Sonic Automotive Inc (SAH): A High-Performing Stock with a GF Score of 93

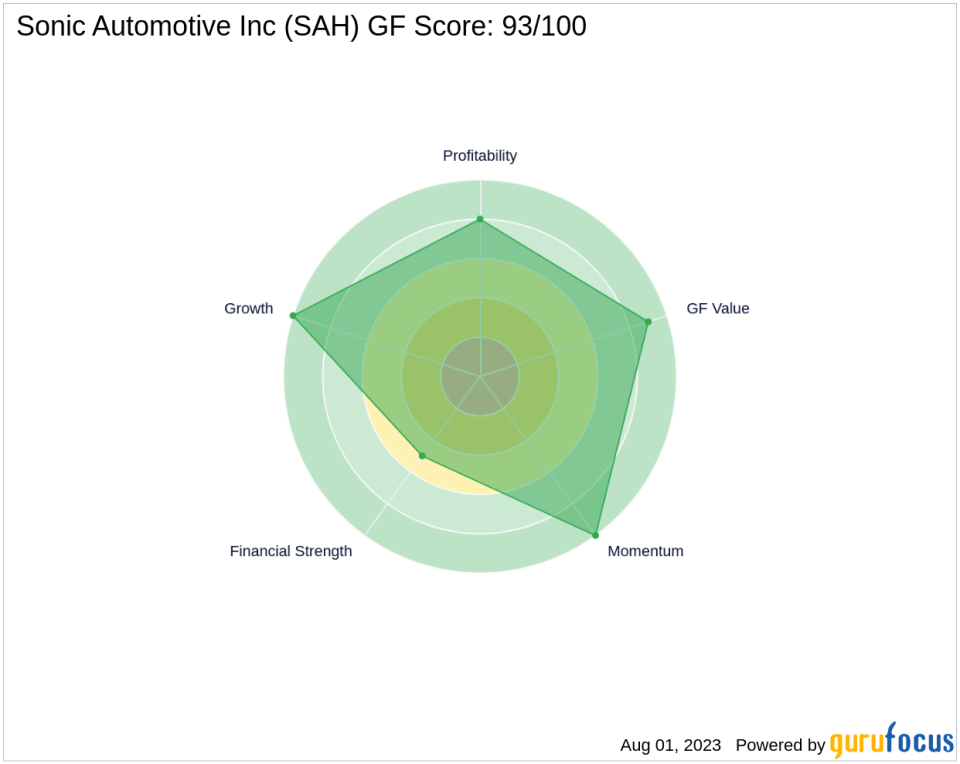

Sonic Automotive Inc (NYSE:SAH), a prominent player in the Vehicles & Parts industry, is currently trading at $50.02 per share. The company has a market capitalization of $1.77 billion and has seen a stock price gain of 4.45% today. Over the past four weeks, the stock price has increased by 4.57%. Sonic Automotive's impressive performance is reflected in its high GF Score of 93 out of 100, indicating the highest outperformance potential. The GF Score is a comprehensive ranking system developed by GuruFocus that evaluates a stock's performance potential based on five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

Financial Strength Analysis of Sonic Automotive Inc

Sonic Automotive's Financial Strength rank stands at 5 out of 10. This rank is determined by several factors, including the company's interest coverage of 3.74, which measures the company's ability to meet its interest expenses, and a debt to revenue ratio of 0.25, indicating a moderate level of debt relative to its revenue. The company's Altman Z score of 3.54 further suggests that it is not in immediate danger of bankruptcy.

Profitability Rank Analysis

The company's Profitability Rank is 8 out of 10, indicating a high level of profitability. This rank is based on several factors, including an operating margin of 4.04%, a Piotroski F-Score of 5, and a consistent profitability record with 9 profitable years over the past decade. The company's profitability trend, as indicated by a 5-year average operating margin of 17.80%, is also on an uptrend.

Growth Rank Analysis

Sonic Automotive's Growth Rank is a perfect 10 out of 10, reflecting strong revenue and profitability growth. The company's 5-year revenue growth rate is 8.60%, and its 3-year revenue growth rate is 13.80%. Additionally, its 5-year EBITDA growth rate is 12.00%, indicating a robust growth in its business operations.

GF Value Rank Analysis

The company's GF Value Rank is 9 out of 10, suggesting that the stock is fairly valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric that adjusts historical multiples based on past returns, growth, and future business performance estimates.

Momentum Rank Analysis

Sonic Automotive's Momentum Rank is 10 out of 10, indicating strong stock price performance. This rank is determined by the standardized momentum ratio and other momentum indicators, reflecting the stock's performance over the past 12 months.

Competitive Analysis

When compared to its main competitors in the same industry, Sonic Automotive stands out with its high GF Score. Openlane Inc (NYSE:KAR) has a GF Score of 74, Cars.com Inc (NYSE:CARS) has a GF Score of 58, and Camping World Holdings Inc (NYSE:CWH) has a GF Score of 85. This comparative analysis further underscores Sonic Automotive's strong performance potential.

In conclusion, Sonic Automotive Inc's high GF Score of 93, coupled with its strong financial strength, profitability, growth, value, and momentum ranks, make it a compelling choice for investors seeking high-performing stocks.

This article first appeared on GuruFocus.