Snap-on (SNA) Q3 Earnings & Sales Beat Estimates, Rise Y/Y

Snap-on Inc. SNA has reported impressive third-quarter 2023 results, wherein earnings and revenues beat the Zacks Consensus Estimate. Moreover, sales and earnings advanced year over year. Results have benefited from the continued positive business momentum and contributions from its Value Creation plan.

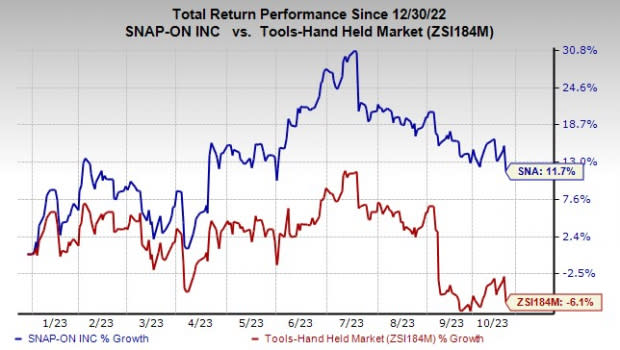

Shares of SNA have gained 11.7% year to date against the industry's 6.1% decline.

Q3 Highlights

Snap-on’s earnings of $4.51 per share in third-quarter 2023 surpassed the Zacks Consensus Estimate of $4.39. The figure also improved 9% from earnings of $4.14 reported in the prior-year quarter.

Image Source: Zacks Investment Research

Net sales grew 5.2% year over year to $1,159.3 million, beating the Zacks Consensus Estimate of $1,139 million. The increase can be attributed to organic sales growth of 4.7% and a $4.4-million positive impact of foreign currency translations.

The gross profit of $578.2 million improved 8.6% year over year, while the gross margin expanded 200 basis points (bps) year over year to 50% in the reported quarter. We had expected a gross margin of 49% and a gross margin expansion of 100 bps for the quarter under discussion.

The company’s operating earnings before financial services totaled $245.2 million, up 9.7% year over year. As a percentage of sales, operating earnings before financial services expanded 100 bps to 21.2% in the third quarter. Financial Services' operating earnings were $69.4 million in the quarter, up 4.5% year over year.

Consolidated operating earnings (including financial services) were $314.6 million, up 8.5% year over year. As a percentage of sales, operating earnings expanded 70 bps year over year to 25.1%.

Segmental Details

Sales in the Commercial & Industrial Group grew 2.7% from the prior-year quarter to $366.4 million on organic sales growth of 3.2%. This was partly offset by a negative currency impact of $1.6 million. Organic growth was aided by an increase in activity with customers in critical industries, partially offset by lower sales in the Asia Pacific region. For the quarter, we had expected sales of $362.5 million from the segment.

The Tools Group segment’s sales rose 3.8% year over year to $515.4 million, which exceeded our estimate of $511.7 million. The upside was driven by organic sales growth of 3.7% and a $0.5-million positive impact of foreign currency. Robust sales in international operations and the U.S. franchise operations aided organic sales.

Sales in Repair Systems & Information Group advanced 4.1% year over year to $431.8 million, with organic sales growth of 3.1%. Sales also gained from a $4.8-million negative impact of foreign currency. Strong sales of diagnostics and repair information products to independent repair shop owners and managers, and a rise in sales of under-car equipment contributed to segment organic sales growth. Our estimate for sales from this segment was $432.4 million in the quarter.

The Financial Services business’ revenues rose 8.7% year over year to $94.9 million in the quarter. Our estimate for sales from this segment was $90.6 million in the quarter.

Financials

As of Sep 30, 2023, Snap-on’s cash and cash equivalents totaled $959.3 million, with long-term debt of $1,184.4 million and shareholders’ equity (before non-controlling interest) of $4,830.2 million. This Zacks Rank #4 (Sell) company incurred $25.1 million in capital expenditure in the quarter under review.

Snap-On Incorporated Price, Consensus and EPS Surprise

Snap-On Incorporated price-consensus-eps-surprise-chart | Snap-On Incorporated Quote

Looking Ahead

Management expects continued progress by leveraging capabilities in the automotive repair arena, as well as expanding its customer base in automotive repair and across geographies, including critical industries. As a result, capital expenditure for 2023 is projected to be $100 million, out of which $73.9 million has already been incurred. The company anticipates an effective tax rate of 23% for 2023.

Stocks to Consider

Some better-ranked companies are MGM Resorts MGM, Guess GES and lululemon athletica LULU.

Guess currently sports a Zacks Rank of 1 (Strong Buy). GES has a trailing four-quarter earnings surprise of 43.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GES’ fiscal 2023 sales and EPS implies improvements of 3.4% and 9.9%, respectively, from the year-ago period’s reported levels.

MGM Resorts currently sports a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 81%, on average.

The Zacks Consensus Estimate for MGM’s 2024 sales and EPS indicates year-over-year increases of 2.2% and 31%, respectively.

lululemon athletica, a yoga-inspired athletic apparel company, carries a Zacks Rank of 2 at present. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 17% and 18.4%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Snap-On Incorporated (SNA) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report