Small-Cap Surprises: 7 Undiscovered Growth Stocks Poised to Explode

Investors looking for high-risk yet potentially high-reward opportunities can find plenty of them among small-cap growth stocks. Arguably, the small-caps category (stocks with a market capitalization between $300 million and $2 billion) offers the best of both worlds.

Small-caps are typically larger, more established enterprises relative to the stocks in the micro-caps category (market cap of $300 million or less). Because of their small size, many have a greater opportunity for growth compared to larger, mature companies in the mid-cap, large-cap, and mega-cap categories.

Admittedly, it may be a stretch to say that the most promising small-cap stocks are “under the radar.” The most appealing situations have more-or-less been initially discovered by those active in this area of the market.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

That said, while some have discovered and have become appreciative of their potential, don’t assume that it’s too late to enter a position. At least, that’s the situation here, with these seven small-cap growth stocks.

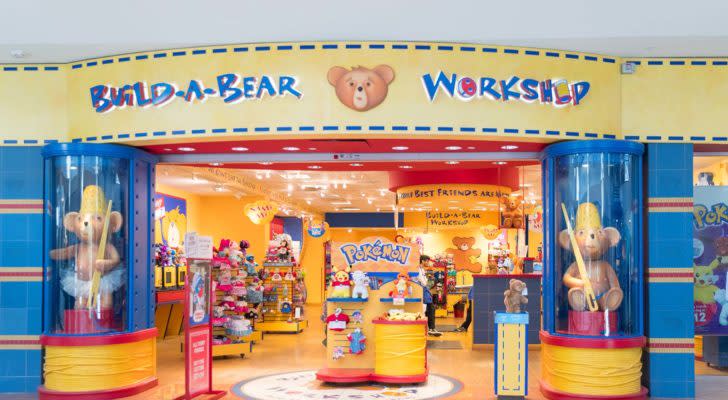

Build-A-Bear Workshop (BBW)

Source: Helen89 / Shutterstock.com

Take a look at the valuation of Build-A-Bear Workshop (NYSE:BBW), and you may question what I would consider it being one of the small-cap growth stocks.

The specialty retailer trades at valuation that clearly puts it in deep value territory (6.3 times forward earnings).

More importantly, this low valuation suggests that BBW stock is at risk of experiencing an earnings decline. Yet as I have pointed out previously, while many on the short-side have wagered on this happening, so far it has not played out.

Build-A-Bear may not be on track to experience high earnings growth, at least based on analyst forecasts. However, merely reporting modest levels of earnings growth, or just keeping earnings steady may drive growth in its stock price. Even a modest re-rating to 10 times forward earnings would represent nearly 70% price appreciation for shares.

CECO Environmental (CECO)

Source: Roman Zaiets/ShutterStock.com

CECO Environmental (NASDAQ:CECO) manufactures air quality and water treatment products used in industrial applications. Strong revenue and earnings growth has resulted in outsized gains for CECO investors over the past two years.

Back in early 2022, CECO stock changed hands for around $6 per share. Today, it trades for over three times that amount. Given recent results, it makes sense that shares continue to trend higher. As InvestorPlace’s Noah Bolton pointed out earlier this month, during Q3 2023, CECO’s revenue grew 38% year-over-year, with earnings increasing by 71%.

Yet while subsequent gains may arrive at a much more modest pace, don’t assume middling returns lie ahead for this stock. Sell-side forecasts call for earnings growth of around 37.7% this year. Such growth may enable CECO Environmental to sustain its valuation (26.6 times forward earnings), and continue to make strong gains over the next twelve months.

Genius Sports (GENI)

Source: Shutterstock

Genius Sports (NYSE:GENI) is one of the small-cap growth stocks garnering increased attention lately. In recent months, shares in this U.K.-based provider of business-to-business tech, data, and content services to the sports gambling industry, have been the recipient of bullish analyst ratings.

Back in November, JMP Securities’ Jordan Bender reiterated his “Market Outperform” rating for GENI stock, citing the company’s strong Q3 2023 results.

In December, the analyst team at Macquarie initiated coverage, assigning the stock an “Outperform” rating, citing both the continued strong growth prospects of the U.S. sports betting industry, plus the fact that Genius Sports is the sole distributor of NFL data for betting purposes.

GENI remains unprofitable on a GAAP basis, but as the aforementioned analysts anticipate large increases in Genius Sports’ EBITDA over the next two years, GAAP profitability could be reached during this time.

Live Oak Bancshares (LOB)

Source: shutterstock.com/marozhka studio

Live Oak Bancshares (NYSE:LOB) is a North Carolina-based commercial bank that operates nationwide. Over the past five years, Live Oak has been successful in its efforts to become “America’s small business bank.”

Over this time frame, Live Oak’s deposits have increased from $3.15 billion to around $10 billion. While shares tanked during the 2022 bear market, and because of the 2023 banking crisis, LOB is up by around 150% since 2018. Trading for around $40 per share today, Live Oak admittedly may seem pricey for a bank stock, as it trades for 24 times forward earnings.

Yet as economic conditions normalize, expect strong earnings growth ahead for Live Oak. Sell-side forecasts call for earnings to come in $2.37 per share this year, and $3.12 per share in 2025. Sustaining similarly-strong levels of growth may enable LOB to re-hit its past all-time high (near $100 per share).

PDF Solutions (PDFS)

Source: Shutterstock

PDF Solutions (NASDAQ:PDFS) is a provider of proprietary software and physical intellectual property products for the semiconductor industry. Shares have pulled back since last summer, after a strong run during the first half of 2023.

Yet while investors may take a breather when it comes to PDFS stock, you may want to take a closer look. Although there have been valuation concerns about the stock in the past, PDFS’s current multiple (40.8 times forward earnings) may be sustainable.

The company reported an earnings beat for Q3 2023. While not for certain, more positive surprises could perhaps arrive in its next quarterly earnings release.

That’s not all. Long-term analyst forecasts call for earnings to hit 91 cents per share in 2024, and $1.55 per share by 2025. Not too shabby, for a growth stock trading for just under $30 per share.

PetIQ (PETQ)

Source: Eric Isselee / Shutterstock

PetIQ (NASDAQ:PETQ) is a purveyor of pet medication and wellness products. During the first three quarters of 2023, PetIQ handily beat expectations with earnings.

With this, it makes sense why the stock has rallied by more than 63.6% over the past twelve months.

These big earnings beats also help to explain why, as InvestorPlace’s Chris Markoch discussed last month, the sell-side community has become increasingly upbeat about PETQ stock. After reporting GAAP losses during its time of faster growth (during the pandemic and post-pandemic periods), big incremental increases to the company’s earnings may be ahead.

Based on forecasts, PetIQ could report earnings growth of nearly 48% next year, and over 35% in the year after that. With PETQ trading at a more-than-reasonable 18.4 times earnings, achieving such earnings growth could result in substantial multiple expansion (say, to a forward multiple in the 25 to 30 range).

RCI Hospitality (RICK)

Source: Shutterstock

RCI Hospitality (NASDAQ:RICK) may sound the name of a hotel REIT, but those in the know are well-aware of the company’s line of business.

RCI Hospitality is a leading operator of gentlemen’s clubs (or as the RCI calls them, “upscale adult nightclubs”) in the U.S.

RICK stock has performed very strongly since the onset of the Covid-19 pandemic, yet more recently has entered a slump. The unfavorable economic climate and its impact on discretionary spending resulted in declining same-store sales and overall profitability.

Yet as conditions improve, RICK (which has already started to bounce back in recent months) could continue to make a recovery. Shares trade at a multiple more on par with a value stock (12.7 times earnings).

However, a post-slowdown growth resurgence could be enough to drive a re-rating to a valuation more on par with a growth play.

On the date of publication, Thomas Niel did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Thomas Niel, contributor for InvestorPlace.com, has been writing single-stock analysis for web-based publications since 2016.

More From InvestorPlace

The #1 AI Investment Might Be This Company You’ve Never Heard Of

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

The post Small-Cap Surprises: 7 Undiscovered Growth Stocks Poised to Explode appeared first on InvestorPlace.