Smartsheet Inc (SMAR) Surpasses $1 Billion in ARR, Reports Strong Q4 and FY 2024 Results

Annualized Recurring Revenue (ARR): Surpassed $1 billion, marking a significant milestone.

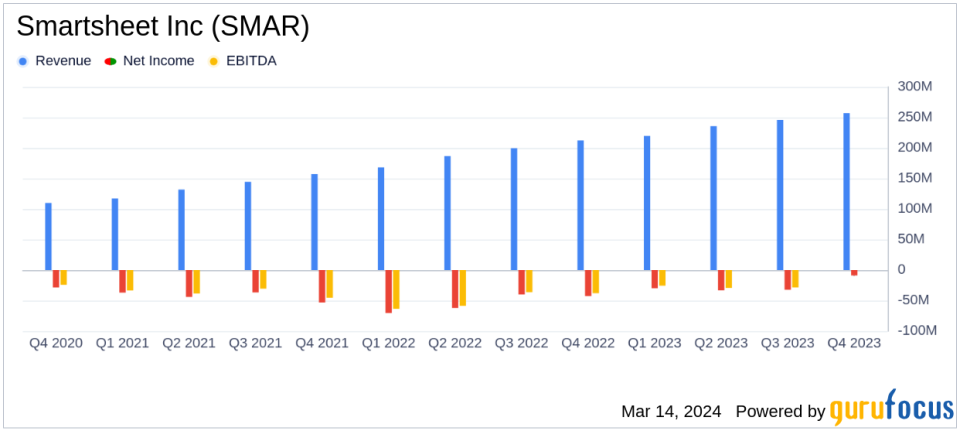

Q4 Revenue Growth: Total revenue increased by 21% year over year to $256.9 million.

Operating Cash Flow: Q4 operating cash flow stood at $59.7 million with free cash flow of $56.3 million.

Net Income Improvement: Non-GAAP net income reached $47.1 million in Q4, a substantial rise from $9.9 million in the same quarter last fiscal year.

Customer Growth: Number of customers with ARR of $100,000 or more grew by 28% year over year.

On March 14, 2024, Smartsheet Inc (NYSE:SMAR) released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended January 31, 2024. The enterprise work management platform provider, known for its cloud-based SaaS solutions that enhance project and process efficiency, reported a year of strong financial performance and customer growth.

Fiscal Year 2024 Performance

Smartsheet's fiscal year was marked by a 25% increase in total revenue, reaching $958.3 million. Subscription revenue, which forms the core of Smartsheet's business model, grew by 27% year over year to $904.0 million. The company also saw a significant reduction in its GAAP operating loss, which improved from $(221.6) million in fiscal 2023 to $(120.3) million in fiscal 2024. Non-GAAP operating income was reported at $100.9 million, a notable turnaround from a non-GAAP operating loss of $(36.0) million in the previous fiscal year.

These financial achievements are critical for Smartsheet as they demonstrate the company's ability to scale its subscription base and improve operational efficiency, which are vital for sustaining growth in the competitive software industry.

Q4 Fiscal 2024 Highlights

For the fourth quarter, Smartsheet's total revenue grew to $256.9 million, a 21% increase from the same period last year. This growth was driven by a 23% increase in subscription revenue, which totaled $244.0 million. The company also reported a substantial improvement in operating efficiency, with non-GAAP operating income reaching $39.6 million, or 15% of total revenue, compared to $7.5 million, or 4% of total revenue, in the prior year's quarter.

The company's net income figures also reflected strong performance, with a non-GAAP net income of $47.1 million in Q4, up from $9.9 million in Q4 of fiscal 2023. This improvement in profitability is significant as it indicates Smartsheet's growing ability to translate revenue growth into bottom-line results.

Operational and Customer Metrics

Smartsheet reported an ARR of $1.031 billion, a 21% year-over-year increase, and a dollar-based net retention rate of 116%. The number of customers contributing more than $100,000 in ARR grew to 1,904, a clear sign of Smartsheet's expanding enterprise customer base. These metrics are important as they reflect the company's success in deepening relationships with existing customers and its effectiveness in acquiring new high-value clients.

Balance Sheet and Cash Flow

The company ended the fiscal year with a strong balance sheet, holding $628.8 million in cash, cash equivalents, and short-term investments. Net operating cash flow for the year was $157.9 million, with free cash flow of $144.5 million, or 15% of revenue. These liquidity measures are crucial for Smartsheet's ongoing investment in product development and potential strategic acquisitions.

Forward-Looking Growth

Looking ahead, Smartsheet provided a financial outlook for Q1 fiscal year 2025, projecting total revenue between $257 million to $259 million and non-GAAP operating income of $32 million to $34 million. For the full fiscal year 2025, the company expects total revenue of $1,113 million to $1,118 million, representing a year-over-year growth of 16% to 17%, and a free cash flow of $200 million.

Smartsheet's CEO, Mark Mader, commented on the results, stating,

Strong demand from our enterprise customers helped us achieve the major milestone of $1 billion in annualized recurring revenue in Q4. Looking forward, were setting the foundation for the next era of profitable growth with proven, more efficient go-to-market motions paired with enterprise-grade product innovation informed by decades of data, work patterns, and customer use cases."

Smartsheet's performance in fiscal year 2024 underscores the company's robust growth trajectory and operational improvements. With a focus on expanding its enterprise customer base and innovating its product offerings, Smartsheet is well-positioned to continue its upward momentum in the collaborative work management market.

Explore the complete 8-K earnings release (here) from Smartsheet Inc for further details.

This article first appeared on GuruFocus.