Solid Growth Efforts Aid Tractor Supply (TSCO) Amid Inflation

Tractor Supply Company TSCO has been gaining from consistent market share expansion and positive customer trends. Also, strength in the Life Out Here Strategy, a solid online show and the Neighbor's Club loyalty program bode well.

These factors led to year-over-year sales growth of 4.3% in third-quarter 2023. Also, the company has been gaining from the execution of the everyday low-price strategy and reduced transportation, which aided margins in third-quarter 2023. The gross margin expanded 101 basis points (bps), whereas the operating margin expanded 62 bps to 10%. Consequently, the bottom line grew 11% year over year.

That said, let’s delve deeper into the growth plans driving the stock.

Factors Narrating TSCO’s Growth Story

Tractor Supply is on track to build up on its Out Here lifestyle assortment and convenient shopping format to gain customers and market share. The strategy is essentially based on five key pillars, including customers, digitization, execution, team members and total shareholder return.

As part of the plans, it revised the long-term financial growth targets for 2022-2026. Management envisions achieving net sales growth of 6-7%, while comps are expected to grow 4-5%. The operating margin is expected to be 10.1-10.6%, up from the earlier mentioned 9-9.5%. Earnings per share are likely to grow 8-11%, up from the previously projected 8-10%.

Earlier, the company launched the Field Activity Support Team (“FAST”) and implemented various technology and service enhancements across the enterprise. It is also in the initial phase of transforming its side lots and mature stores to improve space productivity, bringing the latest merchandising strategies to life, and advancing efforts to remain nationally strong and locally relevant.

Given the changing consumer trends, Tractor Supply is focused on integrating its physical and digital operations to offer consumers a seamless shopping experience. Incidentally, the company has been on track with the ‘ONETractor’ strategy aimed at connecting stores and online shopping. Its omni-channel investments include curbside pickup, same-day and next-day delivery, a re-launched website, and a new mobile app.

Earlier, it launched Tractor Supply, Visa Credit Card, which allows customers to earn points on their everyday purchases, both in-store and anywhere Visa is accepted. Tractor Supply exited the third quarter with high-single-digit e-commerce revenue growth, driven by a strong conversion performance and strength in the buy online, deliver from store program.

Its Neighbor's Club program accounted for more than 77% of digital sales in the quarter under review, driven by continued favorable trends and higher retentions. Management earlier predicted to reach more than $2 billion in sales by 2026, out of which it has already attained $1 billion.

The company is persistently focusing on its growth initiatives, which include the expansion of the store base and the incorporation of technological advancements to induce traffic and drive the top line. TSCO is well-positioned to expand its store base, remaining on track to increase its domestic store to 2,500 in the long term.

In the third quarter, the company opened 17 Tractor Supply stores and three Petsense by Tractor Supply stores. Management intends to continue its store-opening initiatives in 2023. It plans to open 80 Tractor Supply stores and 10-15 Petsense stores in 2023. Also, TSCO anticipates accelerating its annual new store growth to 90 per year in 2025 and 80 stores in 2024.

Another key component of the company’s space productivity initiatives is the transformation of its Side Lot. It expects to complete the aforementioned Orscheln Farm and Home conversions, as well as the Project Fusion remodels and garden center transformations.

TSCO’s Project Fusion and Side Lot model transformations have been significant investments toward stores. These store investments target achieving higher market share, and boost productivity across the existing and new stores. Notably, TSCO boasts more than 700 Project Fusion stores, accounting for 30% of its store base.

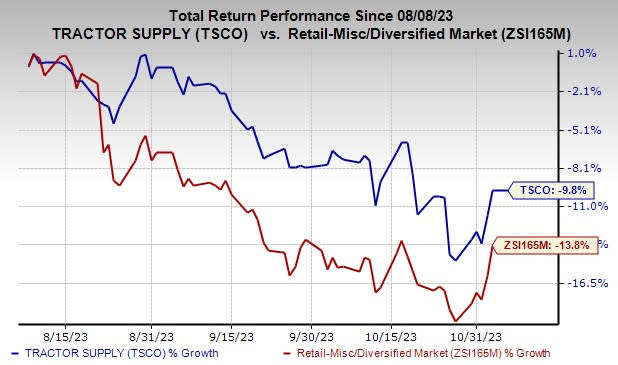

Image Source: Zacks Investment Research

Shares of this Zacks Rank #3 (Hold) company have lost 9.8% in the past three months compared with the industry’s decline of 13.8%.

Headwinds to Overcome

Tractor Supply has been reeling under rising costs stemming from higher depreciation and amortization, the opening of a distribution center, and the impacts of higher medical claims. It expects consumer spending to remain muted throughout the remainder of the year.

Consequently, management expects net sales of $14.5-$14.6 billion, down from the earlier mentioned $14.8-$14.9 billion. Meanwhile, comps are likely to remain flat year over year, down from previously mentioned 1.3-2.5% growth. The operating margin is anticipated to be 10.1-10.2% compared with the 10.2-10.3% mentioned earlier. Earnings per share are expected to be $10.00-$10.10, down from the previously communicated $10.20-$10.40.

Wrapping Up

Online strength, solid demand and well-chalked-out endeavors are likely to help the stock offset inflation-led cost woes.

Analysts also seem optimistic about the stock. The Zacks Consensus Estimate for Tractor Supply’s 2023 sales and EPS is pegged at $14.6 billion and $10.08, suggesting respective growth of 2.9% and 3.8% from the year-ago reported figures.

The Zacks Consensus Estimate for TSCO’s 2023 earnings for the current financial year has inched up by a penny in the past seven days.

Key Picks

Some better-ranked stocks are BJ's Restaurants BJRI, Ross Stores ROST and Walmart WMT.

BJ's Restaurants, which operates a chain of high-end casual dining restaurants in the United States, currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS indicates 5.6% and 405.9% growth, respectively, from the year-ago period’s reported levels. It has a trailing four-quarter earnings surprise of 121.2%, on average.

Ross Stores, which operates off-price retail apparel and home fashion stores, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Ross Stores’ current financial-year sales and earnings indicates growth of 7.1% and 19.4%, respectively, from the year-ago reported numbers. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Walmart, which operates a chain of hypermarkets, discount department stores and grocery stores, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 5.5%.

The Zacks Consensus Estimate for Walmart’s current financial-year sales implies an improvement of 4.2% from the year-ago period’s actual. WMT has a trailing four-quarter earnings surprise of 12%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report