Snap-on (SNA) Rewards Investors With 14.8% Dividend Hike

Snap-on Incorporated SNA announced a dividend increase, showcasing the company's commitment to delivering value to its shareholders. The board of directors approved a 14.8% increase in the quarterly cash dividend, raising it from $1.62 per share to $1.86.

Shareholders can expect to receive the enhanced dividend on Dec 11, 2023. To qualify for the dividend, individuals must be recorded as shareholders at the close of the business on Nov 21, 2023. This move reflects the company's strong financial performance and ability to generate sustainable cash flows.

Snap-on has a remarkable history of consistently paying quarterly cash dividends for an impressive 84 years, dating back to 1939. This uninterrupted record of dividend payments, spanning many decades and various economic conditions, underscores the company's resilience and financial stability.

The 14th consecutive annual increase in the dividend showcases the company's prudent management and foresight in strategically rewarding its stakeholders. This announcement conveys the message that the company sees itself as well-prepared and poised for success in the years to come.

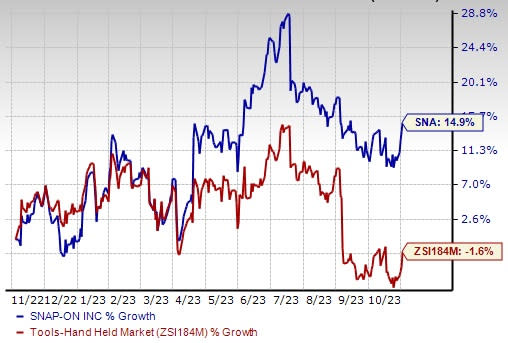

Image Source: Zacks Investment Research

What’s More?

A couple of weeks ago, Snap-on reported third-quarter earnings of $4.51 per share, beating the Zacks Consensus Estimate of $4.39 per share. This compares to earnings of $4.14 per share reported a year ago.

Net sales grew 5.2% to $1,153.9 million in the third quarter of 2023, beating the Zacks Consensus Estimate of $1,139 million, driven by organic sales growth of 4.7% and a $4.4-million positive impact of foreign currency translations.

As of Sep 30, 2023, Snap-on’s cash and cash equivalents totaled $959.3 million, with long-term debt of $1,184.4 million and shareholders’ equity (before non-controlling interest) of $4,830.2 million.

Wrapping Up

SNA's decision to increase its quarterly dividend is a testament to its financial strength, long-term commitment to shareholders and confidence in its prospects. These show that the company is not only weathering challenges but also thriving and actively investing in its growth and improvement. Shareholders can take this announcement as a positive indicator of Snap-on’s ongoing success and its dedication to enhancing shareholder value.

Shares of this Zacks Rank #2 (Buy) company have rallied 14.9% in the past year against the industry’s decline of 1.6%.

Bet Your Bucks on These 3 Other Hot Stocks

Here we have highlighted three other top-ranked stocks, namely American Woodmark Corporation AMWD, G-III Apparel Group, Ltd. GIII and Skechers U.S.A., Inc. SKX.

American Woodmark is the third-largest manufacturer of kitchen and bath cabinets, offering more than 340 cabinet lines in a wide variety of designs, materials and finishes. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Woodmark’s current fiscal-year earnings suggests growth of 4.9% from the year-ago reported numbers. AMWD has a trailing four-quarter earnings surprise of 25.7%, on average.

G-III Apparel Group is a manufacturer, designer and distributor of apparel and accessories. It currently sports a Zacks Rank #1. GIII has a trailing four-quarter earnings surprise of 526.6%, on average.

The Zacks Consensus Estimate for G-III Apparel Group’s current fiscal-year sales and earnings suggests growth of 2.4% and 14.7%, respectively, from the year-ago reported numbers.

Skechers designs, develops, markets and distributes footwear for men, women and children. It currently has a Zacks Rank #2. SKX has a trailing four-quarter earnings surprise of 50.3%, on average.

The Zacks Consensus Estimate for Skechers’ current financial-year sales and earnings suggests growth of 8.2% and 44.1%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Snap-On Incorporated (SNA) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

American Woodmark Corporation (AMWD) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report