Solo Brands Inc (DTC) Reports Decline in Q4 and Full Year 2023 Earnings Amid Strategic Shifts

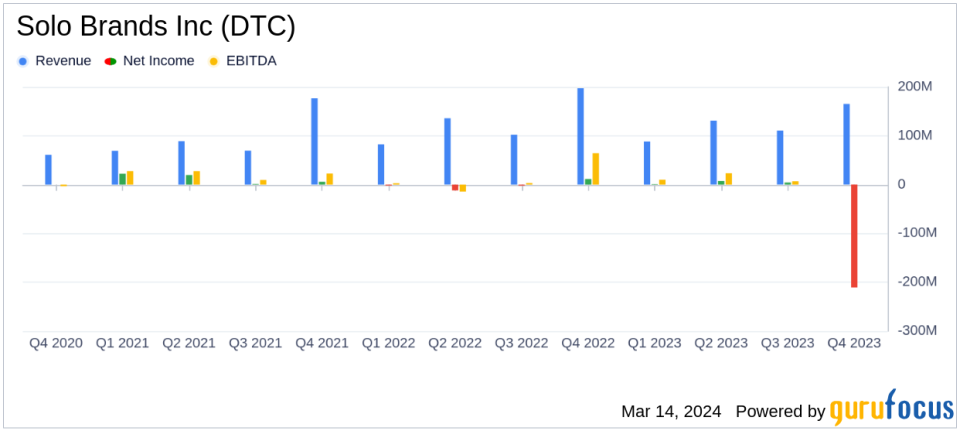

Net Sales: Q4 net sales decreased by 16.2% to $165.3 million; full-year net sales down 4.4% to $494.8 million.

Net Loss: Q4 net loss of $210.9 million; full-year net loss of $195.3 million, primarily due to impairment charges.

Operating Cash Flow: Full-year net cash provided by operating activities increased by 92.7% to $62.4 million.

Free Cash Flow: Free cash flow for the full year increased by 130.3% to $53.3 million.

Adjusted EBITDA: Q4 adjusted EBITDA decreased by 61.6% to $14.9 million; full-year adjusted EBITDA down 19.9% to $70.2 million.

Adjusted Net Income Per Share: Q4 adjusted net income per Class A common stock at $0.13; full-year adjusted net income per share at $0.58.

On March 14, 2024, Solo Brands Inc (NYSE:DTC) released its 8-K filing, disclosing its financial results for the fourth quarter and full fiscal year of 2023. The company, a Direct-To-Consumer (NYSE:DTC) platform operating four premium outdoor lifestyle brands, faced a challenging quarter with a significant net loss primarily due to impairment charges. Despite this, the company saw a substantial increase in operating cash flow and free cash flow, indicating some operational strengths amidst the difficulties.

Company Overview

Solo Brands Inc operates a DTC platform with a portfolio including Solo Stove, Oru, ISLE, and Chubbies apparel. These brands offer a range of outdoor and lifestyle products from portable fire pits and foldable kayaks to premium apparel. The company distributes its products through individual brand websites and strategic partnerships.

Financial Performance and Challenges

The company's net sales for Q4 2023 were $165.3 million, a decrease of 16.2% compared to Q4 2022. The full-year net sales also saw a decline of 4.4% to $494.8 million. This decrease was partly attributed to a lack of significant new product launches. The direct-to-consumer channel experienced a revenue decline, while wholesale revenues saw an increase.

The gross profit margin for Q4 decreased to 58.3%, a reduction of 150 basis points year-over-year, mainly due to a shift in channel mix favoring wholesale, which typically has lower margins. Selling, general, and administrative expenses saw a slight decrease due to lower fixed costs, partially offset by increased marketing expenses.

Impairment charges of $249.0 million were recorded in 2023, significantly impacting the net income, which resulted in a net loss of $210.9 million for Q4 and $195.3 million for the full year. The adjusted net income and adjusted EBITDA also saw declines in both Q4 and the full year, reflecting the challenges faced by the company.

Financial Achievements

Despite the net loss, Solo Brands Inc achieved notable financial improvements in its cash flow metrics. The net cash provided by operating activities for the full year increased by 92.7% to $62.4 million. Additionally, the company's free cash flow saw a significant increase of 130.3% to $53.3 million. These achievements are important as they indicate the company's ability to generate cash from its core operations, which is crucial for sustainability and future investments.

Balance Sheet and Full Year 2024 Outlook

As of December 31, 2023, the company had cash and cash equivalents of $19.8 million and inventory valued at $111.6 million. The outstanding borrowings under the Revolving Credit Facility and Term Loan Agreement were $60.0 million and $91.3 million, respectively.

For the full year 2024, CEO Chris Metz provided guidance with total revenue expected to be between $490 million to $510 million and an adjusted EBITDA margin projected to be between 10% to 12%. This guidance reflects the company's cautious optimism in the face of an uncertain environment and consumer spending pressures.

Conclusion

Solo Brands Inc's financial results for Q4 and the full year of 2023 reveal a company facing significant challenges, particularly with impairment charges that have heavily impacted net income. However, the strong performance in operating cash flow and free cash flow suggests underlying operational strengths. The company's focus for 2024 will be on leveraging brand strengths and making strategic investments for long-term growth, despite the current uncertain economic climate.

For a more detailed analysis and further information, investors are encouraged to review the full 8-K filing and tune into the conference call scheduled for March 14, 2024, at 8:30 a.m. ET.

Explore the complete 8-K earnings release (here) from Solo Brands Inc for further details.

This article first appeared on GuruFocus.