Sonic Automotive Inc (SAH) Posts Mixed Results Amid Market Challenges

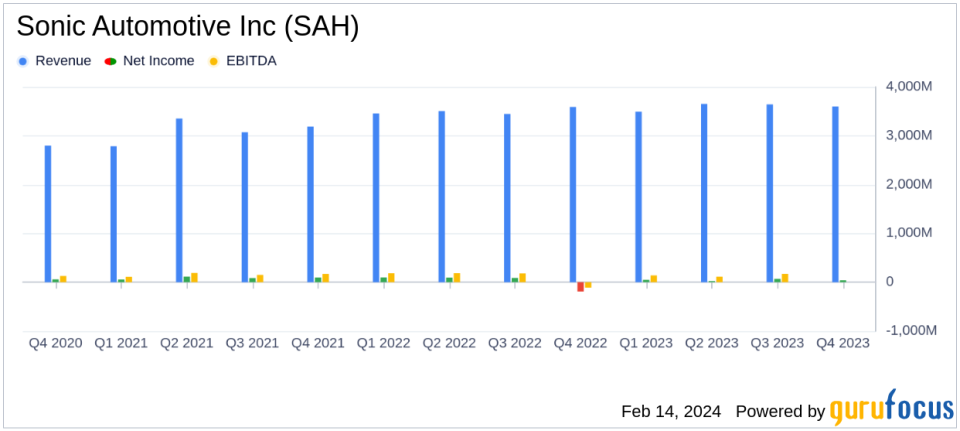

Annual Revenue: Achieved a record $14.4 billion, up 3% year-over-year.

Quarterly Revenue: Remained flat at $3.6 billion compared to the previous year.

Net Income: Reported $38.7 million in Q4, with adjusted net income at $56.9 million.

Earnings Per Share: Q4 diluted EPS at $1.11, adjusted diluted EPS at $1.63.

Segment Performance: Franchised Dealerships up 1% in revenue, EchoPark down 6%.

Liquidity Position: Strong with $846 million in total liquidity as of December 31, 2023.

Stock Repurchase: Repurchased approximately 3.3 million shares for $177.6 million in 2023.

On February 14, 2024, Sonic Automotive Inc (NYSE:SAH) released its 8-K filing, detailing the financial outcomes for both the fourth quarter and the full year ended December 31, 2023. The company, a prominent auto dealership group in the United States, reported a flat quarterly revenue of $3.6 billion, while the annual revenue reached an all-time high of $14.4 billion, marking a 3% increase from the previous year.

Sonic Automotive operates 108 franchised stores and 18 EchoPark used-vehicle stores, among other outlets, with a significant portion of revenue derived from luxury and import dealerships. The company's diversified business model, which includes new and used vehicle sales, parts and collision repair, finance, and insurance, has been crucial in navigating the rapidly changing market dynamics.

Financial Performance and Challenges

The fourth quarter saw a 6% decline in total gross profit to $541.1 million year-over-year, with net income reported at $38.7 million, or $1.11 earnings per diluted share. Adjusted for specific charges, the net income would have been $56.9 million, or $1.63 adjusted earnings per diluted share. The Franchised Dealerships Segment experienced a 7% decrease in gross profit, while the EchoPark Segment gross profit increased by 5%.

Despite these challenges, Sonic Automotive's EchoPark Segment is expected to achieve breakeven adjusted EBITDA in the first quarter of 2024. This optimism is reflected in the 64% year-over-year improvement in the EchoPark Segment's adjusted EBITDA loss, which was $9.1 million for the quarter.

Financial Achievements and Industry Significance

The record annual revenues underscore Sonic Automotive's resilience in a competitive industry. The company's strategic adjustments and diversified business model have allowed it to adapt to market fluctuations and maintain a strong financial position. The repurchase of 3.3 million shares demonstrates confidence in the company's value and future prospects.

Commentaries from Management

"We are proud of our teams performance in the fourth quarter, delivering financial results that reflect our ability to leverage our diversified business model to adapt to rapidly changing market dynamics," said David Smith, Chairman and CEO of Sonic Automotive.

"While consumer affordability and used vehicle sourcing challenges persist, our EchoPark results in the fourth quarter demonstrate our team's valuable industry experience and the adaptability of our innovative EchoPark model," commented Jeff Dyke, President of Sonic Automotive.

"Our diversified cash flow streams continued to benefit our overall financial position in the fourth quarter. As of December 31, 2023, we had $846 million of total liquidity, including $374 million in cash and floor plan deposits on hand," added Heath Byrd, CFO of Sonic Automotive.

Analysis of Company's Performance

While the company's annual revenue growth is a positive sign, the quarterly declines in gross profit and the challenges faced by the EchoPark Segment indicate areas that require strategic focus. The anticipated breakeven of EchoPark's adjusted EBITDA in early 2024 suggests that the company's efforts to refine its business model are starting to pay off. The strong liquidity position provides Sonic Automotive with the flexibility to navigate future market conditions and invest in growth opportunities.

The company's commitment to shareholder returns through stock repurchases and the declaration of a quarterly cash dividend of $0.30 per share, payable on April 15, 2024, reflects its stable financial health and dedication to delivering shareholder value.

For a more detailed analysis of Sonic Automotive's financial results, including segment-specific performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Sonic Automotive Inc for further details.

This article first appeared on GuruFocus.