Soft Demand Prompts UPS to Offer Early Retirement to Pilots

Per a Reuters report, United Parcel Service UPS has offered early retirement to some pilots. The move is aimed to reduce labor costs as the package delivery firm struggles with a decline in demand scenario. The weak freight market has hurt overall volumes.

At present, UPS employs around 3,400 pilots. The company expects 167 pilots to accept this voluntary retirement offer. The separation scheme is quite lucrative as it includes cash as well as healthcare-related benefits. This is, in fact, the first time since 2010 that UPS has decided to reduce employments of its pilots. In 2010, UPS had furloughed 109 pilots, per the report mentioned above.

We remind investors that in August, while releasing second-quarter 2023 results, management trimmed its current-year revenue outlook. UPS now expects 2023 revenues to be around $93 billion (prior view: $97 billion). Management cited costs associated with the labor deal, inked with 330,000 unionized workers, and declining package volumes induced by labor negotiations as reasons for lowering the outlook.

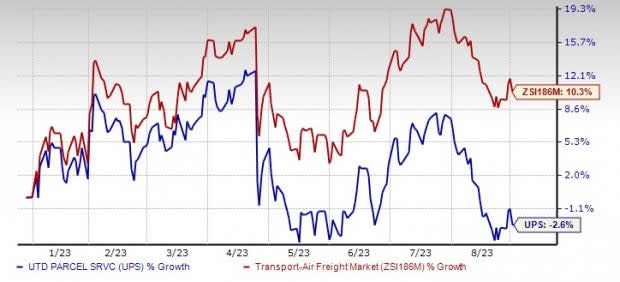

Due to these headwinds, UPS shares have declined 2.6% year to date compared with its industry’s 10.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

UPS currently carries a Zacks Rank #4 (Sell).

Investors interested in the Zacks Transportation sector may consider stocks like United Airlines UALand Air Transport Services ATSG.UAL and ATSG currently sport a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

United Airlines is seeing steady recovery in domestic and international air-travel demand. Owing to this, UAL expects revenues for the September quarter to grow 10-13% year over year. Our projection for third-quarter total revenues hints at an increase of 11.4% year over year.

For third-quarter 2023, United Airlines anticipates capacity to improve 16% from the year-ago reported figure. The Zacks Consensus Estimate for UAL’s current-year earnings has been revised 14.5% upward over the past 60 days.

An uptrend with respect to e-commerce even in the post-pandemic scenario is a huge positive for Air Transport Services. It is the primary driver behind an uptick in demand for midsize air freighters.

Driven by the upbeat demand, ATSG has delivered a record six converted freighters under lease in a month to its customers worldwide. The Zacks Consensus Estimate for ATSG’s current-year earnings has been revised 11.9% upward over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

Air Transport Services Group, Inc (ATSG) : Free Stock Analysis Report