Smith & Wesson's (NASDAQ:SWBI) Q3 Sales Beat Estimates

American firearms manufacturer Smith & Wesson (NASDAQ:SWBI) announced better-than-expected results in Q3 FY2024, with revenue up 6.5% year on year to $137.5 million. It made a GAAP profit of $0.17 per share, down from its profit of $0.24 per share in the same quarter last year.

Is now the time to buy Smith & Wesson? Find out by accessing our full research report, it's free.

Smith & Wesson (SWBI) Q3 FY2024 Highlights:

Revenue: $137.5 million vs analyst estimates of $133.5 million (2.9% beat)

EPS: $0.17 vs analyst estimates of $0.10 ($0.07 beat)

Free Cash Flow of $7.16 million is up from -$37.87 million in the previous quarter

Gross Margin (GAAP): 28.7%, down from 32.7% in the same quarter last year

Market Capitalization: $601.1 million

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

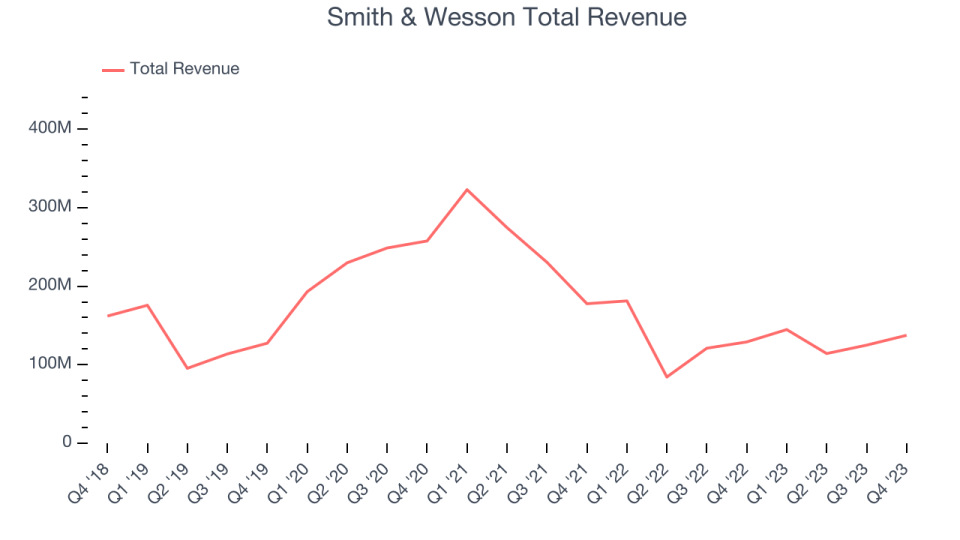

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Smith & Wesson's revenue declined over the last five years, dropping 4.1% annually.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Smith & Wesson's recent history shows its demand has decreased even further as its revenue has shown annualized declines of 28% over the last two years.

This quarter, Smith & Wesson reported solid year-on-year revenue growth of 6.5%, and its $137.5 million of revenue outperformed Wall Street's estimates by 2.9%. Looking ahead, Wall Street expects sales to grow 3.2% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

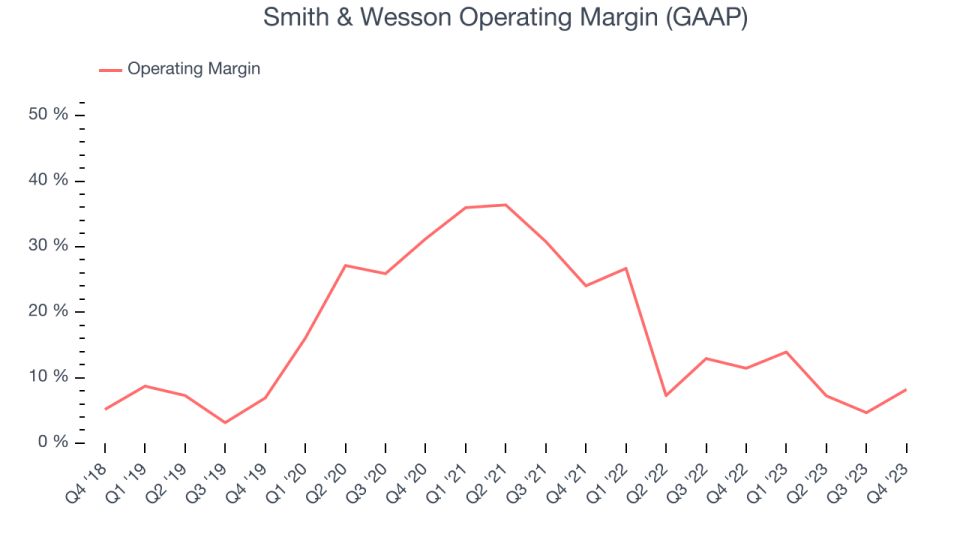

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Smith & Wesson has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 12.6%, higher than the broader consumer discretionary sector.

This quarter, Smith & Wesson generated an operating profit margin of 8.2%, down 3.2 percentage points year on year.

Over the next 12 months, Wall Street expects Smith & Wesson to become more profitable. Analysts are expecting the company’s LTM operating margin of 8.7% to rise to 10.8%.

Key Takeaways from Smith & Wesson's Q3 Results

We were impressed by how significantly Smith & Wesson blew past analysts' operating margin and EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. Management noted it "gained market share as our shipments outpaced the overall firearm market" and that it "expects the firearm market to experience healthy demand through the 2024 election cycle". For context, firearm sales typically rise in each election year as consumers fear potential policy changes and stockpile goods.

Smith & Wesson's Board also authorized a $0.12 per share quarterly dividend that will be paid on April 4, 2024 to stockholders of record on March 21, 2024. This dividend represents a ~3.5% annual yield based on today's stock price.

Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 3.6% after reporting and currently trades at $13.93 per share.

Smith & Wesson may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.