SoFi Technologies: A High-Growth Fintech to Cautiously Observe

Some people are excited to hold SoFi Technologies Inc. (NASDAQ:SOFI) in their portfolio. The reasons are simple; the compayny operates in several high-growth markets, including fintech, lending and insurance, and its operations deliver significant revenue growth.

Investors are definitely investing in its disruption potential that is believed to be more technology-driven and younger demographic centric. However, an investment in SoFi might be a premature decision to make and you want to wait and see before diving in too deep.

SoFi's business model

SoFi Technologies a financial services company based in San Francisco. It was founded in 2011 and has only been publicly traded since June 2020.

Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services and financial planning. The company intends to be a one-stop shop for its clients' finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking.

The company aims to disrupt the traditional financial services industry with its technology-driven approach. SoFi's mobile app and focus on online services cater to younger demographics who might not be drawn to traditional banks.

Impressive growth, but still lacks profitability

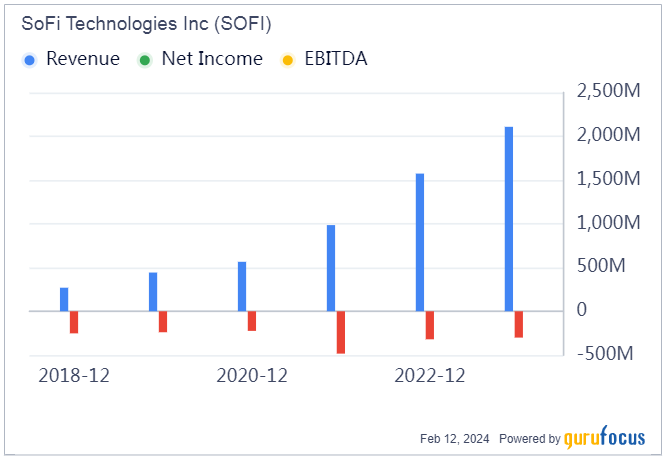

While facing macroeconomic challenges, SoFi managed to deliver its first positive quarterly net income in the final quarter of 2023. Despite this milestone, the company still ended the year with a net loss of $301 million, though narrowing the gap from net loss $320 million in 2022.

Since going public in June 2020, SoFi has shown an impressive revenue growth, increasing from $565.53 million to $985 million in 2021, $1.57 billion in 2022 to $2.07 billion in 2023. This represents an impressive compound annual growth rate of 56.03% over the period.

The impressive revenue growth appeals to investors who believe the industry is ripe for change to being more technology-driven. Additionally, SoFi has successfully built a strong brand name, particularly among younger generations.

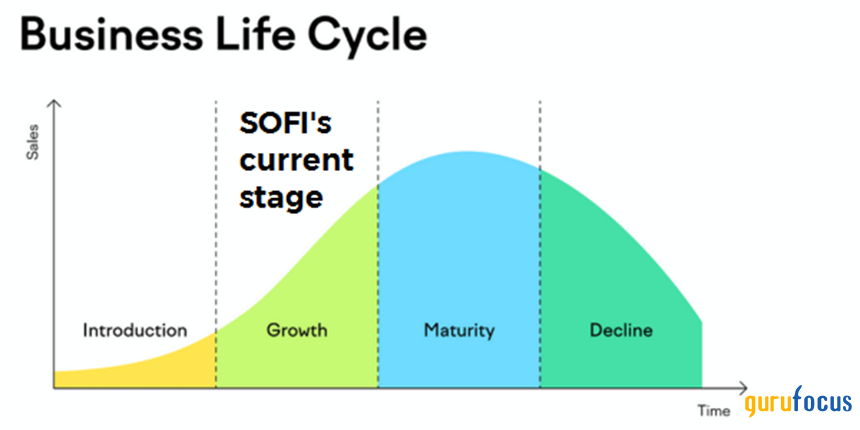

With a 56.03% CAGR of revenue in the last three years, the company's business life cycle clearly has entered the growth stage. Below, the growth in new member additions are shown over the past several years.

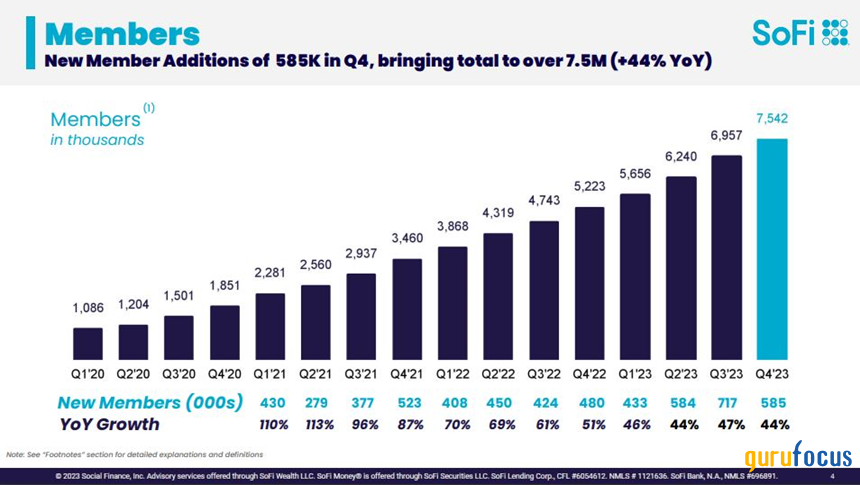

Along with revenue, the number of SoFi members grows significantly from 1 million in the first quarter of 2020 to 7.50 million users in the fourth quarter of 2023, a CAGR of 13.79% over the last 15 quarters. This indicates potential for future revenue growth. However, you may see that the increase has slowed from a 110% increase in the first quarter of 2021 to only a 44% increase in the fourth quarter of 2023. This indicates that someday the company will likely experience a stagnation point where the member growth is not as high.

SoFi has recorded impressive revenue growth and boasts a growing user base. However, achieving profitability remains a challenge. Investors should carefully consider the risks and uncertainties before investing in the company. While SoFi boasts impressive revenue growth, achieving true profitability has remained elusive.

Although its 2023 performance produced a net loss of $301 million, it is still an improvement over 2022's $320 million and 2021's $484 million. And if this improvement persists, SoFi will turn over some profits eventually. And we should wait for this to materialize before dipping our toes into investment as anything could happen.

Further, a significant milestone was reached in the fourth quarter with the company's first-ever quarterly profit. SoFi generated positive GAAP net income of $48 million and earnings of 2 cents per share. This momentum gives hope of a bright future with potential for market share gains, even higher revenue and ultimately, shareholder rewards.

What to expect in 2024

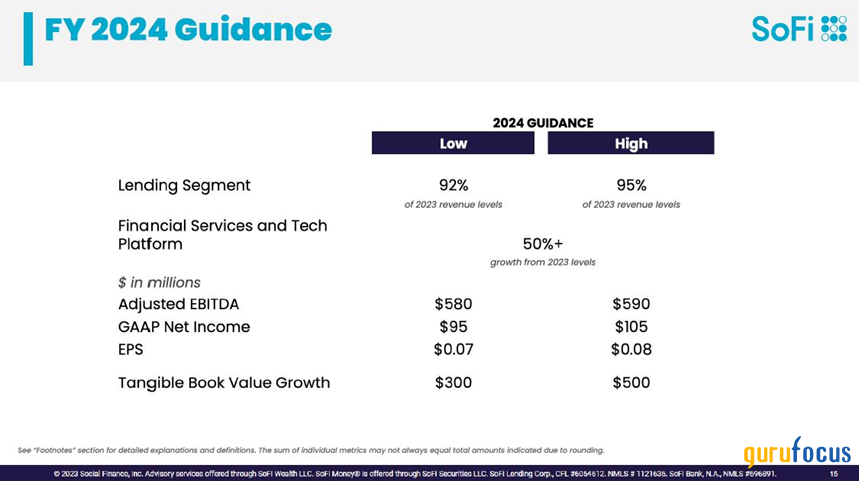

As SoFi has shown a hint of profitability, management in 2024 expects to deliver GAAP net income of $95 million to $105 million with financial product sales growth of 50% or more versus 2023 levels and Lending segment leads at 92% to 95% of 2023 revenue levels. Earnings per share are anticipated to be 7 cents to 8 cents.

If the targets are reached, then it will be a turnover point for SoFi, making it worth observing.

Future growth prospects

The U.S. fintech market reached $4 trillion in 2023 with a CAGR of 11%. This means the market is experiencing rapid growth. In Lending, established banks like JPMorgan Chase (NYSE:JPM) and Bank of America (NYSE:BAC) hold significant market share, but challenger banks like SoFi and Chime are making inroads. The U.S. lending market within fintech was valued at $580 billion in 2023. It is expected to reach $1.20 trillion by 2027. As the industry grows, we expect SoFi to grow as well and see some profits in the future.

Investment risk

SoFi has liabilities of $24.5 billion, of which $8 billion are deposits from clients. While the total assets are $30 billion, the equity comes to $5 billion, and that already includes a cash position of $3 billion as of the end of 2023 for some financial cushion.

Further, the capital adequacy ratio, calculated as equity divided by assets, measures a company's ability to absorb losses. In SoFi's case, it's $5 billion / $30 billion = 0.167. This is above the minimum regulatory requirement of 0.08, indicating the company meets capital adequacy standards.

As for the loan-to-deposit ratio, which is calculated as the difference between assets and deposits divided by deposits, it shows how much lending a bank does with its deposits. In SoFi's case, it's ($30 billion - $18 billion) / $18 billion = 0.667. This is considered conservative, meaning SoFi lends out less than what it receives in deposits, suggesting strong liquidity.

Finally, the debt-to-equity ratio, calculated as total liabilities divided by total equity, indicates how much debt a company uses to finance its operations. In SoFi's case, it is $24.5 billion / $5 billion = 4.9. This is relatively high, suggesting SoFi relies heavily on debt, which can be risky if interest rates rise or the economy weakens.

Overall, based on the ratios, SoFi seems to be in a somewhat stable financial position. It meets capital adequacy requirements and has a conservative loan-to-deposit ratio, but also carries a high debt burden.

However, these ratios are just a starting point for analysis and do not provide the whole picture. Other factors like profitability, asset quality and future growth prospects also play a crucial role.

Investors should know that SoFi's net charge-off rate, representing the percentage of loans that are considered uncollectible and written off after 120 days of delinquency, for all loans was 0.64%. This is higher than the national net charge-off in the U.S. for commercial banks, as reported by Federal Reserve Board, of 0.49% in the second quarter of 2023. Higher NCO is normal for mobile or online-only service banks and, therefore, they charge slightly higher interest to the lenders and that adds more profitability.

Conclusion

SoFi Technologies presents an interesting investment opportunity as a high-growth fintech company catering to younger demographics. It boasts impressive revenue growth, a growing member base and recently achieved its first positive quarterly net income. However, profitability remains elusive, with concerns about high debt and potential stagnation in member growth.

Positives:

Impressive revenue growth: 56% CAGR over the past three years, indicating significant market potential.

Large and growing user base: 5 million users, providing a strong foundation for future revenue.

First profitable quarter: A significant milestone demonstrating progress toward financial sustainability.

Large market opportunity: U.S. fintech market is rapidly growing, creating space for SoFi to capture further market share.

Negatives:

Lack of consistent profitability despite recent progress means overall profitability remains a challenge.

High debt burden raises concerns about financial stability and vulnerability to rising interest rates.

Decelerating member growth may indicate potential saturation in core demographics.

Higher net charge-off rate compared to national averages, raising concerns about loan quality.

Overall, SoFi has potential but carries risks. Before investing, carefully consider its financial health, future growth prospects and your risk tolerance. Monitor revenue and member growth trends and wait for consistent profitability before making a decision.

This article first appeared on GuruFocus.