SM Energy (SM) Raises Q2 Production Outlook, Lowers Capex View

SM Energy Company SM announced specific updates on its activities and revised the guidance for second-quarter 2023.

Higher Production

SM Energy anticipates exceeding the high end of its second-quarter production ranges. The outperformance is expected to have been driven by higher hydrocarbon volumes from new and existing wells in its South Texas program.

For the second quarter, SM increased the oil production outlook by more than 4% (at 42% oil) from the mid-point of the prior-stated 13.3-13.5 million barrels of oil equivalent (MMBoe).

For 2023, SM expects to increase oil production by 1 MMBoe from the previously mentioned mid-point of 52.5-54.5 MMBoe. The company expects an increase in the oil percentage to 43-44%.

Lower Capital Expenditure

For the second quarter, SM Energy expects to spend below the low end of its capital expenditure and lease operating expense (“LOE”) guidance ranges. The underspending was led by favorable cost reduction and a decline in facility expenses.

Capital expenditure savings will be partially allocated to an additional rig in the Midland Basin beginning in October 2023. This is expected to boost oil production volumes in 2024.

For the second quarter, SM Energy announced a 10% reduction in the capital budget (before acquisitions) from the previously mentioned mid-point of $295-$315 million. The company also reduced its 2023 capital budget (including acquisition) by $50 million.

For the second quarter and 2023, SM Energy lowered LOE per barrel of oil equivalent by 50 cents each from the previously mentioned mid-point.

Share Repurchases

In the second quarter, SM Energy repurchased 2.6 million shares from its $500-million stock repurchase program.

The company has repurchased 5.3 million shares since the program’s inception in September 2022. SM currently has shares worth $334 million remaining under the share repurchase authorization through 2024.

Acquisitions

In the second quarter, SM Energy entered an agreement to acquire 20,000 net acres in Texas’ Dawson and northern Martin counties for $93.5 million. The assets involve net production of 1,250 barrels of oil equivalent per day, 90% of which is oil. The acquired assets also include undeveloped acreages.

The company also acquired an additional 2,800 net acres near its previously purchased Midland Basin assets. SM did not reveal the location and acquisition expenses of the transaction.

To conclude, SM Energy commits to increasing the return of capital to shareholders, improving operating performance and driving inventory growth in 2023.

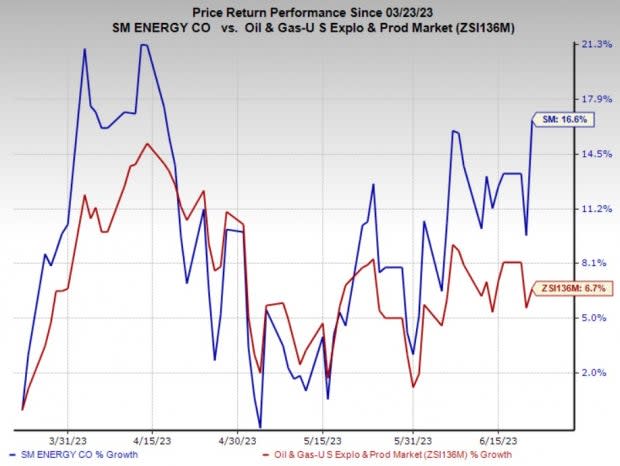

Price Performance

Shares of SM Energy have outperformed the industry in the past three months. The stock has gained 16.6% compared with the industry’s 6.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

SM Energy currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are Seadrill Limited SDRL, Evolution Petroleum Corporation EPM and PHX Minerals Inc. PHX. SDRL and EPM currently sport a Zacks Rank of 1 (Strong Buy), and PHX carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Seadrill is a market-leading international driller with strong exposure in key strategic basins like the U.S. Gulf of Mexico, Brazil and Angola. SDRL reported first-quarter 2023 earnings of 83 cents per share, beating the Zacks Consensus Estimate of earnings of 55 cents per share.

Seadrill has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for SDRL’s 2023 and 2024 earnings is pegged at $2.93 per share and $4.01 per share, respectively.

Evolution Petroleum is an independent energy company. EPM reported first-quarter 2023 earnings of 42 cents per share, beating the Zacks Consensus Estimate of earnings of 17 cents per share.

Evolution Petroleum has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for EPM’s 2023 and 2024 earnings is pegged at $1.11 and $1.05 per share, respectively.

PHX Minerals is an oil and natural gas mineral company. The company posted first-quarter 2023 earnings of 11 cents per share, beating the Zacks Consensus Estimate of earnings of 7 cents per share.

PHX has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for the company’s 2023 and 2024 earnings per share is pegged at 30 cents and 55 cents, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SM Energy Company (SM) : Free Stock Analysis Report

Seadrill Limited (SDRL) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

PHX Minerals Inc. (PHX) : Free Stock Analysis Report