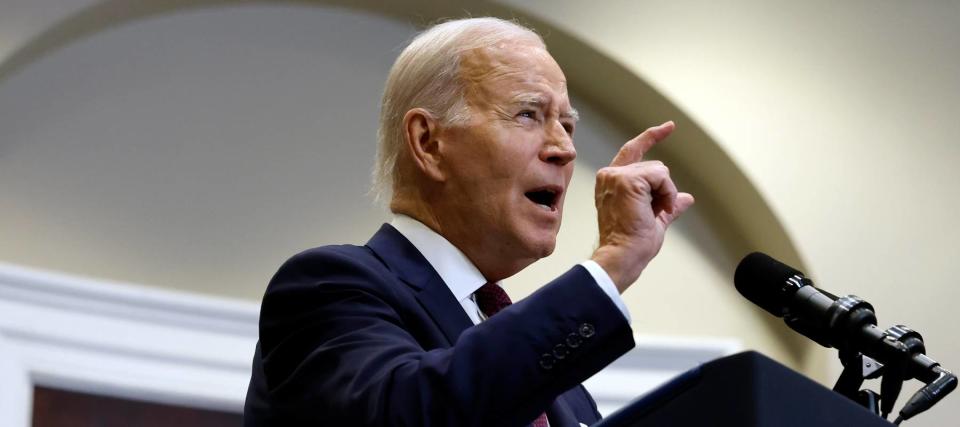

'It's an outrage': U.S. Secretary of Education blasts Supreme Court's decision on Biden's student debt plan as the department faces funding shortfall — what happens when loan payments resume?

The Supreme Court's decision on U.S. President Joe Biden's plan to forgive $1.7 trillion in federal student debt is expected tomorrow ahead of the court's summer recess and the planned restart of loan payments for 43 million Americans.

Officials are worried the U.S. Education Department may not have enough funding to implement “a smooth return to repayment” when people are sent student loan bills for the first time since the COVID-19 pandemic began in March 2020.

Don't miss

If you owe $25K+ in student loans, there are ways to pay them off faster

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Scrubs to riches: A California nurse just went viral showing how she paid off her student loans by 27 while making up to $500K a year — here are 5 ways to build wealth without a wild salary

What would this bumpy road look like for borrowers? Not only would they have to adjust their monthly budget to cover their student debt — but they may also struggle to connect with your loan servicing company if they have questions or concerns and everything could take longer to process.

“It’s a slow-moving car crash,” Jared Bass, senior director for higher education at the Center for American Progress and a former Democratic appropriations staffer, told POLITICO. “We see what’s about to unfold, so let’s just prevent it now and just step in and take preventative measures.”

Education Secretary Miguel Cardona has called for an “all hands on deck” approach to help stem any unnecessary harm to borrowers — and there are also things that you can do to make your student loan repayment as stress-free as possible.

When will student loan payments restart?

Student loan “payments will be due starting in October,” the Education Department announced on its website, while “interest will resume starting on Sept. 1.”

The news comes after President Joe Biden and House Speaker Kevin McCarthy came to terms on a deal in late May to lift the country's debt ceiling. Part of the resulting bill signed in June involved an end to the student loan payment freeze would, which had persisted for three years.

How millions of Americans will transition back to paying back student loans and how much they will be on the hook for remains to be seen. Mark Kantrowitz, a higher education expert, said borrowers should "hold tight" for now as the fate of a separate Biden initiative to cancel up to $20,000 in student debt for low- to middle-income Americans is before the Supreme Court.

The court's decision is expected tomorrow on whether the plan that would see the student debt of 14 million Americans entirely cleared will move forward, according to a report from CNBC.

Prior to the debt ceiling deal, the Education Department had been looking at a range of borrower-friendly programs to help people resume their payments and “remain in good standing with their student loans” — with “a particular focus on those who are most at risk,” it shared in a budget document released last month.

For instance, officials considered a “safety net” or grace period — potentially up to a year after repayment begins — where borrowers won’t be penalized for missing payments, POLITICO reported.

But the Education Department needs adequate funding to bring these initiatives to life — money that Congress has so far been unable to provide.

While lawmakers debate, here are three ways to make your student loan repayments as pain free as possible.

Rebuild your budget

According to Federal Reserve data, the average student loan monthly payment is $393.

Finding nearly $400 every month after a three-year freeze of not having to pay anything could be tricky — especially if you’ve slipped into new habits and allocated that cash to other more urgent needs.

You may want to revisit your budget to ensure you have enough money to cover your student debt. If you don’t, the consequences could be dire.

Read more: 3 big mistakes people make with cash back credit cards that cost them every time they swipe

If you miss a student loan payment, even by just one day, your loan becomes past due or delinquent. It will stay that way until you repay the past-due amount or make other arrangements with your lender.

If you’re delinquent on your loan for 90 days or more, your loan servicer can report the delinquency to the three major national credit bureaus, and your credit rating could be cut.

With a poor credit rating, you may find it difficult to obtain credit cards, home or car loans or other forms of consumer credit — and if you're still able to borrow money, you’ll likely have to pay a higher interest rate than someone with a good credit rating.

If you’re not sure how to rebuild your budget to include student loan repayments, it might be helpful to reach out to a professional financial adviser who can set you on the right path.

Make payments, even though you don't have to

You don’t have to wait for the government’s green light to make your student loan payments.

In fact, it could be beneficial to start making regular payments if you’re not doing so already. The interest rate on federal loans is currently 0%, but with interest set to resume starting Sept. 1, any payments you make between now and then will go entirely toward the principal of your loan.

Paying more than your usual minimum is also a smart idea, if you can afford it, as you’ll chip away at your loan balance.

If you’re saddled with other debt and not yet in a position to start repaying your student loans, consider using this time to clean up your finances and potentially even tame your debt with the help of a lower-interest debt consolidation loan.

Find the best repayment pan

There are ways to clear out your student loan debt faster by switching up your current payment plan, particularly if your income went down during the payment freeze and still hasn’t recovered.

The government offers income-driven repayment plans that allow you to make more affordable payments based on what you earn. After you make 20 or 25 years of regular payments under an income-driven plan, your remaining student debt will be forgiven.

That might be your best shot at having some of your student loans canceled — especially if the Supreme Court rules against Biden’s student loan forgiveness plan.

One simple money-saving step with a federal student loan is to enroll in autopay, as signing up for automatic deposits may qualify you for a 0.25% interest rate reduction when payments resume.

What to read next

Millions of Americans are in massive debt in the face of rising rates. Here's how to get your head above water ASAP

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2023

Here's how much money the average middle-class American household makes — how do you stack up?

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.