Florida. These strategic moves are part of Skyline Champion's efforts to strengthen its position in the market and better serve customer needs.

President and CEO Mark Yost commented on the company's ability to execute on operational and strategic priorities, highlighting the team's impressive handling of business goals during a seasonally slower period.

I am really impressed with how the team handled our business goals this quarter and their ability to execute on our operational and strategic priorities, said Mark Yost, Skyline Champions President, and Chief Executive Officer. Executing during a seasonally slower period while making great progress on the integration of Regional Homes and the rollout of Champion Financing is a testament to our people and our partners. In addition, we expanded our capacity during the quarter with the opening of a new plant in Bartow, Florida to support our growing builder developer channel in the region. The need for housing remains strong and Skyline Champion continues to position itself to better serve the needs of our customers.

Balance Sheet and Cash Flow Statement Highlights

As of December 30, 2023, the company reported $497.9 million in cash and cash equivalents, a decrease from the previous quarter, primarily due to the acquisition of Regional Homes. This was partially offset by the positive operating cash flows.

Investors and analysts are invited to participate in a conference call where management will discuss these financial results and provide an update on current operations.

Analysis and Outlook

The earnings report for Skyline Champion Corp reflects the broader challenges faced by the homebuilding and construction industry, including supply chain disruptions, inflationary pressures, and interest rate hikes. The company's strategic acquisitions and expansion efforts demonstrate a commitment to growth and adaptation in a changing market. However, the decline in key financial metrics such as net income and EBITDA margin suggests that Skyline Champion will need to continue to innovate and optimize operations to maintain its competitive edge.

Value investors may see the increased backlog as a sign of potential revenue growth, while the company's operational cash flow provides some assurance of financial stability. The earnings report presents a mixed picture, with strategic initiatives offering a counterbalance to the current financial headwinds.

For a more detailed analysis and updates on Skyline Champion Corp's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Skyline Champion Corp for further details.

This article first appeared on GuruFocus.