Smith & Nephew (SNN) New Buyout Expands Sports Medicine Suite

Smith & Nephew SNN recently entered into a definitive agreement to acquire CartiHeal, developer of Agili-C, to expand its range of sports medicine technologies. The transaction is likely to close in the first quarter of 2024.

Per terms of the agreement, Smith & Nephew will pay an initial cash consideration of $180 million at closure, with an additional $150 million based on financial performance. The acquisition will be financed from existing cash and debt facilities.

More on the News

CartiHeal was formed as a university spin-off in 2009. It maintains a small factory near Tel Aviv and a sales office in New Jersey. CartiHeal has a considerable amount of raw material in the United States and will have enough U.S. stock by the closure of the transaction to support a full commercial launch. All CartiHeal workers will be transferred to Smith+Nephew.

Agili-C is a one-step, over-the-counter treatment for osteochondral (bone and cartilage) lesions that has a broader indication than current treatments. It is approved to treat a wide range of patients, including those with lesions in their knees due to mild to moderate osteoarthritis.

Agili-C is a porous, biocompatible and resorbable scaffold that facilitates spontaneous articular cartilage regeneration and subchondral bone replacement. Agili-C received Breakthrough Device designation from the U.S. Food and Drug Administration (FDA) in 2020 and Premarket Approval (PMA) in March 2022.

Strategic Implications

The acquisition of this revolutionary technology complements Smith & Nephew's goal of investing in its thriving Sports Medicine company. With the demonstrated commercial expertise in high-growth biologics and Agili-C's exceptional clinical performance, Smith & Nephew can achieve additional success with this attractive therapy choice.

Image Source: Zacks Investment Research

Smith & Nephew is the right new home for Agili-C as a leader in sports medicine and with a thorough understanding of biologics. Agili-C is an excellent addition to the company’s portfolio. It is looking forward to leveraging its experience to improve patient cartilage repair outcomes.

Industry Prospects

Per a report by Grand View Research, the global sports medicine market size was valued at $ 5.08 billion in 2022 and is estimated to witness a CAGR of 8.2% from 2023 to 2030. The demand for sports medicine has gained traction in recent years, owing to the rising incidences of sports injuries and growing participation in sports and fitness-related activities by people. A gradual shift from proactive care to preventive care with respect to sports injuries is projected to drive the market.

Recent Launches

In October 2023, Smith & Nephew launched REGENETEN Bioinductive Implant, allowing access to thousands of patients in Japan. With more than 100,000 procedures completed globally since its introduction in the United States and Europe, REGENETEN has had a transformative impact on the way surgeons approach rotator cuff repair.

In August 2023, Smith & Nephew launched the OR3O Dual Mobility System for use in primary and revision hip arthroplasty in India. Compared with traditional solutions, dual mobility implants have a small diameter femoral head that locks into a larger polyethylene insert — increasing stability, reducing dislocation risk and offering improved range of motion.

Price Performance

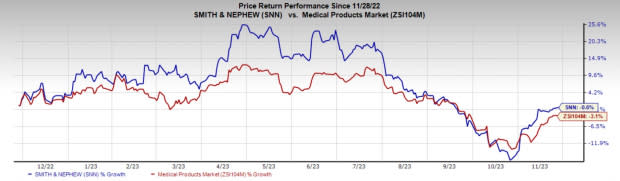

In the past year, SNN has declined 0.6% compared with the industry’s fall of 3.1%.

Zacks Rank and Key Picks

Smith & Nephew carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. While Haemonetics and DexCom each carry a Zacks Rank #2 (Buy), Insulet presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 11.6% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. The company's shares have decreased 40.9% in the past year compared with the industry’s decline of 7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 7.8% in the past year compared with the industry’s decline of 7.1%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Smith & Nephew SNATS, Inc. (SNN) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report