Is SL Green Realty (SLG) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

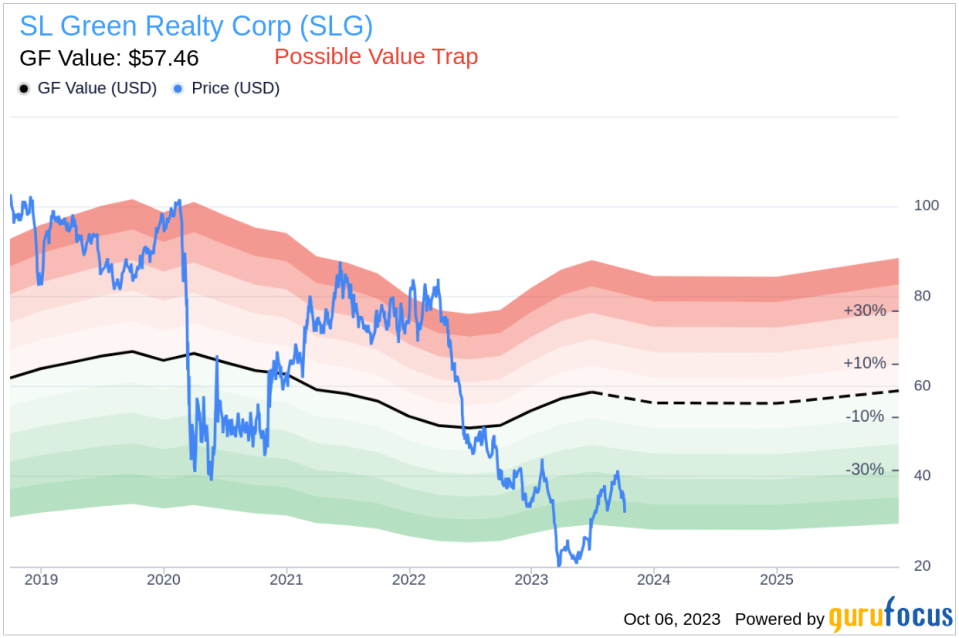

Value-focused investors are constantly seeking stocks priced below their intrinsic value. SL Green Realty Corp (NYSE:SLG), a stock currently priced at 32.44, has caught the attention of many, especially with its recent 3-month increase of 13.31%. Despite the day's loss of 5.83%, the stock's fair valuation stands at $57.46, according to its GF Value. However, is this seemingly attractive valuation a genuine opportunity or a potential value trap?

Understanding GF Value

The GF Value represents a stock's current intrinsic value derived from GuruFocus's exclusive method. This value is calculated based on historical multiples the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance. The GF Value Line on our summary page provides an overview of the fair value at which the stock should be traded. If the stock price significantly deviates from the GF Value Line, it may indicate overvaluation or undervaluation, influencing its future return.

Scrutinizing SL Green Realty's Risk Factors

Despite its apparent undervaluation, certain risk factors associated with SL Green Realty Corp (NYSE:SLG) should not be ignored. These risks are primarily reflected through its low Altman Z-score of 0.23. This indicator suggests that SL Green Realty, despite its attractive valuation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

Decoding the Altman Z-Score

The Altman Z-score is a financial model that predicts the probability of a company entering bankruptcy within a two-year time frame. Invented by New York University Professor Edward I. Altman in 1968, the Z-Score combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

SL Green Realty Corp (NYSE:SLG): A Snapshot

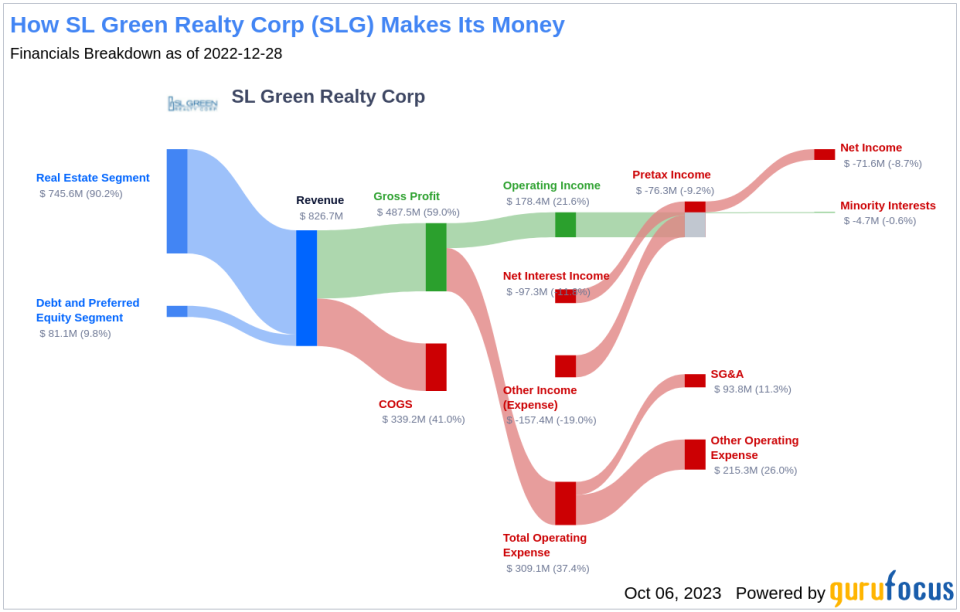

SL Green Realty is one of the largest Manhattan property owners and landlords, with interest in around 35 million square feet of wholly owned and joint-venture office space. The company has additional property exposure through its limited portfolio of well-located retail space. It operates as a real estate investment trust, with a market cap of $2.10 billion and sales of $882 million.

Dissecting SL Green Realty's Low Altman Z-Score

A closer look at SL Green Realty's Altman Z-score reveals potential financial distress. The Retained Earnings to Total Assets ratio, which provides insights into a company's capability to reinvest its profits or manage debt, shows a declining trend for SL Green Realty. Historical data from 2021 to 2023 indicates a diminishing ability to reinvest in its business or effectively manage its debt, negatively impacting its Z-Score.

Furthermore, the company's asset turnover, a vital indicator of operational efficiency, shows a decreasing trend from 2021 to 2023. A drop in this ratio can signify reduced operational efficiency, potentially due to underutilization of assets or decreased market demand for the company's products or services. This shift underlines the need for SL Green Realty to reassess its operational strategies to optimize asset usage and boost sales.

Conclusion: Navigating the Thin Line Between Value and Trap

Considering the potential financial distress indicated by SL Green Realty's low Altman Z-Score and declining operational efficiency, the company appears to be a potential value trap. Despite its seemingly attractive valuation, the risks associated with investing in SL Green Realty should not be overlooked. As always, thorough due diligence is crucial before making an investment decision.

GuruFocus Premium members can find stocks with high Altman Z-Score using the Walter Schloss Screen .

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.