SolarWinds Corp (SWI) Reports Growth in Revenue and Adjusted EBITDA for Q4 and Full Year 2023

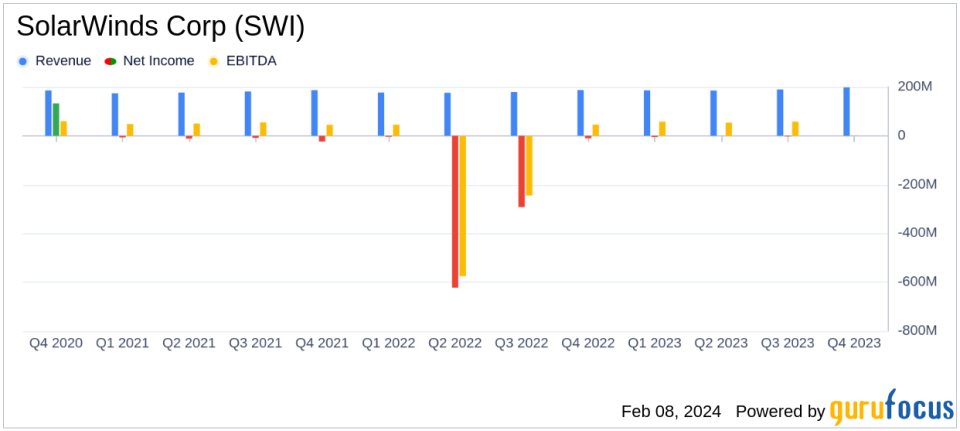

Total Revenue: $198.1 million in Q4, a 6% increase year-over-year; $758.7 million for full year, up 5%.

Net Loss: Reported a net loss of $0.6 million in Q4; $9.1 million for the full year.

Adjusted EBITDA: $87.0 million in Q4, growing 17% year-over-year; $328.6 million for full year, also up 17%.

Subscription ARR: Reached $233.2 million, a significant 34% growth year-over-year.

Total ARR: Increased to $684.1 million, marking an 8% year-over-year growth.

On February 8, 2024, SolarWinds Corp (NYSE:SWI), a leading provider of IT management software, released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which focuses on secure observability and IT management solutions, reported a year of steady revenue growth and margin expansion, despite a net loss for both the quarter and the full year.

Financial Performance and Challenges

SolarWinds' performance in the fourth quarter and throughout 2023 reflects the company's resilience and strategic focus. The growth in total revenue and adjusted EBITDA is particularly noteworthy, as it underscores the company's ability to expand its margins and control costs effectively. The reported net loss, however, indicates ongoing challenges, including the costs associated with the Cyber Incident and restructuring efforts. These challenges are significant as they may impact the company's profitability and operational efficiency.

Financial Achievements and Industry Importance

The company's financial achievements, especially the 34% growth in Subscription Annual Recurring Revenue (ARR) and the overall 8% growth in Total ARR, are critical indicators of SolarWinds' successful transition to a subscription-first model. This transition is vital in the software industry, where recurring revenue streams provide more predictable and stable financial outcomes and reflect strong customer retention and acquisition strategies.

Key Financial Metrics

SolarWinds' balance sheet as of December 31, 2023, shows total cash and cash equivalents and short-term investments of $289.2 million, with total debt standing at $1.2 billion. The company's focus on recurring revenue, which represents 92% of the total revenue, is a strategic move that aligns with industry trends favoring subscription-based models. The adjusted EBITDA margin of 43% for the full year is a testament to the company's operational efficiency and cost management.

"We are pleased to finish the year with fourth quarter and full-year revenue and adjusted EBITDA results that exceeded our guidance, while also expanding our margins," said Sudhakar Ramakrishna, President and Chief Executive Officer of SolarWinds. "Our year-over-year growth in full-year revenue, total ARR, subscription revenue, and adjusted EBITDA represent significant progress towards the priorities we set forth at the beginning of 2023, including our subscription-first strategy, continued focus on customer success and retention, innovation on the SolarWinds Platform, and strong operating discipline. In 2024, we intend to accelerate the execution and progress towards our established priorities."

Analysis of Company Performance

The company's performance in 2023 indicates a strategic shift towards a subscription-based revenue model, which is increasingly common in the software industry. The growth in subscription ARR and total ARR suggests that SolarWinds is effectively capturing market demand and customer loyalty. However, the net losses reported in both the fourth quarter and the full year highlight the need for continued focus on cost optimization and potentially increased operational challenges.

For value investors, the strong adjusted EBITDA margins and recurring revenue base may be attractive, as they suggest a stable and growing business model. The company's proactive measures to refinance its debt and reduce the applicable margin for its borrowings also demonstrate a commitment to improving its financial position.

Looking ahead, SolarWinds provided a financial outlook for the first quarter and full year of 2024, projecting continued revenue growth and adjusted EBITDA expansion. The company's management is focused on building upon the momentum from 2023 and driving further growth through its established priorities.

For more detailed information and analysis on SolarWinds Corp (NYSE:SWI)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from SolarWinds Corp for further details.

This article first appeared on GuruFocus.