SL Green's (SLG) Q3 FFO & Revenues Lag, '23 View Lowered

Shares of SL Green Realty Corp. SLG lost 3.71% in the after-market trading hours in response to dismal third-quarter 2023 results and cut its earnings guidance for 2023.

Funds from operations (FFO) per share of $1.27 missed the Zacks Consensus Estimate by a whisker. The figure also declined 23.5% from the year-ago quarter.

The results reflect lower-than-anticipated revenues despite decent leasing activity in its Manhattan portfolio. Higher interest expense during the quarter acted as a dampener. Expecting higher severance and stock-based compensation costs during the fourth quarter of 2024, SL Green lowered its guidance for 2023 FFO per share.

Net rental revenues of $131.5 million, too, missed the Zacks Consensus Estimate of $143.8 million. Moreover, the figure slipped 8% from the prior-year quarter.

In September, SL Green completed the development of One Madison Avenue, a 27-story, 1.4 million-square-foot premier office tower located in Manhattan's Midtown South submarket, three months ahead of schedule and significantly under budget. Apart from securing the Temporary Certificate of Occupancy for the property, it received $577.4 million in cash, signifying the final equity payment from its joint venture partners. The funds were deployed to repay unsecured corporate debt.

Quarter in Detail

During the third quarter, the same-store cash net operating income (NOI), including SL Green’s share of same-store cash NOI from unconsolidated joint ventures, increased 10.4% year over year to $165.2 million. This excludes the lease termination income.

For its Manhattan portfolio, SL Green signed 50 office leases encompassing 355,831 square feet of space in the reported quarter. The mark-to-market on signed Manhattan office leases decreased 3.8% from the previous fully-escalated rents on the same spaces in the quarter.

The average lease term for the Manhattan office leases signed was 6.3 years, while average tenant concessions were 5.8 months of free rent with a tenant improvement allowance of $63.64 per rentable square foot. This excludes the leases signed at One Vanderbilt Avenue.

As of Sep 30, 2023, Manhattan’s same-store office occupancy, inclusive of 119,409 square feet of leases signed but not yet commenced, was 89.9%, up from 89.8% at the end of the prior quarter but down from 92.8% at the end of the year-ago quarter.

As of the same date, the carrying value of the company’s debt and preferred equity portfolio was $334.3 million. This marked the lowest balance since the third quarter of 2004.

The company’s interest expense (net of interest income) jumped 25.7% year over year to $27.4 million.

Liquidity

SL Green exited the third quarter with cash and cash equivalents of $189.8 million, down from $191.9 million recorded as of Jun 30, 2023.

2023 Guidance Lowered

Anticipating increased severance and stock-based compensation costs, to be realized under general and administrative expenses during the fourth quarter of 2023, SL Green lowered its guidance for 2023 FFO per share to the range of $5.05-$5.35 from $5.30-$5.60 guided earlier. The Zacks Consensus Estimate is currently pegged at 5.55.

SL Green currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

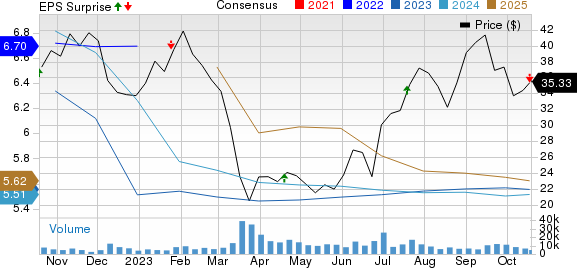

SL Green Realty Corporation Price, Consensus and EPS Surprise

SL Green Realty Corporation price-consensus-eps-surprise-chart | SL Green Realty Corporation Quote

Upcoming Earnings Releases

We now look forward to the earnings releases of other REITs like Equinix EQIX and American Tower AMT, slated to report on Oct 25 and Oct 26, respectively. Meanwhile, Boston Properties BXP is scheduled on Nov 1.

The Zacks Consensus Estimate for Equinix’s third-quarter 2023 FFO per share is pegged at $7.79, implying a marginal year-over-year increase. EQIX currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for American Tower’s third-quarter 2023 FFO per share stands at $2.35, indicating a marginal fall year over year. AMT currently has a Zacks Rank #3.

The Zacks Consensus Estimate for Boston Properties’ third-quarter 2023 FFO per share is pegged at $1.85, suggesting a year-over-year fall of 3.14%. BXP currently carries a Zacks Rank #2.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT) : Free Stock Analysis Report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report