Skyworks Solutions Inc (SWKS) Reports Q1 FY24 Results: A Mixed Performance Amid Market Volatility

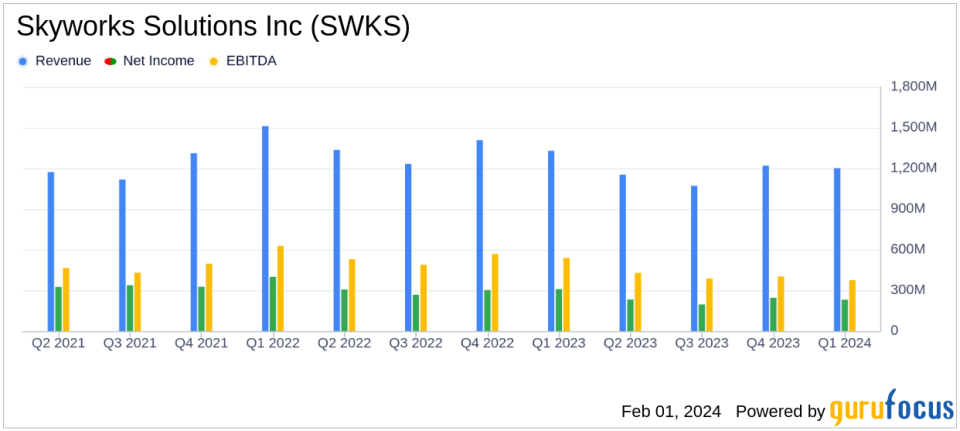

Revenue: Reported at $1.202 billion, a decrease from the previous year's $1.329 billion.

GAAP Diluted EPS: Stood at $1.44, while Non-GAAP Diluted EPS was higher at $1.97.

Operating Cash Flow & Free Cash Flow: Skyworks achieved record operating cash flow of $775 million and record free cash flow of $753 million.

Dividend: Announced a cash dividend of $0.68 per share, payable on March 12, 2024.

Next Quarter Outlook: Expects revenue between $1.02 to $1.07 billion and non-GAAP diluted EPS of $1.52 at the mid-point of the revenue range.

On January 30, 2024, Skyworks Solutions Inc (NASDAQ:SWKS) released its 8-K filing, detailing the financial outcomes for the first fiscal quarter of 2024. Despite the ongoing macroeconomic volatility, the company, known for its high-performance analog semiconductors, managed to deliver a mixed financial performance with a notable decline in revenue compared to the previous year but achieved record operating and free cash flow.

Skyworks Solutions operates in the semiconductor industry, producing components critical for wireless connectivity in a variety of devices, from smartphones to automotive systems. Its products are essential for enabling wireless transmissions, and its customer base includes major smartphone manufacturers and a growing presence in non-handset applications.

The company's revenue for the quarter was $1.202 billion, a decrease from $1.329 billion in the same period last year. However, Skyworks reported a record operating cash flow of $775 million and a record free cash flow of $753 million, reflecting strong working capital management and moderating capital expenditure intensity. GAAP diluted earnings per share (EPS) was $1.44, while non-GAAP diluted EPS was $1.97.

Financial Performance Analysis

Despite the revenue decline, Skyworks Solutions Inc (NASDAQ:SWKS) has shown resilience in its financial performance. The company's ability to generate record cash flows is a testament to its operational efficiency and strategic management of resources. The non-GAAP measures, which exclude certain expenses and items, present a more favorable view of the company's profitability and cash-generating capabilities.

The company's gross margin on a GAAP basis was 42.2%, while the non-GAAP gross margin was higher at 46.4%. The operating margin also reflected a similar trend, with GAAP operating margin at 21.5% and non-GAAP operating margin at 30.4%. These margins are critical indicators of the company's ability to control costs and maintain profitability despite revenue fluctuations.

CEO Liam K. Griffin commented on the performance, stating, "Skyworks continues to execute well and generate robust profitability in light of ongoing macroeconomic volatility." He also highlighted the company's positioning for long-term growth in various sectors, including IoT devices, automotive electrification, and cloud and data center upgrades.

"We delivered record quarterly free cash flow of $753 million, which reflects strong working capital management and moderating capex intensity. We are seeing signs that the Android smartphone market is recovering," said Griffin.

Challenges and Outlook

Despite the strong cash flow performance, Skyworks Solutions Inc (NASDAQ:SWKS) faces challenges, including a decline in revenue and potential market volatility. The company's outlook for the second fiscal quarter of 2024 anticipates a seasonal decline in its mobile business, which is consistent with historical patterns, while expecting modest growth in broad markets off the December quarter.

For the upcoming quarter, Skyworks expects revenue to be between $1.02 to $1.07 billion, with non-GAAP diluted EPS anticipated to be $1.52 at the mid-point of the revenue range. This guidance reflects the company's cautious optimism in the face of uncertain market conditions.

The company's balance sheet remains strong, with cash, cash equivalents, and marketable securities totaling $1.047 billion. The company also declared a cash dividend of $0.68 per share, demonstrating its commitment to returning value to shareholders.

In conclusion, Skyworks Solutions Inc (NASDAQ:SWKS) has demonstrated a robust financial foundation with its record cash flows, despite facing a challenging revenue environment. The company's strategic focus on key growth areas and efficient capital management positions it to navigate the uncertainties of the semiconductor market. Investors and stakeholders will be watching closely to see how the company's strategies unfold in the coming quarters.

Explore the complete 8-K earnings release (here) from Skyworks Solutions Inc for further details.

This article first appeared on GuruFocus.