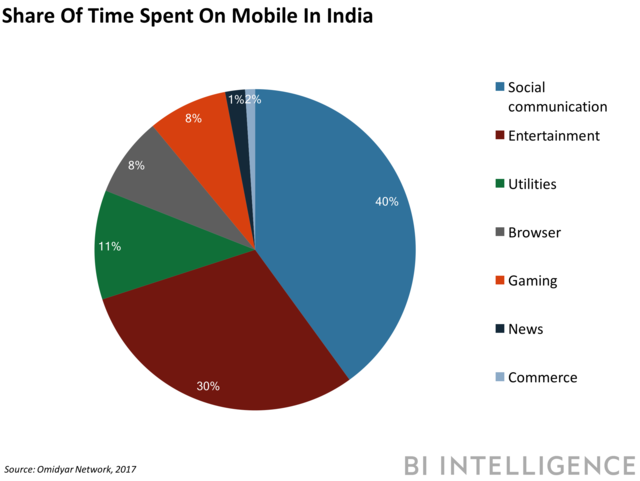

Social chat dominates mobile time in India

BI Intelligence

This story was delivered to BI Intelligence Apps and Platforms Briefing subscribers. To learn more and subscribe, please click here.

Social communication and entertainment apps account for the lion's share of time spent on the mobile internet by consumers in India, according to Omidyar Network.

Indian consumers spend 200 minutes on the mobile internet each day, with social communication apps accounting for 40% and entertainment apps representing 30% of that time.

The allocation of time spent in these apps is far greater in India than in the US — social communication apps account for 33% of mobile time spent in the US, while entertainment apps represent 18%.

The report shows how significant Facebook’s and Google’s influence is over the Indian app market. App usage in India consolidates under Facebook’s and Google’s ecosystems, meaning the two companies aren’t leaving much space for other publishers to get their apps in front of users.

Facebook’s ecosystem dwarfs the Indian app space in terms of usage. Facebook and its family of apps — Facebook, Messenger, WhatsApp, and Instagram — represent 38% of time spent on the mobile internet each day in India. Facebook-owned apps dominate the social communication app segment, accounting for 95% of social communication app usage in India; they make up only 55% of app usage in the US.

YouTube accounts for the majority of time spent in entertainment apps. Google-owned YouTube represents 14% of time spent on the mobile internet each day in India. YouTube also represents 47% of entertainment app usage in India, compared with just 17% in the US.

The Indian app ecosystem presents domestic brands and developers with the opportunity to compete with Facebook and Google using local offerings. While the Indian app market consolidates under the umbrellas of Facebook and Google when it comes to social communication and entertainment apps, their dominance in the US app market in these categories is not as prominent as it is in India. That’s likely because US consumers have additional app options to choose from beyond Facebook’s and Google’s apps. The extra space for app publishers in the US market highlights the potential for local Indian app publishers to enter the space and pull away users’ time spent from the duopoly's ecosystems.

To receive stories like this one directly to your inbox every morning, sign up for the Apps and Platforms Briefing newsletter. Click here to learn more about how you can gain risk-free access today.

See Also: