Snap One Holdings Corp (SNPO) Faces Headwinds Despite Strong Adjusted EBITDA Growth in FY 2023

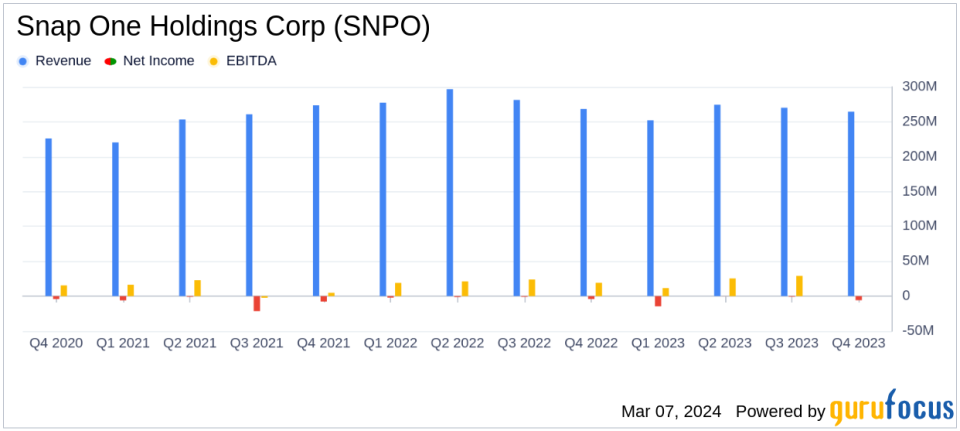

Net Sales: Slight decrease to $1.061 billion in FY 2023 from $1.123 billion in FY 2022.

Net Loss: Expanded to $21.4 million in FY 2023 from $8.7 million in FY 2022.

Adjusted EBITDA: Increased by 2.7% to $117.2 million, representing margin expansion to 11.0%.

Free Cash Flow: Improved significantly to $66.5 million from a negative $44.6 million.

Transacting Domestic Integrators: Grew slightly to 19.7 thousand, with a decrease in spend per integrator.

On March 7, 2024, Snap One Holdings Corp (NASDAQ:SNPO) released its 8-K filing, detailing its financial results for the fiscal fourth quarter and full year ended December 29, 2023. The company, known for providing smart-living products, services, and software to professional integrators, faced a challenging year marked by global uncertainty, channel inventory destocking, and rising interest rates.

Company Overview

Snap One Holdings Corp offers a comprehensive suite of solutions for smart living experiences, including proprietary and third-party hardware and software across connected, infrastructure, and entertainment categories. The company also provides value-added services and workflow solutions to support integrators throughout the project lifecycle.

Fiscal Year 2023 Performance

Despite the headwinds, Snap One reported a strong adjusted EBITDA margin expansion to 11.0%, with adjusted EBITDA increasing to $117.2 million. However, net sales saw a decrease of 5.6% to $1.061 billion compared to the previous year. The net loss widened to $21.4 million, up from $8.7 million in the prior year. The company's contribution margin improved, and free cash flow saw a significant turnaround, totaling $66.5 million compared to a negative free cash flow in the previous year.

Operational Highlights and Challenges

The company was recognized for its excellent integrator partner experience, receiving numerous industry awards. Snap One continued to innovate with new product launches and expanded its local branch presence to 45 North American locations. However, the company faced challenges such as channel inventory destocking and a macroeconomic environment that led to a decrease in spend per transacting domestic integrator by 4.4%.

Financial Outlook for Fiscal 2024

Looking ahead, CEO John Heyman expressed confidence in the company's ability to drive growth but acknowledged the need for a pragmatic approach due to the uncertain macroeconomic environment. For fiscal 2024, Snap One expects net sales to range between $1.06 billion and $1.13 billion and adjusted EBITDA to be between $120 million and $128 million.

Analysis and Investor Considerations

While Snap One's net loss has increased, the company's strong adjusted EBITDA growth and significant improvement in free cash flow are positive indicators of its operational efficiency and cost management. The company's strategic focus on innovation and service models, along with its expanded branch network, positions it well for future growth. However, investors should be mindful of the ongoing macroeconomic challenges that could impact performance.

For more detailed financial information and performance metrics, please refer to the financial tables and key performance indicators provided in the full earnings release.

Investors and interested parties may find additional information and the supplemental earnings presentation on Snap One's Investor Relations website. The company will also hold a conference call to discuss these results and provide further insights into its performance and outlook.

Value investors and potential GuruFocus.com members seeking to understand Snap One's financial health and future prospects should consider both the achievements and the challenges presented in the FY 2023 results. The company's resilience and strategic initiatives may offer opportunities, but it is essential to weigh these against the broader economic context and the company's widened net loss.

Explore the complete 8-K earnings release (here) from Snap One Holdings Corp for further details.

This article first appeared on GuruFocus.