Solid Comps Aid Cheesecake Factory (CAKE), High Costs Hurt

The Cheesecake Factory Incorporated CAKE is benefiting from solid comparable restaurant revenue growth, expansion initiatives and other sales-growth strategies.

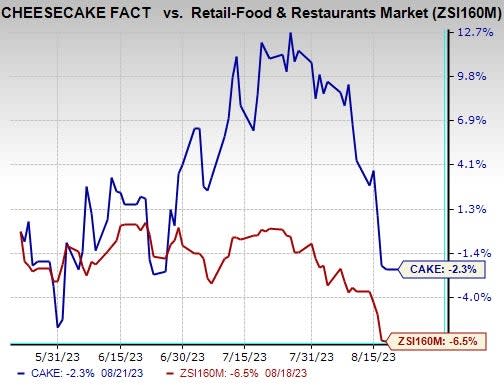

Shares of CAKE declined 2.3% in the past three months compared with the Zacks Retail - Restaurants industry’s 6.5% decline. However, increased costs and expenses, and uncertain macroeconomic environment remain concerns.

Let us delve deeper.

Factors Aiding CAKE’s Growth

Cheesecake Factory is focused on achieving profit targets back to pre-pandemic levels. This is highlighted in the recently reported fiscal second-quarter 2023 results. In the quarter, the company’s earnings topped the Zacks Consensus Estimate by 8.6% and grew 69.2% year over year. The revenues also grew year over year by 4%.

The uptrend in the result was backed by solid comps growth, courtesy of increased average checks and customer traffic. Also, increased menu pricing aided the company to overcome the ongoing inflationary challenges. In the first six months of fiscal 2023, comps at Cheesecake Factory restaurants increased 3.6% year over year and rose 14.5% from the 2019 level.

Image Source: Zacks Investment Research

Cheesecake Factory is keenly focusing on its unit growth strategies. As of the first six months of fiscal 2023, the company opened five new restaurants comprising of one Flower Child in Tucson, three Fox Restaurant Concepts (FRC) restaurants in Nashville, Tucson and Miami along with one Cheesecake Factory restaurant in South Beach.

As of Jul 4, 2023, Cheesecake Factory owned and operated 321 restaurants throughout the United States and Canada under its operating brands. The long-term unit growth expectation of the company for the Cheesecake Factory, North Italia and FRC (including Flower Child) restaurants are approximately 3%, more than 20% and within 15-20%, respectively.

Cheesecake Factory is committed to bolstering sales to stay afloat in the competitive environment. Notably, menu innovation and advanced digital capabilities are the primary fortes of the company.

Going forward, the company intends to carry on with menu innovation to boost its broad consumer appeal and degree of relevancy. Given the menu innovation stride, during the fiscal second quarter of 2023, the company launched its new cookie dough lover's Cheesecake with Pecans in honor of National Cheesecake Day.

Furthermore, on Jun 1, 2023, the company launched its cheesecake rewards program across the country, garnering promising enrollment numbers upon its launch. The dining members of this cheesecake rewards program were offered half price on any slice on Jul 31 and Aug 1, in celebration of National Cheesecake Day. Given the positive start, the company is optimistic in this regard and anticipates the initiative to support its marketing strategy and drive profitable sales growth in the upcoming periods.

Headwinds

Cheesecake Factory is facing high costs trend for some time now. The ongoing inflationary pressures, along with the macroeconomic challenges, are affecting the company’s operations. In the second quarter of fiscal 2023, the preopening costs jumped to $6 million, compared with $2.9 million in the prior year period due to delays in restaurant opening dates.

Moreover, general and administrative expenses accounted for 6.4% of revenues, compared with 6% in the prior-year quarter. Commodity and labor inflation are also notable concerns for the company. For third-quarter fiscal 2023, the company anticipates commodity and labor inflation in low-single digits and mid-single digits, respectively.

Cheesecake Factory is facing construction and permit delays, which are adversely affecting its expansion growth initiatives. The company is cautious about the ongoing uncertain macroeconomic environment and anticipates the headwinds to persist for some time.

Zacks Rank

Cheesecake Factory currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Retail-Wholesale sector are Amazon.com, Inc. AMZN, BJ's Restaurants, Inc. BJRI and Builders FirstSource, Inc. BLDR.

Amazon’s currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMZN delivered a trailing four-quarter earnings surprise of 41%, on average. Shares of the company have gained 58.6% in the year-to-date period. The Zacks Consensus Estimate for AMZN’s 2023 sales and earnings per share (EPS) indicates growth of 10.8% and 204.2%, respectively, from the previous year’s reported levels.

BJ's Restaurants currently sports a Zacks Rank of 1. BJRI delivered a trailing four-quarter earnings surprise of 121.2%, on average. Shares of the company have gained 14.5% in the year-to-date period.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS indicates growth of 5.6% and 423.5%, respectively, from the previous year’s reported levels.

Builders FirstSource currently sports a Zacks Rank of 1. BLDR has a trailing four-quarter earnings surprise of 52.2%, on average. Shares of the company have rallied 106.7% in the year-to-date period.

The Zacks Consensus Estimate for BLDR’s 2023 sales and EPS indicates decline of 23.3% and 29.6%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

The Cheesecake Factory Incorporated (CAKE) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report