Smartsheet's (NYSE:SMAR) Q4 Earnings Results: Revenue In Line With Expectations But Stock Drops

Project management software maker Smartsheet (NYSE:SMAR) reported results in line with analysts' expectations in Q4 FY2024, with revenue up 21% year on year to $256.9 million. On the other hand, next quarter's revenue guidance of $258 million was less impressive, coming in 2.1% below analysts' estimates. It made a non-GAAP profit of $0.34 per share, improving from its profit of $0.07 per share in the same quarter last year.

Is now the time to buy Smartsheet? Find out by accessing our full research report, it's free.

Smartsheet (SMAR) Q4 FY2024 Highlights:

Revenue: $256.9 million vs analyst estimates of $255.9 million (small beat)

EPS (non-GAAP): $0.34 vs analyst estimates of $0.18 ($0.16 beat)

Revenue Guidance for Q1 2025 is $258 million at the midpoint, below analyst estimates of $263.7 million

Management's revenue guidance for the upcoming financial year 2025 is $1.12 billion at the midpoint, missing analyst estimates by 2.4% and implying 16.4% growth (vs 25.3% in FY2024)

Gross Margin (GAAP): 81.9%, up from 78.9% in the same quarter last year

Free Cash Flow of $56.28 million, up from $11.41 million in the previous quarter

Net Revenue Retention Rate: 116%, in line with the previous quarter

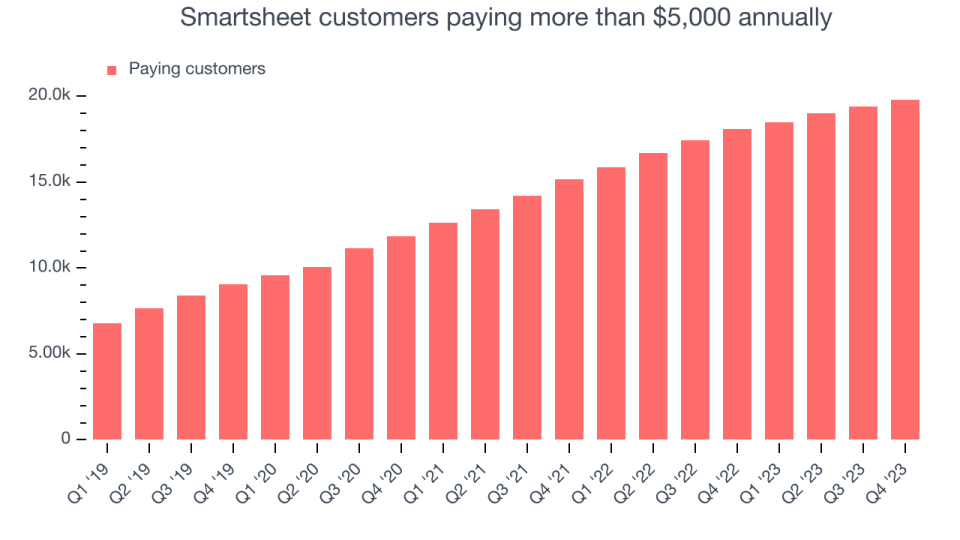

Customers: 19,818 customers paying more than $5,000 annually

Market Capitalization: $5.62 billion

“Strong demand from our enterprise customers helped us achieve the major milestone of $1 billion in annualized recurring revenue in Q4,” said Mark Mader, CEO of Smartsheet.

Founded in 2005, Smartsheet (NYSE:SMAR) is a software as a service platform that helps companies plan, manage and report on work.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

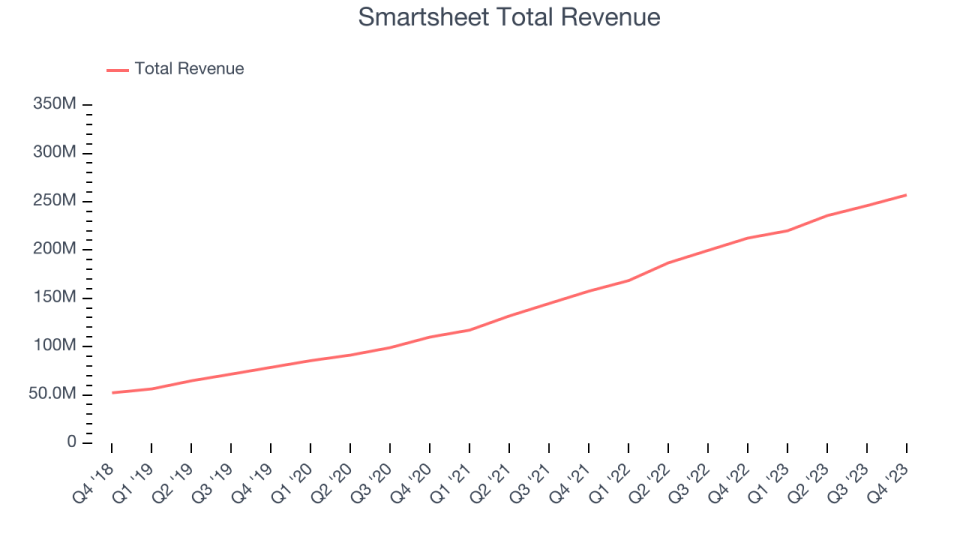

Sales Growth

As you can see below, Smartsheet's revenue growth has been very strong over the last three years, growing from $109.9 million in Q4 2021 to $256.9 million this quarter.

This quarter, Smartsheet's quarterly revenue was once again up a very solid 21% year on year. On top of that, its revenue increased $11.03 million quarter on quarter, a solid improvement from the $10.33 million increase in Q3 2024. Thankfully, that's a slight acceleration of growth.

Next quarter's guidance suggests that Smartsheet is expecting revenue to grow 17.3% year on year to $258 million, slowing down from the 30.6% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.12 billion at the midpoint, growing 16.4% year on year compared to the 25% increase in FY2024.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Large Customers Growth

This quarter, Smartsheet reported 19,818 enterprise customers paying more than $5,000 annually, an increase of 429 from the previous quarter. That's quite a bit more contract wins than last quarter but also quite a bit below what we've typically observed over the last year, suggesting that the company may be reinvigorating growth.

Key Takeaways from Smartsheet's Q4 Results

We enjoyed seeing Smartsheet exceed analysts' billings expectations this quarter. We were also glad its gross margin improved. On the other hand, its full-year revenue guidance was below expectations and suggests a slowdown in demand. Overall, the results could have been better. The company is down 6% on the results and currently trades at $37.89 per share.

Smartsheet may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.