SoftBank’s Son Is Poised for Best Quarter in Years as Arm Jumps

(Bloomberg) -- After a series of brutal setbacks, Masayoshi Son has SoftBank Group Corp. on track for one of its strongest quarters in years, including what’s likely to be its first profit in more than a year.

Most Read from Bloomberg

The Tokyo-based investment firm is expected to report net income of ¥373 billion ($2.5 billion) for the three months ended December, according to a Bloomberg average of five analysts. That’s thanks to a gain on its stake in T-Mobile USA Inc. and rising valuations for startups in its Vision Fund portfolio. The Vision Fund is likely to report its largest profit, ¥111 billion, since June 2021, according to Astris Advisory.

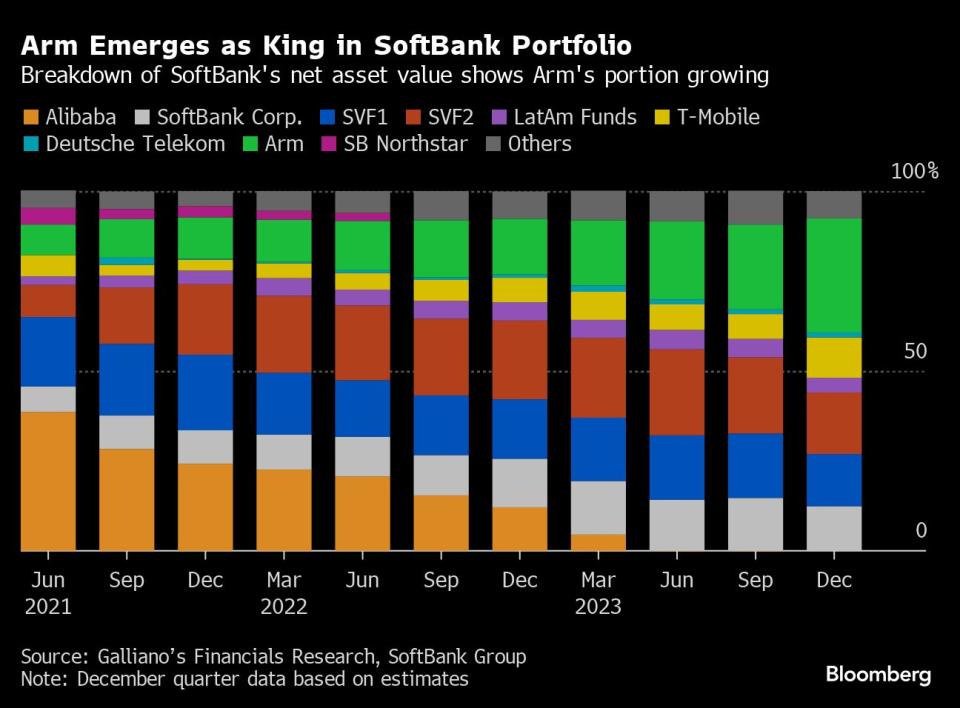

On top of that, Son’s most prized holding — Arm Holdings Plc — has rallied more than 40% since its went public in New York last year. That gain won’t hit SoftBank’s income statement because of complex accounting rules, but it contributes to SoftBank’s net asset value, one of Son’s favored metrics for the investment firm’s health.

Buoyed by Arm, SoftBank’s NAV is likely to have topped $121 billion, its highest in almost two years. In the December quarter, the chip designer’s shares shot up to a high of $77.47 apiece, valuing the firm at $79 billion.

“That’s a pretty good progression,” said Kirk Boodry, an analyst at Astris Advisory. “They’re going to say, ‘look we’re good investors because our NAV is going up.’ That would be the first point. The second one is that the value is driven by AI - That’ll tie back into the AI story.”

Arm’s gain was fueled by expectations that the UK chip designer will play an increasingly vital role in producing AI chips. Shares of semiconductor companies capped their best year in more than a decade, led by chipmakers that may benefit most from artificial intelligence. Nvidia Corp. stood out, with shares more than tripling and becoming the first chipmaker to be valued above $1 trillion.

Read More: Nvidia and AMD Power Chipmakers to Best Year Since 2009

Arm, with its outsize share of SoftBank’s NAV, has effectively replaced Alibaba Group Holding Ltd. as the crown jewel in the firm’s portfolio. SoftBank, wary of US-China trade tensions, has been gradually reducing its dependence on China and has halted new investments in the country for months.

“Son’s strength is that when he has conviction, he’s willing to invest and he can borrow a lot of money very cheaply,” said Boodry. “You only need one or two big winners. If he didn’t invest in Alibaba, we wouldn’t even be talking about SoftBank. But he did. So we are. And Arm is another one.”

Still, skepticism remains about SoftBank’s portfolio of hundreds of privately-held startups in its two Vision Funds. The second Vision Fund, funded entirely by SoftBank and Son personally, is mired in losses after a series of markdowns enforced by a tumultuous time for tech shares. SoftBank’s own stock is down more than 35% from its peak in 2021, while it trades at a discount of about 50% to its NAV.

The discount — one measure used for gauging the possibility of a share buyback — widened in December as Arm shares rose. That discount of 50% or more is the steepest it’s been since September 2020 during the Covid pandemic, according to Astris Advisory.

To Victor Galliano, an independent analyst who publishes on Smartkarma, SoftBank’s growing reliance on Arm is a reason to be wary. “They are increasingly dependent on Arm’s share price appreciation,” he said. “They are, in my humble opinion, not in the same league as, for example, Nvidia.”

Astris Advisory’s Boodry also sees a bubble forming in the recent upward climb in Arm’s shares. He estimates the chip designer’s stock is overvalued at levels above $70 apiece. “Son has to be careful of hubris,” Boodry said. “If he comes out now and he goes, ‘See, look, I was right about Arm,’ and then the stock falls by 40%, it’s not going to look very good.”

Here is what others are saying:

Macquarie (Paul Golding, Emma Liang)

“We think the market is overly discounting NAV broadly, even more so now since the recent Arm move to the upside and the T-Mobile option exercise, while shares have continued to climb in value”

Current level of discount implies “the market continues to see NAV as highly susceptible to fluctuations in Vision Fund private company valuations or the tech sector having material downside in public names — both contrary to what one might expect from what could be an improving interest rate environment in the near-to-medium term”

Raised price target to ¥8,050 from ¥7,750

Citigroup Global Markets (Mitsunobu Tsuruo)

Vision Fund losses are narrowing, while overall valuation gains and losses on non-listed companies were at breakeven for the September quarter

“While economic sentiment has been stagnant, trends in market interest rates have been positive for corporate valuations, notably the decline in discount rates used to evaluate enterprise value”

Similar to the Alibaba agreement, over half of T-Mobile shares from the option agreement can be used for structured finance for imminent monetization at the point of stock provision

Raised price target to ¥7,300 from ¥7,100

Bloomberg Intelligence (Marvin Lo, Chris Muckenstrum)

Profit boost from T-Mobile shares “stops short of anything more sustainable, nor does it signal a higher possibility of share buybacks”

“Consensus expects high earnings growth from Arm, but its profit could still be small and might not move the needle, given SVF’s swingy pre-tax income of ¥61 billion in 1Q and losses of ¥259 billion in 2Q”

SoftBank mobile remains a stable recurring-profit contributor amid a steady recovery of its mobile business

--With assistance from Reinie Booysen, Jin Wu, Yue Qiu, Takahiko Hyuga and Vlad Savov.

Most Read from Bloomberg Businessweek

OpenAI’s Secret Weapon Is Sam Altman’s 33-Year-Old Lieutenant

How Jack Dorsey’s Plan to Get Elon Musk to Save Twitter Went South

©2024 Bloomberg L.P.