Solo Brands (NYSE:DTC) Misses Q4 Revenue Estimates

Outdoor lifestyle and recreational products company Solo Brands (NYSE:DTC) fell short of analysts' expectations in Q4 FY2023, with revenue down 16.2% year on year to $165.3 million. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $500 million at the midpoint. It made a non-GAAP profit of $0.13 per share, down from its profit of $0.33 per share in the same quarter last year.

Is now the time to buy Solo Brands? Find out by accessing our full research report, it's free.

Solo Brands (DTC) Q4 FY2023 Highlights:

Revenue: $165.3 million vs analyst estimates of $166.1 million (0.5% miss)

EPS (non-GAAP): $0.13 vs analyst expectations of $0.17 (22.6% miss)

Management's revenue guidance for the upcoming financial year 2024 is $500 million at the midpoint, in line with analyst expectations and implying 1.1% growth (vs -1.2% in FY2023)

Gross Margin (GAAP): 58.3%, down from 59.8% in the same quarter last year

Free Cash Flow of $21.11 million is up from -$16.11 million in the previous quarter

Market Capitalization: $139.4 million

“I am thrilled to be leading Solo Brands. In my first two months here I have been incredibly impressed with the strength of our core brands, record operating cash flow and the tremendous growth potential ahead,” said Chris Metz, CEO of Solo Brands.

Started through a Kickstarter campaign, Solo Brands (NYSE:DTC) is a provider of outdoor and recreational products.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

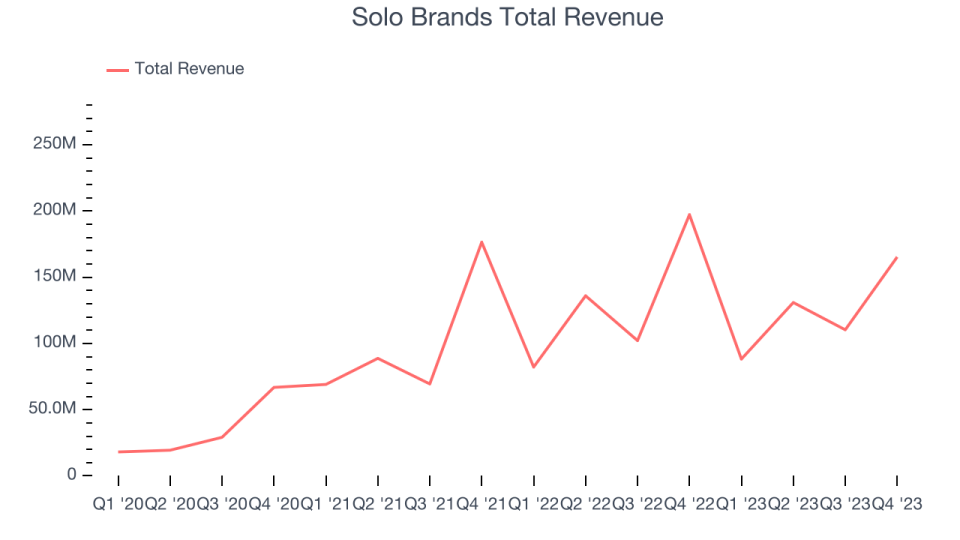

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Solo Brands's annualized revenue growth rate of 54.8% over the last three years was incredible for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Solo Brands's recent history shows its momentum has slowed as its annualized revenue growth of 10.7% over the last two years is below its three-year trend.

This quarter, Solo Brands missed Wall Street's estimates and reported a rather uninspiring 16.2% year-on-year revenue decline, generating $165.3 million of revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

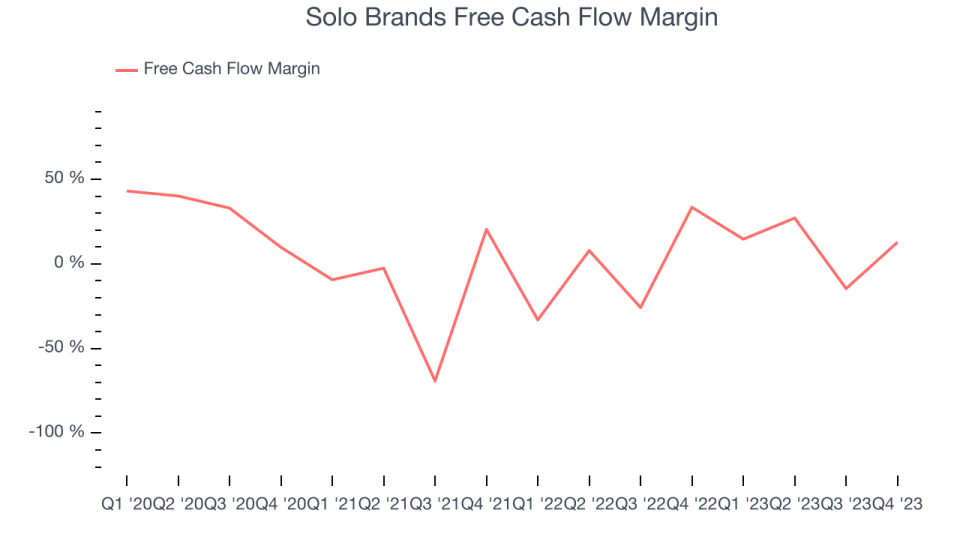

Over the last two years, Solo Brands has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 7.6%, subpar for a consumer discretionary business.

Solo Brands's free cash flow came in at $21.11 million in Q4, equivalent to a 12.8% margin and down 68% year on year.

Key Takeaways from Solo Brands's Q4 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS fell short of Wall Street's estimates as it launched fewer new products than in the same quarter last year - management suggested this has historically been a driver of revenue growth. Its full-year 2024 EBITDA margin guidance also fell short of estimates. Overall, the results could have been better. The stock is up 1.7% after reporting and currently trades at $2.45 per share.

So should you invest in Solo Brands right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.