Sonic Automotive (SAH) Q4 Earnings Top, Sales Lag Estimates

Sonic Automotive, Inc. SAH registered adjusted earnings per share of 97 cents in fourth-quarter 2019, beating the Zacks Consensus Estimate of 89 cents. Moreover, the bottom line rose from 76 cents per share reported in the year-ago quarter. The outperformance was driven by higher-than-expected gross profit from new and used-vehicle units.

Total revenues in the reported quarter amounted to $2,748.4 million, up 6.7% from the prior-year period. However, revenues missed the Zacks Consensus Estimate of $2,766 million.

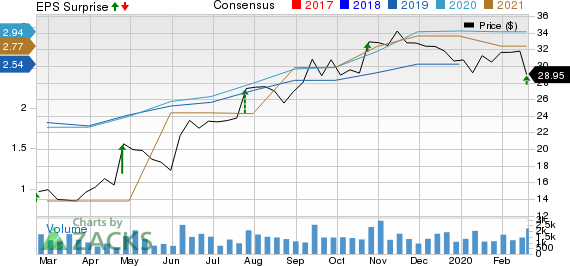

Sonic Automotive, Inc. Price, Consensus and EPS Surprise

Sonic Automotive, Inc. price-consensus-eps-surprise-chart | Sonic Automotive, Inc. Quote

Key Takeaways

During the reported quarter, revenues from the sale of new vehicles grew 3% year over year to $1,360.1 million. Gross profit increased to $67.6 million from $65.8 million recorded in the year-ago period. The metric also surpassed the consensus mark of $64 million.

Revenues from the sale of total used vehicles rose 15% from the prior-year quarter to $869.7 million. Unit sales rose from 35,135 a year ago to 39,775 in the quarter under review. Gross profit increased 9.6% year over year to $36.8 million in the fourth quarter of 2019. The metric also topped the Zacks Consensus Estimate of $36 million.

Wholesale vehicle revenues decreased 6.6% on a year-over-year basis to $46.6 million. Nonetheless, gross loss narrowed from $2.2 million in the year-ago quarter to $1.3 million.

Revenues from parts, services and collision repair grew 2.1% year over year to $346.5 million. Gross profit increased $165.3 million in the quarter under review from $163.8 million in the year-ago period.

Finance, insurance and other revenues rose 14.5% on a year-over-year basis to $125.5 million.

Selling, general and administrative expenses decreased to $260.9 million from $273.9 million in the year-ago quarter. The company recorded operating income of $92.2 million compared with $58.7 million in the year-ago quarter.

In the quarter under review, the EchoPark segment recorded revenues of $308.6 million, reflecting a 52% uptick from the year-ago figure. Its stores sold 12,676 units, up 45% on a year-over-year basis. The segment registered income of $2.1 million, up 145% year over year.

Dividend Payment

The board of directors announced a quarterly dividend of 10 cents per share, which will be paid on Apr 15, 2020 to its shareholders of record as of Mar 13, 2020.

Zacks Rank & Stocks to Consider

Sonic Automotive currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Auto-Tires-Trucks sector include AutoNation, Inc. AN, Group 1 Automotive, Inc. GPI and America's Car-Mart, Inc. CRMT, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AutoNation, Inc. (AN) : Free Stock Analysis Report

America's Car-Mart, Inc. (CRMT) : Free Stock Analysis Report

Sonic Automotive, Inc. (SAH) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research