Sociedad Quimica (SQM) Earnings and Sales Miss Estimates in Q4

Sociedad Quimica y Minera de Chile S.A. SQM recorded earnings of 71 cents per share for fourth-quarter 2023, down from $4.03 in the year-ago quarter. Earnings per share for the reported quarter missed the Zacks Consensus Estimate of $1.22.

The company registered revenues of $1,311.6 million for the quarter, down around 58% year over year. It missed the Zacks Consensus Estimate of $1,358 million.

The company’s results were hurt by lower average sales prices in the lithium business. However, it saw record-high sales volumes in the lithium business and higher volumes in iodine and potassium business lines in the reported quarter.

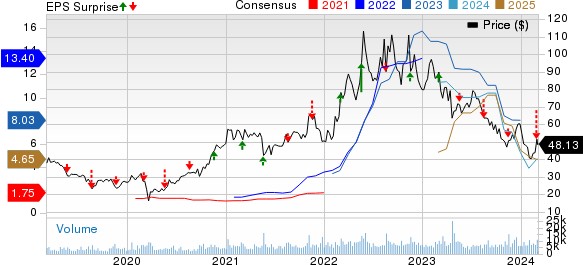

Sociedad Quimica y Minera S.A. Price, Consensus and EPS Surprise

Sociedad Quimica y Minera S.A. price-consensus-eps-surprise-chart | Sociedad Quimica y Minera S.A. Quote

Segment Highlights

Revenues from the Lithium and Derivatives segment fell roughly 69% year over year to $791.4 million in the reported quarter. Higher sales volumes (up around 20% year over year) were more than offset by lower average sales prices (down around 73% year over year).

The Specialty Plant Nutrients ("SPN") segment raked in revenues of $223.7 million, down around 18% year over year. Sales were hurt by significantly lower average sales prices.

Revenues from the Iodine and Derivatives unit came in at $218.1 million, up around 3% year over year. Sales were aided by higher sales volumes.

Revenues from the Potassium business fell roughly 37% year over year to $50.8 million. Significantly lower average sales prices more than offset higher sales volumes.

The Industrial Chemicals unit recorded sales of $18.8 million, down around 45% year over year, impacted by lower sales volumes.

Financials

The company’s cash and cash equivalents were $1,041.4 million at the end of 2023, down around 61% year over year. Long-term debt was $3,213.4 million, up around 34% year over year.

Outlook

Moving ahead, SQM sees another robust year of growth in the lithium market as it enters 2024, with global demand rising at least 20%. This is expected to be supported by electric vehicle sales growth globally and rising demand for battery materials.

However, SQM anticipates the excess lithium and battery materials capacity witnessed during last year to continue during 2024, which is expected to put pressure on lithium market prices. The company expects average lithium prices to remain relatively stable throughout 2024. It also anticipates sales volumes to rise modestly this year, subject to market conditions and any changes in supply-demand balance.

In SPN, the company saw demand recovery during the fourth quarter and expects this momentum to continue into 2024, driving roughly 10% increase in demand during the year.

In iodine and derivatives, SQM expects sales volumes to be flat this year, subject to market conditions and any additional supply coming to the market.

For potassium, the company expects sales volumes to reach 600,000 metric tons during 2024.

Price Performance

Shares of Sociedad Quimica are down 44.4% over a year compared with the industry’s decline of 32.9%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

SQM currently has a Zacks Rank #5 (Strong Sell).

Better-ranked stocks worth a look in the basic materials space include, Alpha Metallurgical Resources Inc. AMR, Carpenter Technology Corporation CRS and Hawkins, Inc. HWKN.

The Zacks Consensus Estimate for Alpha Metallurgical Resources’ current-year earnings has been revised upward by 8.8% in the past 60 days. AMR delivered a trailing four-quarter earnings surprise of roughly 24.8%, on average. Its shares are up around 108% in a year. AMR currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Carpenter Technology’s current fiscal year earnings is pegged at $4.00, indicating a year-over-year surge of 250.9%. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have gained around 30% in the past year. CRS currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Hawkins’ current fiscal year earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26.2%. The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised 4.3% upward in the past 30 days. HWKN, a Zacks Rank #2 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 30.6%. The company’s shares have rallied roughly 74% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report