SkyWest (SKYW) Q2 Earnings & Revenues Surpass Estimates

SkyWest SKYW reported second-quarter 2023 earnings of 35 cents per share. The Zacks Consensus Estimate was pegged at a loss of 46 cents. The bottom line, however, plunged 67.3% year over year. SkyWest reported earnings per share of $1.07 a year ago.

Revenues of $725.6 million beat the Zacks Consensus Estimate of $706.1 million but slipped 9.2% year over year. SKYW deferred recognizing $60 million revenues in the June-end quarter compared with $16 million in the previous year.

Revenues from flying agreements (contributing 96.5% to the top line) declined 9.5% from the prior-year reported figure of $700.4 million. Expenses decreased 2.3% to $693.8 million from the year-ago levels, driven by a fall in operating costs.

The airline carried 11.1% fewer passengers in the reported quarter on a year-over-year basis. Departures were 12.9% less on a year-over-year basis. The passenger load factor (percentage of seats filled by passengers) decreased 0.5 points to 85.5%.

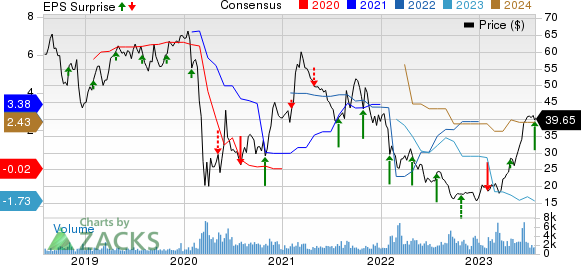

SkyWest, Inc. Price, Consensus and EPS Surprise

SkyWest, Inc. price-consensus-eps-surprise-chart | SkyWest, Inc. Quote

The fleet size decreased to 492 from 521 a year ago. SKYW, which has 235 E175 aircraft in its fleet currently, aims to operate 239 such jets by 2025 end.

At the end of the second quarter, the company had cash and marketable securities of $862.3 million compared with $1047.2 million reported at 2022 end. SkyWest spent $31 million toward capital expenditure for spare engines and other fixed assets. It ended the quarter with a long-term debt (net of current maturities) of $2.74 billion, down from $2.94 billion reported at 2022 end.

Zacks Rank

Currently, SkyWest carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Q2 Performance of Some Other Transportation Companies

J.B. Hunt Transport Services’ JBHT second-quarter 2023 earnings of $1.81 per share missed the Zacks Consensus Estimate of $1.97 and declined 25.2% year over year. Total operating revenues of $3,132.6 million also missed the Zacks Consensus Estimate of $3,347.5 million. The top line fell 18.4% year over year.

The downfall was due to a decline in revenue per load of 24% in Integrated Capacity Solutions, 13% in Intermodal and 21% in Truckload. A 4% decrease in productivity in Dedicated Capacity Solutions added to the woes. Changes in customer rate, freight mix and lower fuel surcharge revenues resulted in this downtick.

Delta Air Lines’ DAL second-quarter 2023 earnings (excluding 16 cents from non-recurring items) of $2.68 per share comfortably beat the Zacks Consensus Estimate of $2.42. DAL reported earnings of $1.44 a year ago.

Revenues of $15,578 million outshined the Zacks Consensus Estimate of $14,991.6 million. Total revenues increased 12.69% on a year-over-year basis driven by higher air-travel demand. Adjusted operating margin was 17.1% compared with 11.7% in the prior-year period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report