Solid Power Inc (SLDP) Reports Full Year 2023 Financial Results

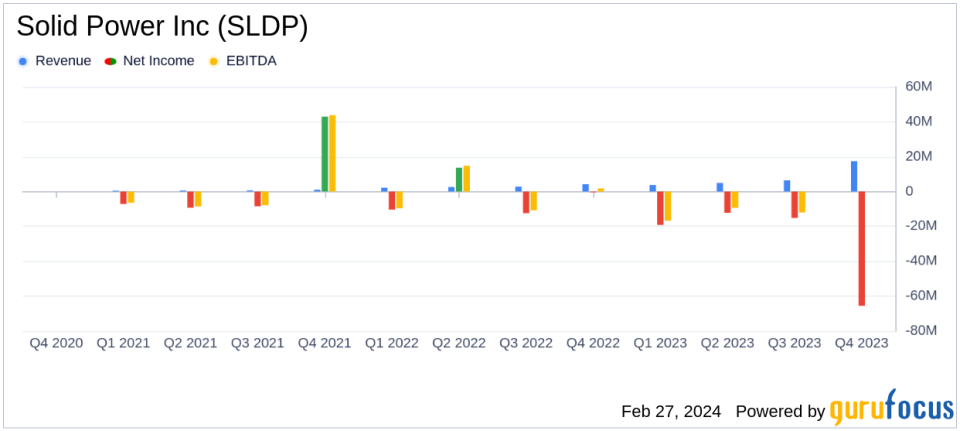

Revenue: Increased to $17.4 million in 2023, up from $11.8 million in 2022.

Net Loss: Reported a net loss of $65.5 million, or $0.37 per share.

Liquidity: Ended the year with $415.6 million in total liquidity.

Capital Expenditures: Totaled $34.5 million, mainly for the new electrolyte production facility.

2024 Outlook: Expects cash used in operations to be $60-$70 million and capital expenditures of $40-$50 million.

Stock Performance: Common stock issued and outstanding increased from 176,007,184 shares in 2022 to 179,010,884 shares in 2023.

On February 27, 2024, Solid Power Inc (NASDAQ:SLDP) released its 8-K filing, detailing its operational and financial performance for the full year of 2023. The company, a leader in the development of all-solid-state battery technology, is poised to revolutionize the EV and broader battery markets with its innovative approach to battery cell design and manufacturing.

According to President and CEO John Van Scoter, Solid Power achieved several strategic milestones in 2023, enhancing its operational and technological capabilities. The company successfully produced electrolyte at a rate of 1.1 metric tons per month and entered the automotive qualification process with its A-1 Sample cells. Looking ahead, Solid Power aims to expand its electrolyte production, advance cell designs, and strengthen its presence in the Korean battery ecosystem.

Financial Performance and Challenges

Despite a revenue increase to $17.4 million in 2023, up $5.6 million from the previous year, Solid Power faced higher operating expenses due to investments in product development and scaling operations. This led to an operating loss of $90.6 million and a net loss of $65.5 million, or $0.37 per share. The company's financial health remains robust, with a strong liquidity position of $415.6 million as of December 31, 2023.

The company's balance sheet reflects a commitment to growth, with significant capital expenditures of $34.5 million, primarily for the electrolyte production facility. This investment is crucial for Solid Power's strategy to scale up production and meet the growing demand for its solid-state battery technology.

2024 Outlook and Strategic Focus

For 2024, Solid Power anticipates cash used in operations to be between $60 million and $70 million, with capital expenditures ranging from $40 million to $50 million. These projections include approximately $35 million in operational and capital investments deferred from 2023. The company expects revenue for 2024 to be between $20 million and $25 million, signaling continued growth and execution under its joint development agreements.

As Solid Power continues to navigate the competitive landscape of the battery technology industry, its focus on executing key milestones and commitments to joint development partners will be critical for maintaining its leadership position and driving long-term shareholder value.

Value investors and potential GuruFocus.com members should note the strategic advancements and financial commitments Solid Power Inc (NASDAQ:SLDP) is making to solidify its position in the market. The company's progress in 2023 and its outlook for 2024 reflect a clear vision for growth and innovation in the solid-state battery sector.

Explore the complete 8-K earnings release (here) from Solid Power Inc for further details.

This article first appeared on GuruFocus.