Skyworks' (SWKS) Q1 Earnings Beat Estimates, Revenues Down Y/Y

Skyworks Solutions SWKS reported first-quarter fiscal 2024 non-GAAP earnings of $1.97 per share, comfortably beating the Zacks Consensus Estimate by 1.03% and declining 23.9% year over year.

Revenues of $1.20 billion dropped 9.6% on a year-over-year basis and missed the consensus mark by 0.19%.

Mobile revenues contributed nearly 71% to total revenues and increased 7% sequentially.

SWKS made investments in product development, particularly focusing on highly integrated platforms for leading mobile Original Equipment Manufacturers (OEMs).

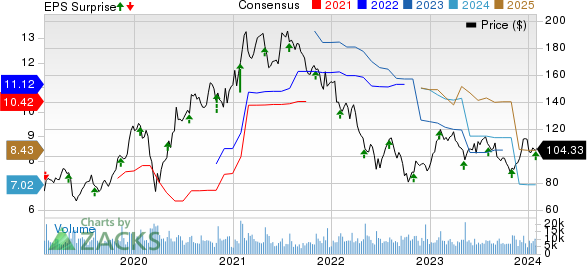

Skyworks Solutions, Inc. Price, Consensus and EPS Surprise

Skyworks Solutions, Inc. price-consensus-eps-surprise-chart | Skyworks Solutions, Inc. Quote

Skyworks Solutions successfully obtained design wins in various sectors such as infrastructure, WiFi, automotive and emerging IoT, underscoring its competitive edge and strong market presence.

Broad markets contributed nearly 29% to total revenues and suffered from high inventory levels in wireless infrastructure, automotive and industrial end-markets.

Operating Details

Non-GAAP gross margin contracted 510 basis points (bps) on a year-over-year basis to 46.4%, primarily due to unfavorable mix shifts caused by reduced revenue from broad markets.

Research & development expenses, as a percentage of revenues, increased 40 bps year over year to 12.7%.

Selling, general and administrative expenses declined 20 bps to 6.6% in the reported quarter.

Non-GAAP operating margin contracted 650 bps on a year-over-year basis to 30.4% in the reported quarter.

Balance Sheet & Cash Flow

As of Dec 29, 2023, cash & cash equivalents and marketable securities were $1047.6 million compared with $738.5 million as of Sep 29, 2023.

Long-term debt was $9.93 billion as of Dec 29, 2023, up from $1.29 billion as of Sep 29, 2023. It repaid $300 million of term loan in the reported quarter.

Cash generated by operating activities was $775 million in the quarter under discussion compared with $365.7 million in the previous quarter.

Free cash flow was $753 million, with a 63% free cash flow margin.

Skyworks paid dividends worth $109 million in the reported quarter.

Guidance

For the second quarter of fiscal 2024, the company currently expects revenues between $1.02 billion and $1.07 billion. Earnings are expected to be $1.52 per share at the mid-point of this revenue guidance.

The Zacks Consensus Estimate for second-quarter fiscal 2024 earnings is currently pegged at $1.54 per share unchanged over the past 30 days. The consensus mark for revenues is pegged at $1.04 billion, indicating 9.61% year-over-year decline.

The gross margin is expected to be between 45% and 46%. Operating expenses are expected to be in the range of $193-$197 million.

Zacks Rank & Stocks to Consider

Skyworks currently carries a Zacks Rank #3 (Hold).

The company’s shares have declined 8.4% in the past six months compared with the Zacks Computer & Technology sector’s growth of 12.8%.

Pinterest PINS, AvidXchange AVDX and Shopify SHOP are some better-ranked stocks that investors can consider in the broader sector, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shopify’s shares have gained 22.1% in the past six months. SHOP is set to report its fourth-quarter 2023 results on Feb 13.

Pinterest’s shares have gained 32.7% in the past six months. PINS is set to report its fourth-quarter 2023 results on Feb 8.

AvidXchange’s shares have declined 9.6% in the past six months. AVDX is set to report its fourth-quarter 2023 results on Feb 28.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skyworks Solutions, Inc. (SWKS) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

AvidXchange Holdings, Inc. (AVDX) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report