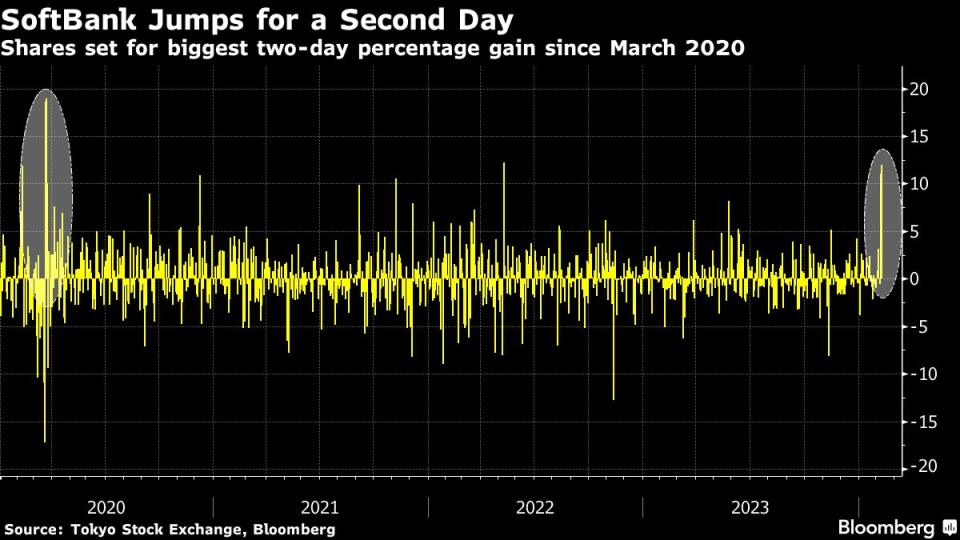

SoftBank Set for Biggest Two-Day Rally Since 2020 as Arm Surges

(Bloomberg) -- SoftBank Group Corp. shares surged for a second day to the highest level in almost three years, bolstered by a continued upward climb by its crown jewel, Arm Holdings Plc.

Most Read from Bloomberg

Japan Loses Its Spot as World's Third-Largest Economy as It Slips Into Recession

Israel Quits Ceasefire Talks Over ‘Delusional’ Hamas Demands

Trump Eyes NATO Makeover, Hurried Peace in Ukraine If Elected

Dip Buyers Wade Back In to Fuel Wall Street Gains: Markets Wrap

Arm surged 48% as artificial intelligence spending helped bolster the chip designer’s forecast. Chief Executive Officer Rene Haas said on Bloomberg Television that the opportunities presented by AI are just beginning to be recognized.

SoftBank shares rose 12% in Tokyo trading on Friday, extending their two-day gain to about 24% and heading for their best such rally since March 2020. The stock gained 11% on Thursday after Arm reported its financial results, closing at the highest level since July 2021.

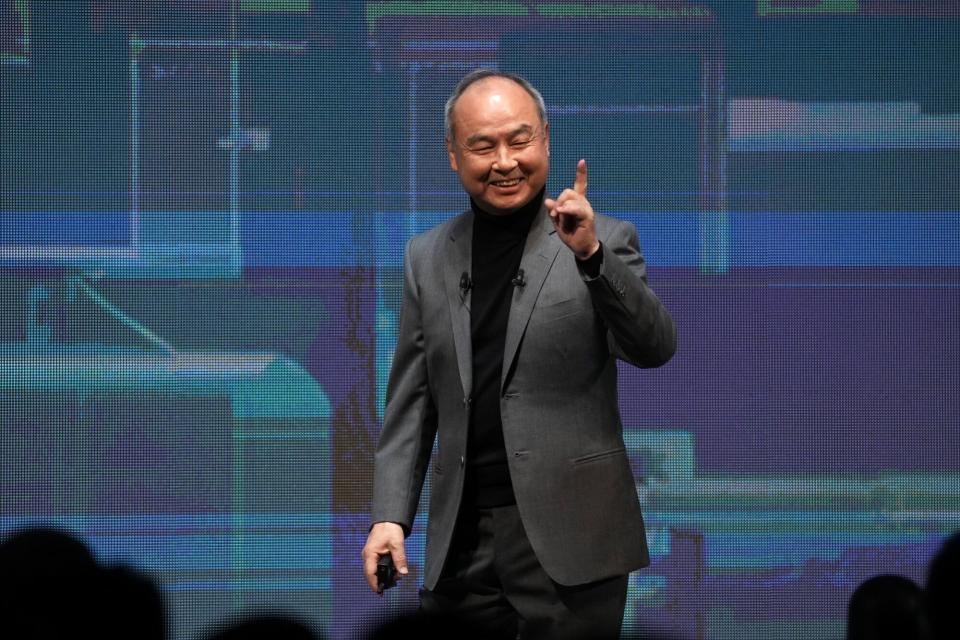

SoftBank owns about 90% of Arm and founder Masayoshi Son has pledged to explore ways to use Arm’s chip designs as he pursues AI-related investments. The Tokyo-based company reported its first profit after four quarters of losses on Thursday, with its Vision Fund also logging a profit in the December quarter.

“Arm’s results, while singularly impressive, were part of a diverse combination of tailwinds stemming from SoftBank’s AI, telecom, and broader tech portfolio,” Macquarie analysts Paul Golding and Emma Liang wrote in a note.

“The remaining question now is on net new investments, whether cash will or can be deployed in the context of quickly rising AI valuations, and high-quality criteria for investing from mgmt’s perspective,” the note said.

SoftBank Swings to Profit and Refocuses Its Strategy Around Arm

New investment activity by the second Vision Fund dwindled to $90 million, a fraction of the billions that SoftBank used to wield in the startup space. Bets on startups have been outpaced by exit activity in recent quarters.

SoftBank Vision Fund Sold Down Paytm Stake Before Shares Plunged

“New investments are crucial to sustain its profit recovery,” said Bloomberg Intelligence analyst Marvin Lo. “Results are good in general. The only concern I have is that the company might be struggling to find good AI investment opportunities, echoed by a decline in investment value.”

(Updates with latest share price move and chart)

Most Read from Bloomberg Businessweek

‘Playing God’: This Labor Activist’s Relentless Emails Force Companies to Change

The US Will Face Blowback in the Middle East, No Matter What

It’s Not Love Generating Those Dating Reality Shows. It’s Money

©2024 Bloomberg L.P.