Snowflake Inc (SNOW) Reports Steady Growth with 33% Increase in Q4 Product Revenue

Q4 Product Revenue: $738.1 million, up 33% year-over-year.

Full-Year Product Revenue: $2.67 billion, a 38% increase from the previous fiscal year.

Net Revenue Retention Rate: Remained strong at 131%.

Remaining Performance Obligations: Grew to $5.2 billion, marking a 41% year-over-year increase.

Non-GAAP Adjusted Free Cash Flow: Reached $810 million for the full year, a 56% year-over-year growth.

Customer Growth: 461 customers with trailing 12-month product revenue greater than $1 million.

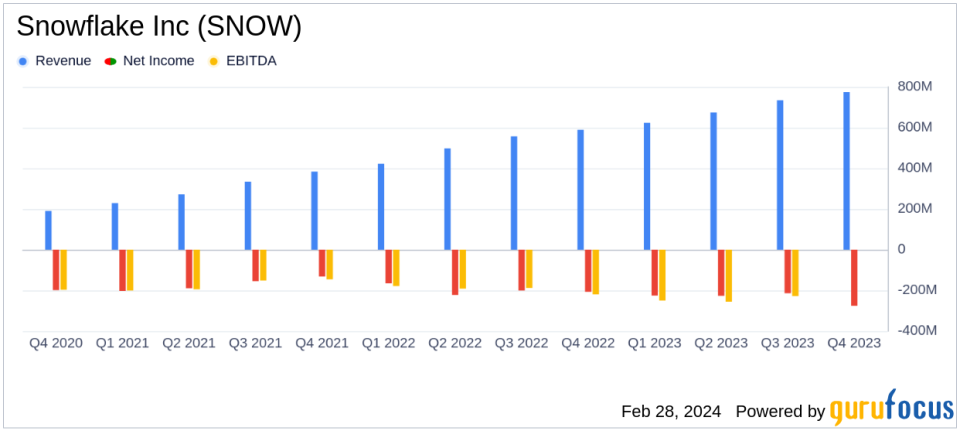

On February 28, 2024, Snowflake Inc (NYSE:SNOW) released its 8-K filing, announcing financial results for the fourth quarter and full-year of fiscal 2024. The data cloud company, known for its data lake, warehousing, and sharing capabilities, reported a 33% year-over-year growth in Q4 product revenue, reaching $738.1 million. This growth is indicative of the company's robust performance in a competitive market.

Founded in 2012 and public since 2020, Snowflake has over 3,000 customers, including nearly 30% of the Fortune 500. The company's data solutions, which can be hosted on various public clouds, have seen increasing adoption, as evidenced by the 461 customers with trailing 12-month product revenue greater than $1 million, and a net revenue retention rate of 131%.

Financial Highlights and Challenges

Snowflake's financial achievements reflect its strategic positioning in the software industry. The company's product gross profit for Q4 stood at $545.3 million with a margin of 74%, while non-GAAP results showed a product gross profit of $576.0 million and a margin of 78%. However, the company reported an operating loss of ($275.5) million, or (36)% of revenue, on a GAAP basis. On a non-GAAP basis, operating income was $71.0 million, or 9% of revenue. The discrepancy between GAAP and non-GAAP results highlights the significant impact of stock-based compensation and other adjustments.

For the full year, Snowflake's product revenue totaled $2.67 billion, a 38% increase year-over-year. The non-GAAP adjusted free cash flow was $810 million, representing a 56% growth compared to the previous fiscal year. These figures underscore the company's ability to generate cash and reinvest in growth initiatives.

Key Financial Metrics

Examining the income statement, Snowflake's revenue for the full year was $2.81 billion, a substantial increase from the previous year's $2.07 billion. The balance sheet shows a healthy cash and cash equivalents position of $1.76 billion as of January 31, 2024. The cash flow statement reveals a net cash provided by operating activities of $848.1 million for the full year, up from the prior year, demonstrating the company's operational efficiency.

These metrics are crucial for Snowflake as they reflect the company's financial health and its ability to sustain and expand its operations. The strong net revenue retention rate indicates customer satisfaction and the potential for upselling, while the significant remaining performance obligations suggest a solid backlog of future revenue.

Forward-Looking Statements and Outlook

Looking ahead, Snowflake provided guidance for the first quarter of fiscal 2025, projecting product revenue between $745 million and $750 million, which would represent a 26-27% year-over-year growth. The company also anticipates a non-GAAP operating margin of 3% for the quarter. For the full year, Snowflake expects product revenue to reach approximately $3.25 billion, a 22% increase, with a non-GAAP product gross profit margin of 76% and an operating margin of 6%.

Chairman and CEO Frank Slootman commented on the results, stating,

Snowflake finished fiscal 2024 with a 38% year-over-year product revenue growth, totaling $2.67 billion. Non-GAAP adjusted free cash flow was $810 million, representing 56% year-over-year growth. We are successfully campaigning the largest enterprises globally, as more companies and institutions make Snowflakes Data Cloud the platform of their AI and data strategy."

Overall, Snowflake's performance in fiscal 2024 reflects its strong position in the data cloud sector and its ability to attract and retain large enterprise customers. The company's focus on expanding its product offerings and customer base, coupled with efficient cash flow management, positions it well for continued growth in the upcoming fiscal year.

For more detailed information and analysis, investors and interested parties can access the full earnings report and join the conference call hosted by Snowflake.

Explore the complete 8-K earnings release (here) from Snowflake Inc for further details.

This article first appeared on GuruFocus.