Solid Comps Growth to Aid Red Robin's (RRGB) Q2 Earnings

Red Robin Gourmet Burgers, Inc.’s RRGB second-quarter fiscal 2023 results are likely to improve on a year-over-year basis.

In the previous quarter, the company’s earnings and revenues topped the Zacks Consensus Estimate by 140.3% and 3.1%, respectively. Red Robin’s earnings topped analysts’ expectations in eight of the trailing 19 quarters.

The Trend in Estimate Revision

For the quarter, the Zacks Consensus Estimate is pegged at a loss of 55 cents per share. In the prior-year quarter, RRGB reported a loss per share of 75 cents. The consensus mark for revenues is pegged at $295.3 million, suggesting growth of 0.4% year over year.

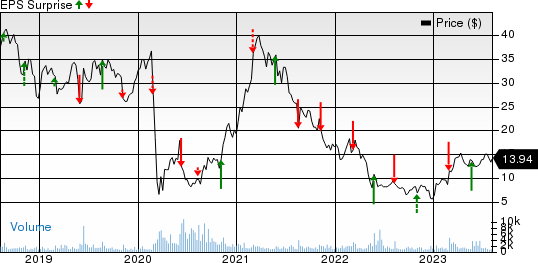

Red Robin Gourmet Burgers, Inc. Price and EPS Surprise

Red Robin Gourmet Burgers, Inc. price-eps-surprise | Red Robin Gourmet Burgers, Inc. Quote

Let's look into the factors that are likely to have influenced the company's performance in the quarter.

Factors at Play

Red Robin's fiscal second-quarter’s revenues are likely to have benefited from menu price increases, favorable sales channel mix, growth in restaurant traffic and solid loyalty program. These factors are anticipated to have aided comparable restaurant revenue growth year over year.

Our models predict restaurant revenues during fiscal second-quarter 2023 to increase 0.2% year over year to $289.1 million. We anticipate comparable restaurant revenues and average guest check in to increase 2.1% and 4% in the quarter, compared with 6.7% and 9.6%, respectively, in the prior year quarter.

Meanwhile, Red Robin expects to witness a setback in the restaurant level operating profit margin in the fiscal second quarter, sequentially, due to typical seasonal sales shifts and accelerated investments. It has been investing heavily in several sales building initiatives like advertising and technical upgrades, which are likely to have resulted in elevated costs.

However, the company expects the reduction of repair, maintenance and cleaning costs with the upgradation of its cooking method. It expects to complete the system-wide implementation of flat-top grills in the second quarter. Also, its implementation of various cost savings initiatives bodes well for the company’s earnings in the quarter.

In fiscal second-quarter 2023, our model estimates total costs and expenses to decline 4.1% year over year to $294.8 million. On the other hand, we expect restaurant level operating profit margin to decline 140 basis points to 12.2% year over year.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Red Robin this time around. The company does not have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat.

Earnings ESP: Red Robin has an Earnings ESP of 0.00%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: Red Robin has a Zacks Rank of 2.

Stocks Poised to Beat on Earnings

Here are some stocks from the Zacks Retail-Wholesale sector, which according to our model, have the right combination of elements to post an earnings beat.

Farfetch Limited FTCH has an Earnings ESP of +13.46% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

FTCH’s earnings for the to-be-reported quarter are expected to remain flat. The company reported better-than-expected earnings in two of the last four quarters and missed on the other two occasions, the average surprise being 4.5%.

Arhaus, Inc. ARHS has an Earnings ESP of +7.69% and a Zacks Rank of 2.

ARHS’ earnings for the to-be-reported quarter are expected to decline 7.1%. The company reported better-than-expected earnings in all the trailing four quarters, the average surprise being 82.4%.

Jack in the Box Inc. JACK has an Earnings ESP of +0.60% and a Zacks Rank of 2.

JACK is expected to register a 3.6% decline in earnings for the to-be-reported quarter. Notably, the company reported better-than-expected earnings in two of the last four quarters and missed on the other two occasions, the average surprise being 7.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Janus Henderson Sustainable & Impact Core Bond ETF (JACK) : Free Stock Analysis Report

Red Robin Gourmet Burgers, Inc. (RRGB) : Free Stock Analysis Report

Farfetch Limited (FTCH) : Free Stock Analysis Report

Arhaus, Inc. (ARHS) : Free Stock Analysis Report