SolarEdge Technologies Inc (SEDG) Faces Market Headwinds: A Look at Q4 and Full Year 2023 Results

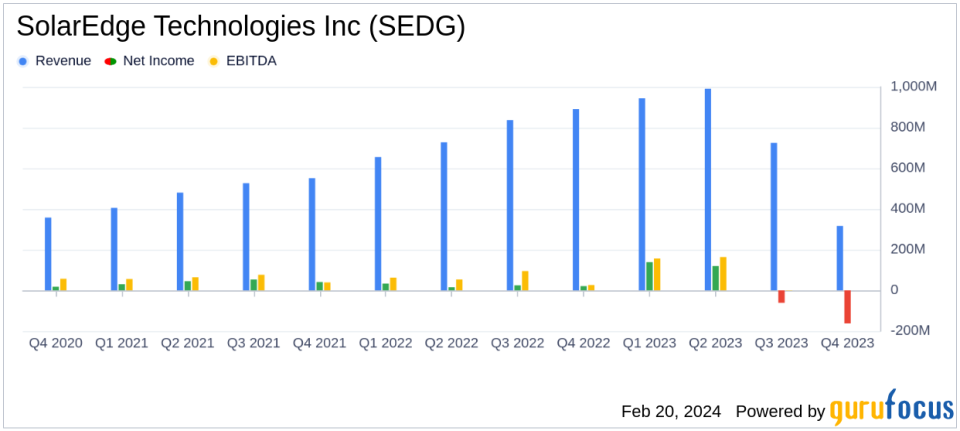

Revenue: Q4 revenue plunged to $316.0 million, a 65% decrease year-over-year.

Net Loss: GAAP net loss widened to $162.4 million in Q4, with a loss per share of $2.85.

Gross Margin: Negative GAAP gross margin of 17.9% in Q4, reflecting market pressures.

Operating Cash Flow: Operating activities used $139.9 million in cash in Q4.

Full Year Performance: 2023 total revenues slightly down by 4% to $3.0 billion compared to the prior year.

Cost Reductions: Non-GAAP operating expenses decreased by 8% quarter-over-quarter.

Liquidity Position: Cash and equivalents, net of debt, totaled $634.7 million as of December 31, 2023.

SolarEdge Technologies Inc (NASDAQ:SEDG) released its 8-K filing on February 20, 2024, revealing the financial outcomes for both the fourth quarter and the full year ended December 31, 2023. The company, known for its direct current optimized inverter systems for solar photovoltaic installations, faced significant market challenges in the latter half of 2023, which impacted its financial performance.

Financial Performance Overview

In the fourth quarter, SEDG reported a sharp decline in revenues, which fell to $316.0 million, a 65% decrease from the same quarter last year. The solar segment, in particular, saw a 66% decrease in revenues year-over-year. The company's GAAP gross margin turned negative to 17.9%, a stark contrast to the positive margins reported in the previous year. This decline was attributed to a weaker market driven by higher interest rates and lower power prices, leading to an inventory buildup and slowed shipments.

Operating expenses on a GAAP basis increased by 14% from the prior quarter to $181.2 million, while non-GAAP operating expenses saw a decrease of 8% quarter-over-quarter. The GAAP operating loss was $237.6 million, compared to a loss of $16.8 million in the prior quarter. The net loss on a GAAP basis also expanded significantly to $162.4 million, with a loss per share of $2.85.

For the full year 2023, total revenues were $3.0 billion, a slight decrease of 4% from the prior year. The GAAP gross margin for the year was 23.6%, down from 27.2% in the prior year. Non-GAAP operating income for the year fell by 34% to $290.0 million, and GAAP net income decreased by 63% to $34.3 million.

Balance Sheet and Cash Flow Highlights

The balance sheet as of December 31, 2023, showed that cash, cash equivalents, bank deposits, restricted bank deposits, and marketable securities, net of debt, totaled $634.7 million, a decrease from $831.4 million on September 30, 2023. Cash used in operating activities for the fourth quarter was $139.9 million, a significant shift from the cash generated in the same quarter of the previous year.

Management Commentary

"Despite the challenges we faced in the second half of 2023, we concluded the year with $3.0 billion in revenue, just below 2022 levels," said Zvi Lando, Chief Executive Officer of SolarEdge. "The first half of 2023 included record installations and expectations for continued growth, with a shift in the second half of the year to a weaker market due to higher interest rates and lower power prices, which resulted in an inventory buildup that slowed our shipments. Nevertheless, we believe we are well positioned for the next growth cycle in our industry due to our expanding product portfolio as well as the operational and cost reduction measures we have taken."

Looking Forward

SEDG provided guidance for the first quarter of 2024, projecting revenues to be between $360 million to $380 million and non-GAAP gross margin to be within the range of 26% to 30%. The company's focus on expanding its product portfolio and implementing operational and cost reduction measures is aimed at positioning itself for recovery and growth in the upcoming cycles of the industry.

For value investors and potential GuruFocus.com members, the detailed financials and management's strategic response to current market conditions provide a comprehensive view of SEDG's resilience and future potential in the smart energy technology sector.

For further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from SolarEdge Technologies Inc for further details.

This article first appeared on GuruFocus.