Skyworks' (SWKS) Q3 Earnings Beat Estimates, Revenues Down Y/Y

Skyworks Solutions SWKS reported third-quarter fiscal 2023 non-GAAP earnings of $1.73 per share, comfortably beating the Zacks Consensus Estimate of $1.67 but decreasing 29.1% year over year.

Revenues of $1.07 billion decreased 13.1% on a year-over-year basis but beat the consensus mark by 0.07%.

Mobile revenues accounted for 59% of total revenues. Broad markets accounted for 41% of total revenues and benefited from strong automotive (double-digit year-over-year revenue growth), infrastructure and industrial end-markets.

However, the challenging macroeconomic environment and sluggish demand in the Android ecosystem negatively impacted profitability.

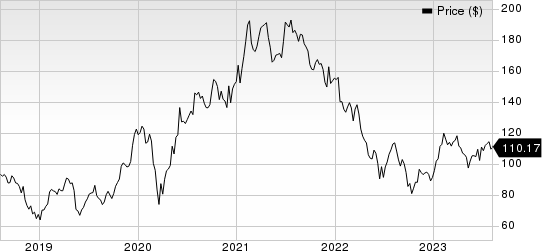

Skyworks Solutions, Inc. Price

Skyworks Solutions, Inc. price | Skyworks Solutions, Inc. Quote

The company’s shares have gained 20.9% year to date, underperforming the Zacks Computer & Technology sector’s growth of 38.5%.

Operating Details

Non-GAAP gross margin contracted 370 basis points (bps) on a year-over-year basis to 47.5%, primarily due to factory underutilization on a temporary basis.

Research & development expenses, as a percentage of revenues, increased 110 bps year over year to 13.9%.

Selling, general and administrative expenses increased 100 bps to 7.2% in the reported quarter.

Non-GAAP operating margin contracted 520 bps on a year-over-year basis to 30.5% in the reported quarter.

Balance Sheet & Cash Flow

As of Jun 30, 2023, cash & cash equivalents and marketable securities were $739.5 million compared with $1.06 billion as of Mar 31, 2023.

Long-term debt was $1.49 billion as of Jun 30, 2023, down from $1.99 billion as of Mar 31, 2023.

Cash generated by operating activities was $305.7 million in the quarter under discussion compared with $411.7 million in the previous quarter.

Skyworks paid dividends worth $99 million. The company also raised its quarterly dividend by 10% to 68 cents per share.

Guidance

For the fourth quarter of fiscal 2023, Skyworks expects double-digit revenue and earnings growth on a sequential basis.

The company currently expects revenues between $1.19 billion and $1.24 billion. Earnings are expected to be $2.10 per share at the mid-point of this revenue guidance.

Gross margin is expected between 47% and 48%. Operating expenses are expected to be in the range of $178-$182 million, down 6.5% year over year at the midpoint.

Zacks Rank & Stocks to Consider

Skyworks currently carries a Zacks Rank #4 (Sell).

BILL Holdings BILL, CACI International CACI and Cisco Systems CSCO are some better-ranked stocks that investors can consider in the broader sector, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BILL Holdings shares have gained 3% year to date. BILL is set to report its fourth-quarter fiscal 2023 results on Aug 17.

CACI International shares have gained 18.9% year to date. CACI is set to report its fourth-quarter fiscal 2023 results on Aug 9.

Cisco Systems shares have returned 11.3% year to date. CSCO is set to report its fourth-quarter fiscal 2023 results on Aug 16.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Skyworks Solutions, Inc. (SWKS) : Free Stock Analysis Report

CACI International, Inc. (CACI) : Free Stock Analysis Report

BILL Holdings, Inc. (BILL) : Free Stock Analysis Report