Solid Bookings to Aid Norwegian Cruise (NCLH) Q2 Earnings

Norwegian Cruise Line Holdings Ltd. NCLH is scheduled to report second-quarter 2023 results on Aug 1, 2023, before the opening bell. In the last reported quarter, the company delivered an earnings surprise of 30.2%.

The Trend in Estimate Revision

The Zacks Consensus Estimate for second-quarter earnings per share (EPS) is pegged at 27 cents. In the prior-year quarter, NCLH reported a loss per share of $1.14.

For revenues, the consensus mark is pegged at $2,178 million. The projection suggests an increase of 83.5% from the year-ago quarter’s reported figure.

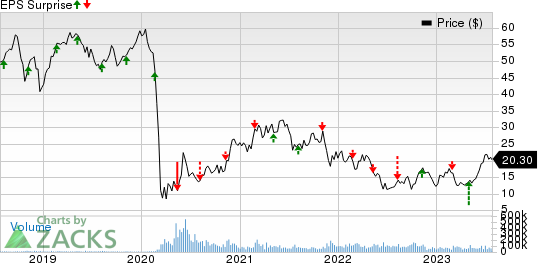

Norwegian Cruise Line Holdings Ltd. Price and EPS Surprise

Norwegian Cruise Line Holdings Ltd. price-eps-surprise | Norwegian Cruise Line Holdings Ltd. Quote

Let's look at how things have shaped up in the quarter.

Factors at Play

Norwegian Cruise’s second-quarter top line is expected to have increased year over year on the back of strong booking activities, occupancy improvements and fleet-expansion efforts. Strength in onboard revenue generation (driven by enhancements in bundled offerings), solid advance ticket sales and elevated pricing levels are likely to have aided the company’s performance in the to-be-reported quarter.

The Zacks Consensus Estimate for second-quarter passenger ticket revenues and onboard and other revenues is currently pegged at $1,570 million and $622 million compared with $794 million and $393 million, respectively, reported in the prior-year quarter.

For second-quarter 2023, our model predicts passenger ticket and onboard and other revenues to increase 117.5% (to $1,726.7 million) and 2% ($401.3 million), respectively, on a year-over-year basis.

Emphasis on margin enhancement initiatives, such as itinerary optimization, supply chain initiatives and rationalization of product delivery are likely to have aided the company’s performance in the second quarter. The company anticipates second-quarter net yields to rise 2-2.8% (on a reported basis) and 2.5-3.3% (constant-currency basis) from 2019 levels. The company anticipates adjusted EBITDA at approximately $485 million. It expects adjusted EPS to be nearly 25 cents.

Elevated costs concerning food, perishables and logistics are likely to have hurt margins in the second quarter. During the quarter, the company anticipates Net Cruise Cost (excluding Fuel per Capacity Day) to be approximately $159 million. Per our model, total cruise operating costs in the second quarter is expected to rise 18.3% year over year to $1,269.3 million.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Norwegian Cruise this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP: Norwegian Cruise has an Earnings ESP +10.43%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks Poised to Beat on Earnings

Here are a few other stocks from the broader Zacks Consumer Discretionary sector, which according to our model, also have the right combination of elements to beat on earnings this season:

Electronic Arts Inc. EA has an Earnings ESP of +2.54% and carries a Zacks Rank #2

Shares of Electronic Arts have increased 5.6% in the past year. EA’s earnings beat estimates in two of the trailing four quarters and missed twice, the average surprise being 7.3%.

MGM Resorts International MGM has an Earnings ESP of +19.43% and a Zacks Rank #2.

Shares of MGM Resorts have increased 58.2% in the past year. MGM’s earnings beat estimates in two of the trailing four quarters and missed twice, the average surprise being 81%.

Boyd Gaming Corporation BYD has an Earnings ESP of +2.92% and a Zacks Rank of 3.

Shares of Boyd Gaming have gained 29% in the past year. BYD’s earnings beat estimates in all the trailing four quarters, the average negative surprise being 13.7%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report