Skyworks' (SWKS) Q4 Earnings Beat Estimates, Revenues Down Y/Y

Skyworks Solutions SWKS reported fourth-quarter fiscal 2023 non-GAAP earnings of $2.20 per share, comfortably beating the Zacks Consensus Estimate by 4.76% but decreasing 27.2% year over year.

Revenues of $1.219 billion decreased 13.4% on a year-over-year basis but beat the consensus mark by 0.25%. Sequentially, revenues increased 14%.

Mobile revenues accounted for roughly 65% of total revenues and increased 25% sequentially. Broad markets accounted for nearly 35% of total revenues and suffered from high inventory levels.

The company’s shares have gained 20.9% year to date, underperforming the Zacks Computer & Technology sector’s growth of 38.5%.

Operating Details

Non-GAAP gross margin contracted 410 basis points (bps) on a year-over-year basis to 47.1%, primarily due to factory underutilization due to the right-sizing of inventory levels.

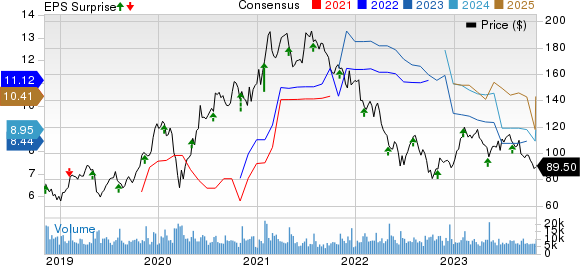

Skyworks Solutions, Inc. Price, Consensus and EPS Surprise

Skyworks Solutions, Inc. price-consensus-eps-surprise-chart | Skyworks Solutions, Inc. Quote

Research & development expenses, as a percentage of revenues, increased 140 bps year over year to 12%.

Selling, general and administrative expenses decreased 20 bps to 6% in the reported quarter.

Non-GAAP operating margin contracted 490 bps on a year-over-year basis to 32.6% in the reported quarter.

Balance Sheet & Cash Flow

As of Sep 29, 2023, cash & cash equivalents and marketable securities were $738.5 million compared with $739.5 million as of Jun 30, 2023.

Long-term debt was $1.29 billion as of Sep 29, 2023, down from $1.49 billion as of Jun 30, 2023. It repaid $200 million of term loan in the reported quarter.

Cash generated by operating activities was $365.7 million in the quarter under discussion compared with $305.7 million in the previous quarter.

Skyworks paid dividends worth $108 million.

Guidance

For the first quarter of fiscal 2024, the company currently expects revenues between $1.175 billion and $1.225 billion. Earnings are expected to be $1.95 per share at the mid-point of this revenue guidance.

Gross margin is expected to be between 46% and 47%. Operating expenses are expected to be in the range of $193-$197 million.

Zacks Rank & Stocks to Consider

Skyworks currently carries a Zacks Rank #3 (Hold).

NetEase NTES, NVIDIA NVDA and Model N MODN are some better-ranked stocks that investors can consider in the broader Zacks Computer & Technology sector, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NetEase shares have gained 51.1% year to date. NTES is set to report its third-quarter 2023 results on Nov 16.

NVIDIA shares have returned 197.5% year to date. NVDA is set to report its third-quarter fiscal 2024 results on Nov 21.

Model N shares have declined 39.2% year to date. MODN is set to report its fourth-quarter fiscal 2023 results on Nov 9.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Skyworks Solutions, Inc. (SWKS) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report