Snap-on Inc (SNA) Posts Incremental Growth Amidst Market Challenges

Quarterly Revenue: Increased by 3.5% to $1,196.6 million.

Organic Sales Growth: Reported a 2.2% rise in organic sales.

Diluted EPS: Gained 7.5% to $4.75 for the quarter.

Operating Margin: Slightly improved to 21.6% from 21.5% in Q4 2022.

Annual Performance: Full year net sales up 5.3%, with net earnings increasing to $1,011.1 million.

Strategic Acquisitions: Mountz, Inc. acquisition expands product offerings in precision-critical industries.

Future Outlook: Snap-on anticipates continued progress and capital expenditures of $100 million to $110 million in 2024.

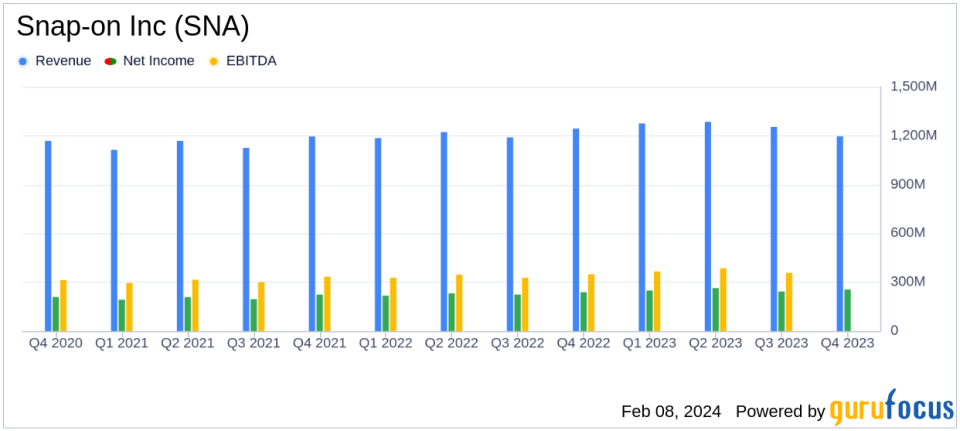

On February 8, 2024, Snap-on Inc (NYSE:SNA) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, known for its high-quality tools, equipment, diagnostics, and repair information solutions, reported a 3.5% increase in quarterly sales to $1,196.6 million, with a 2.2% organic sales growth. The diluted earnings per share (EPS) for the quarter rose by 7.5% to $4.75, reflecting the company's ability to navigate the complexities of the current economic landscape.

Snap-on's operating margin before financial services inched up to 21.6% compared to 21.5% in the same quarter of the previous year, indicating a steady performance in profitability. The company's financial services segment also showed strength with a revenue increase to $97.2 million from $88.3 million in the prior year and operating earnings of $67.9 million, up from $63.9 million.

For the full year, Snap-on reported net sales of $4,730.2 million, a 5.3% increase from 2022, with organic sales contributing a 5.6% gain. Net earnings for the year stood at $1,011.1 million, an 11.5% increase from the previous year, with diluted EPS climbing to $18.76 from $16.82.

The company's chairman and CEO, Nick Pinchuk, commented on the results:

"Were encouraged by our 2023 performance which reflects steadfast progress along both our runways for growth and our runways for improvement, and aligns with our ongoing, longer-term expectations for sales and operating income expansion, all achieved against the significant variation and turbulence that mark the commercial arenas of today."

Segment-wise, the Commercial & Industrial Group saw a 3.3% organic gain, while the Snap-on Tools Group experienced a 5.7% organic sales decline, primarily due to lower activity in U.S. operations. The Repair Systems & Information Group reported a 2.0% organic sales increase.

Looking ahead, Snap-on expects to continue its growth trajectory in 2024, with capital expenditures projected to be between $100 million and $110 million. The company anticipates a full-year effective income tax rate of 22% to 23%.

Value investors may find Snap-on's consistent performance and strategic initiatives, such as the Mountz, Inc. acquisition, appealing as they reflect the company's commitment to expanding its product offerings and market reach. The company's resilience in the face of economic variability and its focus on growth and improvement runways suggest a robust business model poised for future success.

For a more detailed analysis of Snap-on Inc (NYSE:SNA)'s financials, including income statements, balance sheets, and cash flow statements, interested readers and potential investors are encouraged to visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from Snap-on Inc for further details.

This article first appeared on GuruFocus.