Snap's 2Q user growth tops expectations

Snap (SNAP) beat revenue estimates and added more users than expected in its fiscal second quarter, reflecting the company’s efforts to attract and retain users on the Snapchat platform through new content developments and an Android app upgrade launched this spring.

Here were the main numbers from the report, compared to consensus expectations compiled by Bloomberg:

Revenue: $388 million vs. $360.5 million expected

Adj. loss per share: 6 cents, vs. 10 cents expected

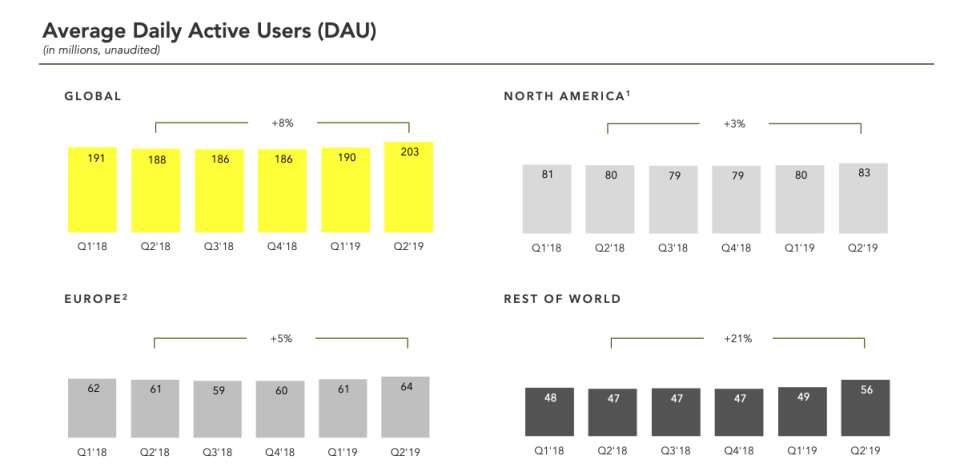

Daily active users (DAUs): 203 million vs. 191.7 million expected

Shares of Snap climbed 11.5% to $16.55 each as of 4:24 p.m. ET.

DAUs, or users who opened the app at least once a day, were a key focus for the Street, with Snap just recently turning stagnant growth into gains. The company exited the first quarter with a better-than-expected 190 million DAUs, an increase from the quarter prior but slight decrease from the year earlier. The quarter before that, Snap’s DAUs came in flat sequentially, besting expectations for a quarterly decline.

Snap’s addition of 13 million DAUs in the second quarter represented the highest net add since 2016.

The Santa Monica, California-based company also showed evidence it was better monetizing its users, with average revenue per user (ARPU) increasing 37% to $1.91. North American ARPU posted the biggest gains since the second quarter of 2017, climbing 42% over last year to $3.14.

During a call with investors Tuesday, Snap CEO Evan Spiegel said more than 75% of the 13- to 34-year-old population in the U.S. is active on Snapchat, making the platform “larger than services like Facebook and Instagram” among this audience.

U.S. Snapchat users who joined 5 years ago and were active at the end of their first year have retained at a more than 95% annualized rate, he added.

“We believe this high retention rate underscores the important role Snapchat plays in the lives of the people who use our products,” Spiegel said.

Snap pointed to further strength in the current quarter, delivering guidance that topped the Street’s expectations. Snap sees third-quarter DAUs in a range of between 205 million to 207 million, better than the 193.4 million consensus estimate. And Snap guided for third-quarter revenue of between $410 million and $435 million, ahead of the $402.9 million expected.

Investors had been looking for Snap to post second-quarter results that would justify its more than 160% stock run-up this year, which has coincided with new content features helping keep users – and advertisers – coming back to the platform.

During the three months to June, Snap announced the launch of Snap Games, allowing users to play games with friends on Snapchat without leaving the app. The company also introduced viral lenses allowing users to swap genders or reconfigure their faces to look a different age. Snap’s management suggested Tuesday that they would continue to lean into the app’s augmented reality (AR) developments.

“On the AR front, we’re barely scratching the surface,” Spiegel said.

Plus, at the end of the first quarter, Snap released its new and improved Android app, a redesign that had been years in the making and streamlined the user experience for billions of global Android users. Snap reported Tuesday that Snapchatters on the new platform sent 7% more Snaps when compared to the old version.

Snap landed several bullish calls ahead of its earnings announcement Tuesday, reflecting an investment community that had warmed up to the stock after a bruising 2018.

On Monday, Rosenblatt Securities initiated shares of Snap with a Buy recommendation and $18 price target. And Stifel analyst John Egbert upgraded shares of Snap to Buy from Neutral, and also raised his price target to $17 per share, from $13 previously. He cited improving DAU and pricing trends, along with a higher likelihood of a re-acceleration in revenue growth in the next several quarters “as the company continues to expand its advertiser base, foster engagement with premium monetizable content (Discover, Games), and improve engagement/retention on Android devices.”

Earlier this month, Goldman Sachs analyst Heath Terry and his team upgraded shares of Snap to Buy from Neutral and raised their price target to $18, from $13 per share. Terry wrote he believed “product improvements and feature additions are driving positive trends in user growth and engagement, along with monetization improvements from ad tech initiatives.”

Recent ad data from independent firms pointed to strong trends in Snap’s advertising business, presaging a strong second-quarter earnings report. Global visits to Snap’s advertising platform jumped by 23.9% over last year to 1.9 million during the second quarter, according to recent data from SimilarWeb.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Netflix’s 2Q global paid subscriber additions miss expectations

Tech companies like Lyft want your money – not ‘your opinion’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read the latest financial and business news from Yahoo Finance